Regional Education Leader Step Co (TSE: 9795) is Japan’s Newest Dividend Aristocrat

Steady Growth, High Margins and a Rising Dividend Track Record

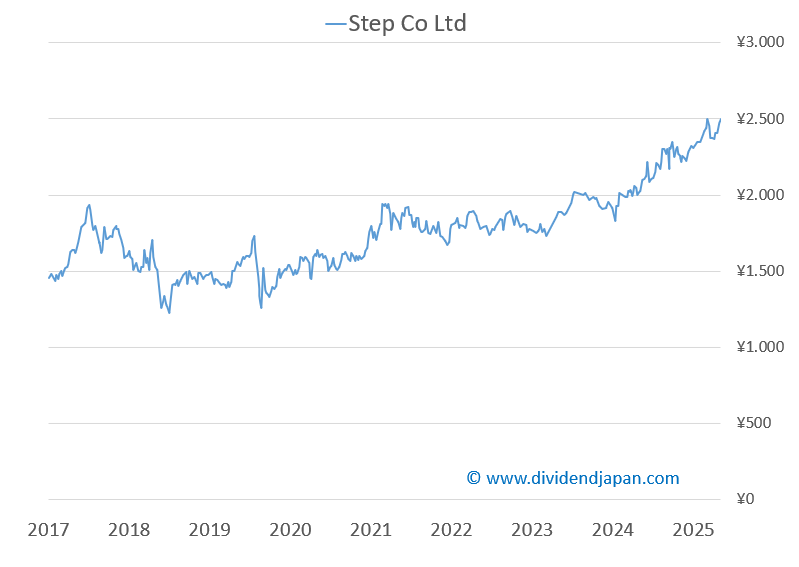

STEP CO (TSE 9795) has evolved from a Kanagawa-based cram-school operator into one of Japan’s most reliable dividend growers. With strong profitability, predictable demand for exam-prep education, and a long history of disciplined expansion, the company is now positioning itself as a new Dividend Aristocrat in Japan. Earnings continue to rise steadily, margins remain among the highest in the sector, and the dividend has once again increased for FY2025.

Key Points

Dividend yield: 3.6% at a share price of ¥2,374

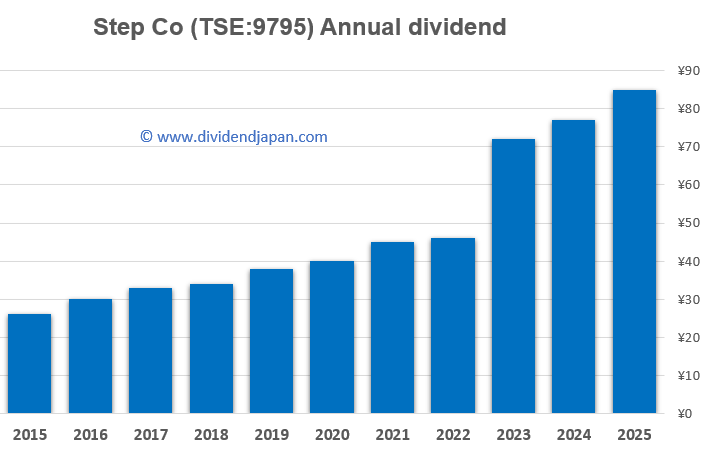

FY2025 dividend: ¥85 total (up 10.4% YoY); ¥45 final dividend paid on 16 Dec (ex-date 29 Sep)

Growth profile: Revenue rising 3–5% annually; FY2025 revenue +5% to ¥15.85 bn

Profitability: Operating margin above 23%; ROIC around 9.3–9.5%

Valuation: Market cap ¥39.6 bn; estimated FY2025 P/E ≈ 14

Earnings outlook: EPS ¥170.35 (FY2025), with potential to reach ~¥190 by FY2028

Dividend stance: Payout ratio ~49%, above the Japanese corporate norm (~30%) yet supported by stable cash generation

Company Overview

STEP CO., LTD., founded in 1975, operates a tightly knit network of juku (cram schools) concentrated in Kanagawa Prefecture. Unlike nationwide chains, STEP follows a single-region strategy, focusing on high-quality instruction, long-tenured teachers, and consistent learning outcomes. This disciplined model has allowed the company to maintain strong brand recognition and a stable student base across elementary, junior-high, and high-school levels.

The company also offers after-school care services for younger children, extending engagement beyond exam preparation. Decades of controlled expansion and consistent academic results underpin its reputation as one of the most stable education businesses in Japan.

Dividend

STEP pays dividends on a semi-annual basis.

For FY2025 (ending September), the company will distribute ¥85 per share in total, representing a 10.4% increase year on year.

Final dividend: ¥45

Payment date: 16 December

Ex-date: 29 September

Dividend yield: 3.6% at ¥2,374

The payout ratio of roughly 49% is above the Japanese average (~30%), but remains aligned with STEP’s stable cash flow, minimal capital requirements, and steady earnings growth. STEP’s consistent increases place the company firmly on track as an emerging Dividend Aristocrat.

Fundamentals

STEP demonstrates the hallmark characteristics of a mature but consistently expanding education provider.

Revenue growth: Typically 3–5% per year; FY2025 rose 5% to ¥15.85 bn

2026 revenue estimate: +4.1% growth

Operating margin: Above 23%, among the strongest in the juku sector

ROIC: Between 9.3–9.5%

EPS: ¥170.35 in FY2025, projected to grow toward ~¥190 by FY2028

Market cap: ¥39.6 bn

Estimated P/E (FY2025): ~14

Earnings have been growing steadily for many years, supported by disciplined capacity additions and resilient local demand for education services.

Growth Drivers

STEP operates in a mature market, yet several structural elements support continued measured expansion:

Stable local demand: Kanagawa remains one of Japan’s most competitive and education-focused prefectures.

Premium positioning: Emphasis on teacher quality and structured instruction attracts parents seeking higher-value academic support.

After-school care: Growing demand from dual-income households provides a steady, recurring revenue source.

Selective expansion: New branches within the prefecture allow incremental growth without diluting teaching quality.

Competitive Landscape

The company competes in a fragmented market that includes large nationwide chains and smaller regional operators. Online learning platforms add new alternatives, but STEP’s classroom-based model and long-standing reputation maintain strong relevance—especially for students preparing for high-stakes entrance exams. Its localized scale and consistent academic performance provide recognizable differentiation in Kanagawa.

Outlook Summary

STEP CO. combines stable revenue growth, strong margins, expanding EPS, and a history of rising dividends. The FY2025 dividend increase reinforces its emerging status as one of Japan’s next generation of Dividend Aristocrats—companies able to sustain dependable dividend growth supported by long-term operational consistency.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders! Investing in Japan isn’t for everyone, given its unique trading hours, large price swings, currency fluctuations, lot size requirements, and limited analyst coverage — yet the country also offers some of the world’s best dividend growth opportunities, with countless hidden gems waiting to be discovered.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.