Elliott steps into Kansai Electric (TSE:9503), dividend back in the spotlight

Activist investor urges Japan’s largest nuclear utility to unlock assets and boost payouts, as stock gains momentum but dividend track record lags.

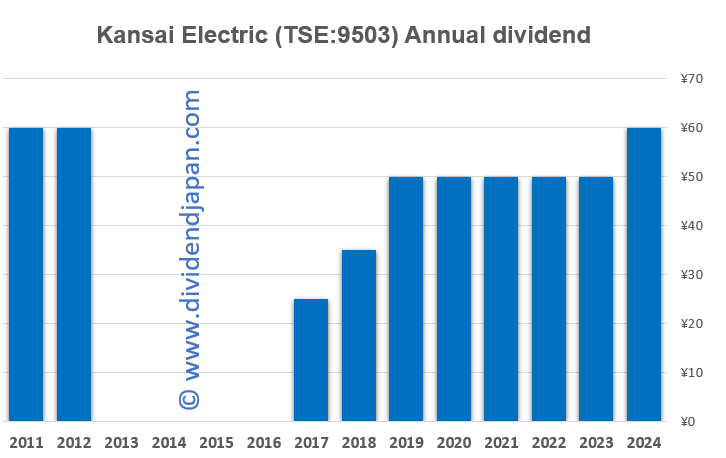

Kansai Electric Power (TSE:9503) has a poor history when it comes to dividends. The payout was scrapped entirely in 2012 and only resumed in 2017. Even after a 20% hike this year to 60 yen per share, investors are no further ahead than in 2011, when the same dividend was last paid by ‘Kepco’.

Despite that uninspiring record, activist fund Elliott Management has taken a 4–5% stake, urging Kansai to sell off 150 billion yen in assets annually from a 2 trillion yen pool it has identified, and to use the proceeds for higher dividends and share buybacks.

📌 Key Points

✅ Elliott Management takes a 4–5% stake in Kansai Electric, becoming a top-three shareholder.

✅ The activist investor pushes for higher dividends, bigger buybacks and ¥150bn annual asset sales.

✅ Kansai shares surged +8.5% in two days, now +30% YTD; stock trades at just 8x earnings.

✅ Dividend history weak: cut in 2012, resumed 2017, only now back at 2011 levels despite a 20% hike.

Activist investor Elliott Management has become one of the top three shareholders of Kansai Electric Power (TSE:9503), with a stake of between 4% and 5%, the Financial Times reported. The U.S. fund is calling on the Osaka-based utility to raise dividends, expand share buybacks and sell around 150 billion yen ($1 billion) in non-core assets annually from a pool worth more than 2 trillion yen, including over 1 trillion yen in real estate.

The market reacted sharply. Kansai Electric’s share price jumped 5.3% on September 10 to 2,230 yen and added another 3% the next day to 2,296 yen, lifting its market capitalisation to 2.56 trillion yen ($17.4 billion). The stock is now up 30% in 2025, though it still trades well below its all-time high from May 2024.

Valuation metrics suggest the stock is cheap: Kansai trades at just 8 times expected earnings this fiscal year and offers a dividend yield of 2.6%. Analyst coverage is thin, with only four brokers following the stock—one rating it a “buy” and three “hold.”

But the company’s dividend track record leaves much to be desired. The payout was cut entirely in 2012 in the aftermath of Fukushima and only reinstated in 2017. Long-term growth has been weak: even after a 20% increase this year to 60 yen per share, the dividend is merely back at the 2011 level. For income investors, Kansai has delivered little progress over more than a decade. Elliott’s demand for a higher dividend—closer to 100 yen per share—marks a sharp break with that history.

Beyond payouts, Kansai Electric is Japan’s largest nuclear operator, running half of the country’s restarted reactors. In July, it became the first utility in more than a decade to begin surveys for a new reactor at its Mihama plant—underscoring its central role in Japan’s nuclear revival as the government seeks to cut reliance on imported gas.

Whether Elliott’s pressure leads to bigger dividends and improved shareholder returns remains to be seen. But with the shares already rallying and the fund pushing for change, Kansai Electric has suddenly become one of Japan’s most closely watched utilities.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.