Disco Corp Hits All-Time High After Blowout Earnings

Disco Corp (TSE: 6146) surges to a record high as quarterly results far exceed expectations, triggering the maximum daily price move in Tokyo.

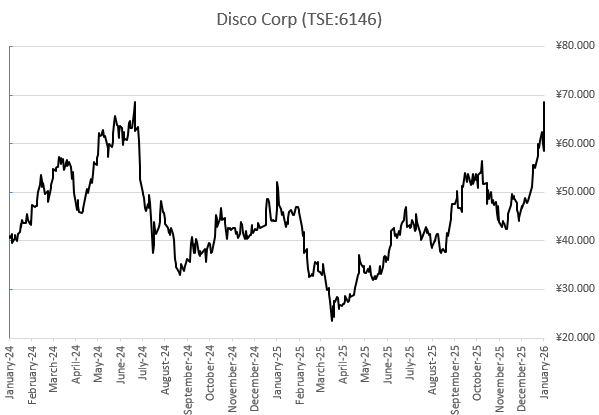

Disco Corp (TSE:6146) stunned the Tokyo market on Wednesday after reporting exceptionally strong quarterly results, sending the stock to a new all-time high. Shares jumped by the maximum ¥10,000 daily limit, closing at ¥68,570, and are expected to remain in focus in the next session.

Key Points

Disco shares surged by the maximum daily limit to ¥68,570, a new all-time high

Stock is now up 42% in 2026, after an already extreme recovery in 2024–2025

Q3 operating profit: ¥47.3 billion, well above expectations

Market capitalization rises to ¥6.4 trillion ($40 billion)

Analyst price targets now sit well below the current share price

From Deep Lows to Record Highs

The scale of the move is striking. Just over a year ago, Disco shares traded near ¥24,000. In September 2025, DividendJapan.com published an in-depth article when the stock stood around ¥44,000. Since then, the rally has accelerated sharply, culminating in today’s record-breaking session.

Wednesday’s move marks one of Disco’s strongest single-day performances in decades and reflects a dramatic reassessment of the company’s earnings power.

Quarterly Results Exceed Expectations

Disco reported operating profit of ¥47.3 billion for the three months ended December, comfortably beating market expectations. For the nine-month period ended December 31, 2025, net sales increased 11.5%, while net income rose 8.7% year-on-year.

Detailed figures underline the strength of the quarter. Net sales reached ¥109.3 billion, with gross profit of ¥78.1 billion, resulting in a gross margin of 71.4%. Operating income came in at ¥47.3 billion, corresponding to an operating margin of 43.3%. Net income attributable to shareholders totaled ¥36.7 billion, a net margin of 33.6%. Overseas sales accounted for 91.5% of total revenue.

The company also guided for continued growth in net sales, net income and shipments for the fiscal year ending March.

Business and Market Position

Disco manufactures precision grinders and dicers used to cut silicon wafers into individual semiconductors. These tools are essential in advanced chip production, making Disco a key supplier in the global semiconductor ecosystem.

Demand for Disco’s equipment has strengthened alongside rising capital expenditure by major chip manufacturers, particularly in areas linked to memory, storage and AI-related applications. Management indicated that operations are currently running near full production capacity, with demand expected to remain strong.

Valuation and Analyst Gap

Before the earnings release, Disco traded at an estimated price-to-earnings ratio of around 50 based on today’s record share price. Following the results, earnings expectations have been revised upward, which may mechanically reduce that multiple going forward.

What stands out is the gap between market pricing and analyst expectations. The average analyst price target is around ¥55,000, roughly 20% below today’s closing price. Prior to the results, eight analysts had a hold rating, and one analyst even carried a sell recommendation. These assessments are now likely to be reviewed in the coming days.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.