Fujikura Ltd. (TSE:5803) — Japan’s Silent Giant Powering the Global Connectivity Boom

From optical fiber to energy infrastructure, Fujikura’s transformation mirrors the world’s demand for data, electrification, and digital networks.

Fujikura Ltd. is a Japan-based technology group engaged in the manufacturing, sales, and servicing of products across five main divisions: Information Technology, Electronics, Automotive, Energy, and Real Estate. Founded in 1885 and headquartered in Tokyo, the company has evolved from a traditional wire producer into a global supplier of critical infrastructure for the connected age.

Key Points

Fujikura shares jumped 155% in 2025, driven by AI, data centers, and grid expansion.

FY2025 revenue rose 22.5% to ¥979 billion, with over half of sales in the U.S.

Market value reached USD 32 billion, among Japan’s largest tech-industrial firms.

The company is debt-free, with EPS expected to climb 40% to ¥469 in FY2026.

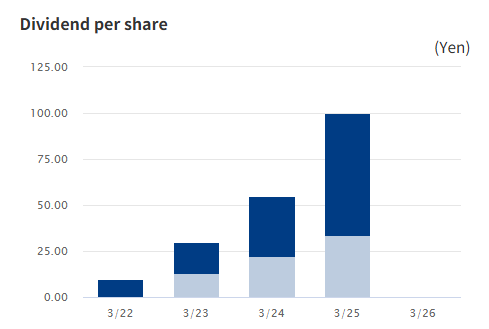

Dividend hit a record ¥100 per share, up 82%, with a 30% payout and 0.6% yield.

Its Information Technology segment produces optical fibers, optical cables, telecommunications components, and network equipment. The Electronics division delivers printed circuit boards, connectors, and specialty wires.

In the Automotive segment, Fujikura supplies wiring harnesses and power systems for vehicles, while its Energy division provides power and communication cables essential to grid expansion and renewable integration. The Real Estate segment manages leasing activities.

The Story Behind Fujikura’s Logo

Fujikura introduced its current group logo on April 1, 2011, bringing a unified identity to its companies in Japan and abroad. The design combines the familiar “F” — used for over 25 years — with the Fujikura name, symbolizing unity across the group.

The company’s logo tradition dates back to 1910, marking its 25th anniversary and incorporation. A new emblem followed in 1985 for the 100th anniversary, and again in 2011 to reflect a global outlook.

The logo expresses Fujikura’s goal to connect more customers worldwide and strengthen the trust built over more than a century.

The company’s global footprint has expanded rapidly, with more than half of total revenue now coming from the United States, followed by Japan (23%) and Europe (11%). For the fiscal year ending March 2025, Fujikura reported a 22.5% increase in revenue to ¥979 billion, fueled by robust demand for optical fiber and power cables supporting AI data centers and electrical grid upgrades worldwide.

Amphenol: Fujikura’s Western Counterpart

While Fujikura represents Japan’s mastery of optical and power technologies, Amphenol Corporation APH 0.00%↑ of the United States stands as its closest Western equivalent. Founded in 1932 in Chicago, Amphenol is one of the world’s largest suppliers of connectors, sensors, and interconnect systems.

Both companies share a global reach and deep exposure to long-term growth drivers such as cloud infrastructure, automotive electrification, and high-speed communication. Yet their strengths diverge: Amphenol dominates the high-performance connector and sensor space—serving aerospace, defense, and datacom markets—whereas Fujikura leads in optical fiber, wiring systems, and energy distribution networks.

Amphenol’s revenue reached USD 15.2 billion in 2024, nearly double Fujikura’s, but Fujikura’s recent growth rate has outpaced its American counterpart. Together, they form two halves of the global connectivity equation—one centered on interconnect systems, the other on the cables and fiber that carry the world’s information and power.

With a market capitalization of approximately USD 32 billion, Fujikura has become one of Japan’s most valuable industrial technology firms. The company’s earnings per share are expected to rise 40% in FY2026 to ¥469, while maintaining a debt-free balance sheet with net cash. Valuation remains elevated at a price-to-earnings ratio of 37, reflecting the market’s confidence in sustained double-digit growth.

Fujikura continues to reward shareholders with a disciplined dividend policy: a payout ratio of around 30% and a record ¥100 per share dividend in 2025, up 82% year-on-year. Over the past decade, dividend growth has averaged 30% annually, and dividends are distributed twice a year. At the current price of ¥16,675, the dividend yield stands at 0.6%.

Analyst sentiment remains supportive, with 3 “strong buy,” 9 “buy,” and 1 “hold” recommendations and no sell ratings. The consensus target price of ¥13,000 sits below the current level, reflecting conservative Japanese coverage rather than weakening fundamentals.

Fujikura’s remarkable 2025 share price performance — up 155% year-to-date — underscores its strategic role in the global megatrends of data connectivity, electrification, and sustainability. Its focus on optical, electrical, and automotive systems positions it at the intersection of the digital and energy revolutions shaping the modern world.

Would you buy Fujikura at current levels? Let us know in the comments below this article! Our partners at dividendhike.com highlighted Amphenol earlier in 2025. The stock is one of the best performers in the Dividend Hike Portfolio this year.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.

Fujikura closed op 8% today and closed at a fresh all time high of 19,355 yen. We bring you the winners :D. #japan #dividends #investing

The comparison to Amphenol is spot on and highlights how these companies attack diferent layers of the connectivity stack. While Amphenol excels at the endpoint connections with their high margin connectors and sensors, Fujikura owns the physical transport layer with fiber and cables. What's fascinating is how Fujikura's recent growth outpaced Amphenol despite the latter's AI datacenter tailwinds, which suggests Fujikura is benefiting from the infrastucture buildout side more than the compute side. Both are riding the same megatrends but from complementary angles, making them potentially better as a pair than either alone.