KIOXIA – Japan’s Best Performing Semiconductor Stock in 2025

Explosive share price growth and bullish outlook as Citi sets ¥12,000 target for the AI-driven memory leader Kioxia Holdings Corp (TSE:285A)

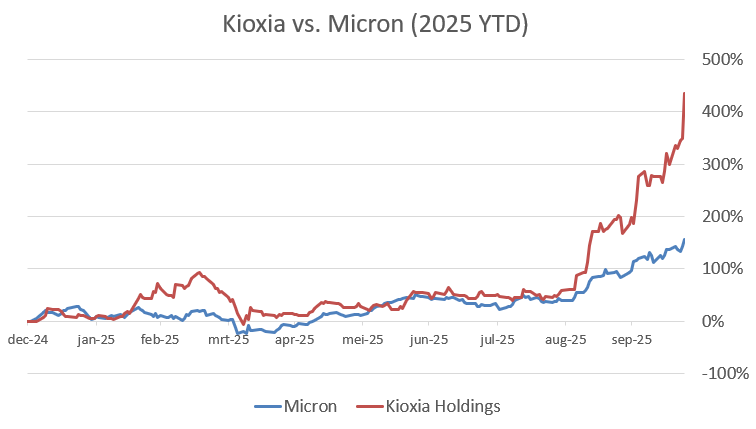

In our earlier article “Japan’s Semiconductor Star Kioxia Holdings”, we highlighted Kioxia as one of Japan’s most promising chipmakers. Just six weeks later, the company has become Japan’s best-performing semiconductor stock in 2025. On Friday, October 24, shares closed at ¥8,780, a new all-time high — up roughly +150% since our original piece in September when the stock traded near ¥3,500. Year-to-date Kioxia’s shares are now up 435%.

With a market capitalization of around USD 26 billion and an estimated P/E ratio of 20 for 2025, Kioxia remains attractively valued relative to its growth outlook. The company’s rise has been driven by accelerating demand for NAND flash memory used in AI, cloud, and data-center storage systems.

Key Points in this article

Kioxia is Japan’s best-performing semiconductor stock in 2025, up +435% year-to-date

Citigroup initiated coverage with a Buy rating and ¥12,000 target price

The company develops NAND flash memory and SSDs used in AI, cloud, and automotive markets

No dividend is currently paid by Kioxia (we think they can and should!)

Kioxia and Micron (USA:MU) both excel in memory chips and dominate 2025’s semiconductor rally.

Comparison: Micron Technology in the U.S.

In the United States, Micron Technology MU 0.00%↑ plays a similar role to Kioxia in Japan. Like Kioxia, Micron is a key global supplier of NAND flash and SSD storage used in data centers, AI systems, and consumer devices. However, Micron also produces DRAM memory, giving it a broader exposure across the semiconductor memory spectrum.

Micron shares are up about +160% year-to-date in the U.S., versus +435% for Kioxia in Japan — but unlike Kioxia, Micron is paying a progressive dividend.

Micron’s shares have surged around +160% in 2025, driven by the same global trends boosting Kioxia — rising AI-driven demand for high-capacity memory and a sharp rebound in NAND and DRAM pricing. Together, Kioxia and Micron represent the leading edge of the global memory revival.

Citi Research Note

Citigroup Buy Rating – Target ¥12,000

Kioxia shares jumped another +19% on Friday after Citigroup initiated coverage with a Buy and High Risk rating.

“Kioxia Holdings is poised to benefit from a firming NAND flash memory market in 2H as AI-driven demand for energy storage systems drives up volume growth and rising prices boost profits. We project operating profit to surge 195% for the fiscal year ending March 2027.” Citigroup expects a full upswing in NAND prices to begin in late 2025, noting that the market has yet to fully price in Kioxia’s profit potential.

Company Overview

Kioxia Holdings Corporation (TSE: 285A) is a Tokyo-based holding company that develops, manufactures, and sells NAND flash memory and solid-state drives (SSDs). The company originated from Toshiba’s memory division, which invented NAND flash memory in 1987, and was rebranded as Kioxia in 2019 following the Toshiba Memory spin-off.

Japan’s Semiconductor Star Kioxia Holdings (TSE:285A) Needs a Dividend

Kioxia Holdings Corporation was established on October 1, 2019, bringing together the memory and SSD businesses under a single umbrella. From the outset, the company has positioned itself as a pioneer in digital storage, committed to accelerating the future of the digital society through its technologies.

Kioxia is one of the world’s leading suppliers of NAND flash chips alongside Samsung and SK Hynix, with major customers in the PC, smartphone, and data-center markets. Its signature BiCS FLASH™ 3D technology underpins its high-density storage solutions. In 2025, Kioxia began expanding its Kitakami Plant (Fab 2) to meet growing AI-related demand.

Market Context

Kioxia operates in the rapidly evolving NAND flash memory and SSD sector. This market is experiencing strong structural growth as AI workloads, hyperscale data storage, and electric vehicles drive higher memory-density needs. NAND demand is expected to grow roughly 20% annually, with pricing improving in 2H 2025.

Dividend and Analyst Ratings

Kioxia currently does not pay a dividend.

Analyst consensus: 2 × Strong Buy, 2 × Buy, 1 × Hold, 1 × Strong Sell.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.