Meet the real Dividend Aristocrats from Japan: #1 Kao Corp

A closer look at Kao Corporation (TSE:4452): its rich history, global brands, and unmatched dividend growth track record in Japan

When most investors think of long-term dividend growth, their minds go straight to the U.S. Dividend Aristocrats — companies that have raised their payouts for at least 25 consecutive years. While the U.S. boasts over 100 of these elite stocks, and Europe far fewer, few realize that Japan has a hidden gem of its own: Kao Corporation, listed under ticker code 4452 on the Tokyo Stock Exchange.

In this blog post, we take a closer look at the true Dividend Aristocrats in Japan. As of July 2025, there are only four companies that have increased their dividend for 25 years or more. However, many more are on the way in the coming years, with a large group of companies currently approaching the 20-year mark.

Earlier on DividendHike.com, we covered Kao Corp — the Japanese peer of Procter & Gamble and L’Oréal — which has raised its dividend for decades in a row.

With now 35 consecutive years of dividend increases, Kao stands as one of Japan’s few true Dividend Aristocrats, earning its place alongside global consumer product giants.

Kao raised its dividend this year for the 35th consecutive time, though the increase was minimal—just 1.3%, bringing the total to 152 yen. Compared to other Japanese Dividend Aristocrats, this is quite low, especially with Kao’s 5-year dividend CAGR sitting at only 3.2%.

In FY 2024, Kao’s revenue grew by 4.9% to 1.62 trillion yen, and analysts expect a further 3.6% increase in 2025, bringing it to 1.7 trillion yen. One notable strength: Kao remains debt-free, with a net cash position of 112 million yen at the end of 2024—a figure expected to rise further in the coming years.

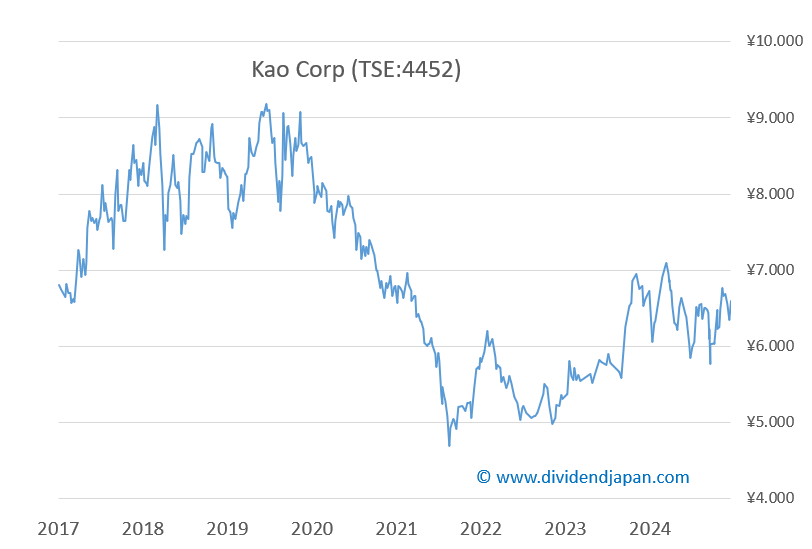

Now, on to valuation: with the stock trading at 6,694 yen, Kao has a forward P/E of 25. That’s relatively high considering its limited growth, especially on the dividend front. The dividend yield currently sits at just 2.3%.

In future posts, we’ll take a closer look at other Japanese Dividend Aristocrats. Subscribe to get these updates straight to your inbox—free of charge.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders! Investing in Japan isn’t for everyone, given its unique trading hours, large price swings, currency fluctuations, lot size requirements, and limited analyst coverage — yet the country also offers some of the world’s best dividend growth opportunities, with countless hidden gems waiting to be discovered.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.