Air Water (TSE:4088) Falls Nearly 20% on Accounting Issue, Despite Record Dividend Increase

Accounting adjustments total ¥2.5 billion; dividend lifted for 2025 with payout up 17% year on year.

Air Water Inc. (TSE: 4088) Shares Plunge 19.4% After Accounting Irregularities Disclosure — Yet Fundamentals Remain Solid (for now….).

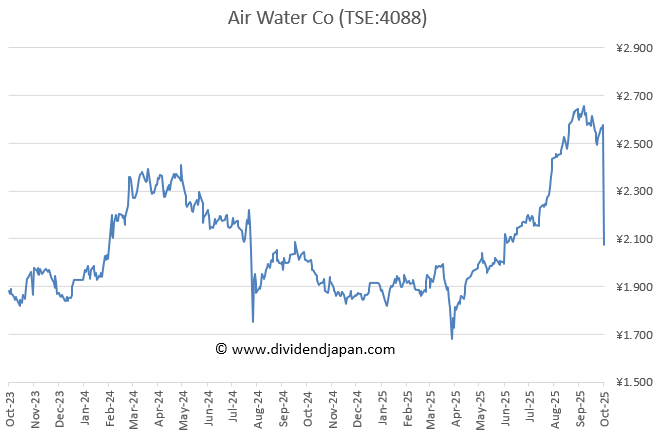

Shares of Air Water Inc. tumbled 19.4% on Thursday after the company revealed accounting irregularities involving the deferral of loss recognition across several subsidiaries. According to a supplementary statement released on October 9, 2025, the total estimated impact amounts to approximately ¥2.5 billion.

The irregularities were identified in four cases: Nippon Helium Inc. (¥1.9 billion), Air Water Ecoroca Inc. (¥0.45 billion), Air Water Mechatronics Inc. (¥0.1 billion), and Air Water Inc.’s Plant Gas Division (¥0.02 billion). The company stated it is fully cooperating with a Special Investigation Committee, and that the scope and amounts may change as additional audits and reviews progress.

Although the market reaction was severe, analysts emphasized that the financial impact appears relatively minor for a company of Air Water’s size. The sell-off reflects short-term uncertainty and a loss of confidence, rather than a material threat to its long-term fundamentals.

Air Water remains regarded as a solid dividend stock, known for its consistent shareholder returns. The company has increased its dividend every year, with a 17% hike in 2025, marking a new record payout. The dividend yield now stands around 3.6%, while the stock trades at an estimated FY2025 P/E ratio of roughly 9, a level seen by many investors as attractive given its diversified earnings base.

Analyst sentiment remains constructive, with four buy ratings and two holds, and no sell recommendations currently on record.

Company Overview:

Air Water Inc. is a Japan-based diversified industrial group engaged primarily in the manufacture and sale of industrial gas, chemicals, medical, and energy-related products. It operates through eight business segments:

Industrial Gas-related: Manufactures and sells industrial gases and installs high-pressure gas systems.

Chemical-related: Produces basic and fine chemicals.

Medical-related: Supplies medical gases and hospital equipment construction.

Energy-related: Offers liquefied petroleum gas (LPG) and kerosene.

Agriculture and Food-related: Manufactures and sells fruits, vegetables, frozen foods, processed meat products, and soft drinks.

Logistics-related: Provides logistics services for high-pressure gas and general cargo.

Seawater-related: Produces salts, salt by-products, and magnesium compounds.

Other: Includes the aerosol business, as well as development of green chemicals, biofuels, and rehabilitation systems.

Despite the current setback, many observers note that Air Water’s broad business portfolio, stable cash flow, and progressive dividend policy continue to make it a resilient long-term holding.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.