Japan’s Freund Corp (TSE:6312) Soars 19% on CEO-Led Buyout

A textbook MBO as management takes control and prepares to delist

Japanese engineering firm Freund Corporation (TSE:6312) is set to go private in a bold management buyout (MBO) led by CEO Iwao Fusejima. The move comes via a tender offer launched by Tomo Co., Ltd., a new acquisition vehicle fully owned by Fusejima himself. The goal: to delist Freund from the Tokyo Stock Exchange and consolidate control.

The company’s largest outside investor, the Japan Absolute Value Fund, is backing the deal and will tender its 11.37% stake. Fusejima and related insiders — who already own over 22% — are not selling, ensuring tight control once the company exits the market.

The tender offer aims to secure at least 44.3% of the outstanding shares, the threshold for delisting. Financing is being provided by Sumitomo Mitsui Banking Corporation, and the offer will proceed under Japanese law, with no involvement of U.S. securities rules.

The market’s reaction was swift and strong: shares jumped 19% to ¥916 today following the announcement.

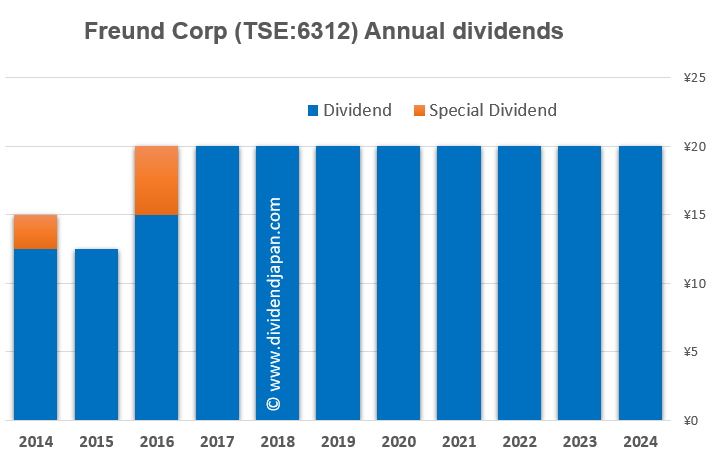

We know Freund Corp because of its dividend; the company last hiked its dividend in 2017 with now 7 consecutive years without an increase based on the current annual dividend of ¥20 per share. At a stock price of ¥916 the dividend yield for Freund is 2.6%.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders! Investing in Japan isn’t for everyone, given its unique trading hours, large price swings, currency fluctuations, lot size requirements, and limited analyst coverage — yet the country also offers some of the world’s best dividend growth opportunities, with countless hidden gems waiting to be discovered.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.