Gunze Ltd. (3002 JP): Diversified Global Dividend Powerhouse from Japan

Diversified manufacturer Gunze surprises with a massive dividend hike in 2025 and a special dividend

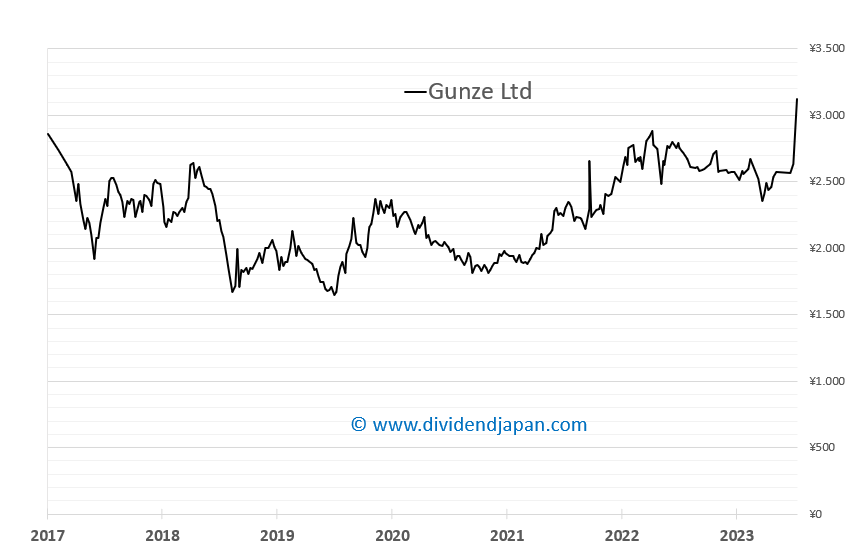

Gunze Ltd., founded in 1896 in Kyoto, has grown from a regional silk yarn producer into a truly diversified global player. Today, it operates across four main segments—Functional Solutions, Medical, Apparel, and Lifestyle Creations—supplying everything from plastic films and engineering plastics to innerwear, medical sutures, commercial real estate and green infrastructure. With operations in over 20 countries and a debt-free balance sheet, Gunze combines stability with long-term growth potential. The stock jumped to a new 52 week high this week after its last earnings report.

Gunze Ltd.: A Century of Innovation from Silk to Sustainability

Founded in 1896 in Kyoto, Japan, Gunze Limited began as a promoter of the silk yarn industry. Over the years, it has grown into a diversified global enterprise that blends traditional Japanese craftsmanship with cutting-edge technological innovation. Gunze’s products and services can be seen virtually everywhere,

from your home and town to offices, factories, and many other places.

Gunze History

Founded in 1896 in Kyoto, Japan, Gunze began as a silk manufacturer supporting regional industry. Over the decades, it expanded globally and diversified into apparel, engineering plastics, plastic films, medical materials, and real estate. Milestones include early exports to the U.S., innovations in hosiery and innerwear, and ventures into electronics, green business, and sports. Today, Gunze operates under four business segments and remains committed to sustainability, innovation, and shareholder value.

Recent Financials: A Mixed Reaction

Fiscal Year Ended March 31, 2025

Revenue: ¥141.08 billion (+2.9% vs. FY2024)

Operating Profit: ¥7.92 billion (vs. ¥6.78 billion)

Pretax Profit: ¥8.18 billion (vs. ¥6.77 billion)

Net Profit: ¥6.28 billion (vs. ¥5.11 billion)

EPS: ¥189.70 (diluted ¥189.27) vs. ¥150.55 (¥150.21)

With solid top- and bottom-line growth, the stock jumped to a new 52 week high following the latest results.

Three Pillars of Business

Gunze operates through three core divisions:

Apparel Division

Specializing in innerwear, legwear, and casual clothing, Gunze has established popular brands like BODY WILD and KIREILABO. It is currently expanding its reach through direct-to-consumer (D2C) e-commerce and company-operated stores, responding to shifts in consumer behavior. The company is also investing in automation and a globally optimized production system to enhance competitiveness and sustainability.Lifestyle Creations Division

This segment covers commercial facility development, landscaping and greening, and sports clubs. Gunze is leveraging this division to contribute to urban revitalization, environmental responsibility, and regional wellbeing—most notably through greening initiatives ahead of events like the Osaka Expo.Functional Solutions Division

This innovative arm includes plastic films, engineering plastics, medical materials, and mechatronics. It supports industries from semiconductors to healthcare. Recent efforts focus on sustainability, including the introduction of eco-friendly products and the development of a Circular Factory™ to support resource recycling.

Recent Developments and Strategy

During fiscal year 2022–2023, the Japanese economy showed signs of recovery post-COVID. However, Gunze faced challenges including rising material costs and currency fluctuations, exacerbated by global events like the conflict in Ukraine.

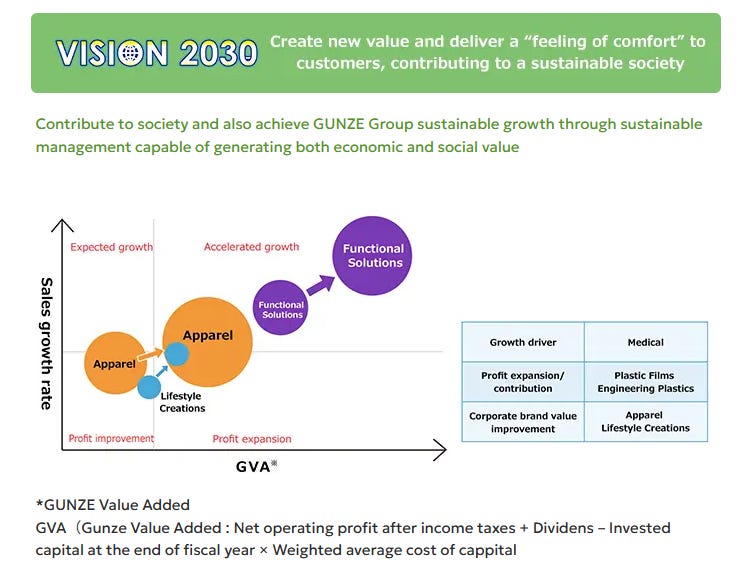

In this context, Gunze launched "VISION 2030 Stage 1", its medium-term management plan centered on four key strategies:

Creation of New Value

Capital Cost-focused Management

Evolution of Corporate Constitution

Environmentally Responsible Management

Actions included the sale of the film business in its Electronic Components segment and a reorganization of production bases in its legwear segment to optimize operations.

Segment Performance

Functional Solutions: Despite increased raw material and fuel prices, overall sales remained strong.

Apparel: Sales recovered but were pressured by currency volatility and input costs.

Lifestyle Creations: This segment performed well, particularly due to land redevelopment efforts.

Looking Forward

Gunze’s forward-looking strategy includes:

In Functional Solutions: Launching new eco-friendly products, operationalizing the Circular Factory™, expanding global sales, and applying digital technology to boost productivity.

In Medical: Scaling up production of sutures and artificial skin, focusing on the U.S. and China, and accelerating product innovation.

In Apparel: Enhancing competitiveness through D2C growth, automation, and the Net Zero Factory Plan, aiming for near-zero CO₂ emissions using renewable energy.

In Lifestyle Creations: Strengthening facility profitability and expanding green projects and educational sports programs.

Commitment to Shareholders

Gunze places a high priority on returning earnings to shareholders. It maintains a stable dividend policy with a target payout ratio of around 50%. For its 128th business term, it declared a period-end dividend of 153 yen per share.

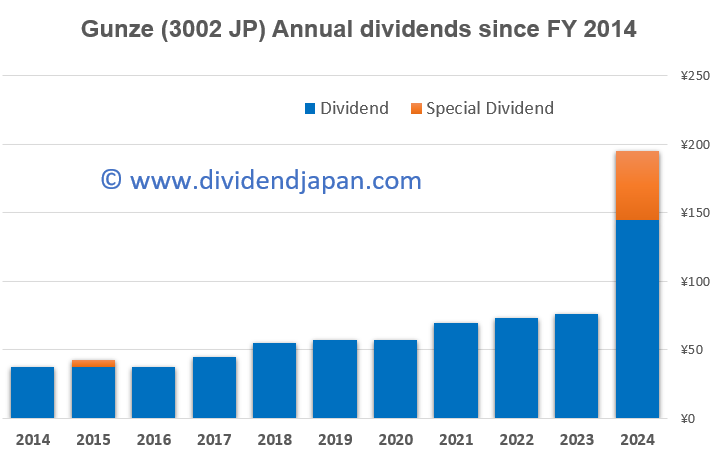

Dividend: The Standout Metric

Gunze has rewarded shareholders with a stable to rising dividend for years.

FY2024 dividend: ¥76.50 per share (¥153.00 per share before stock split)

FY2025 ordinary dividend: ¥144.50 per share (nearly double last year’s)

Special dividend: ¥50.50 per share

Total FY2025 payout: ¥195.00 per share

Yield: ~6.5% at a share price of ¥3,000

This explosive dividend growth stands out in Japan in 2025, especially for a stock with a record of annual dividend hikes, and underscores Gunze’s commitment to returning cash to investors.

Valuation & Analyst Sentiment

Consensus P/E (FY2025): ~13×

Analyst Ratings: 4 × “Buy”

Weaknesses: Relatively low ROIC and modest EBIT margins

Strengths: Consistent revenue and profit growth, debt-free balance sheet, high dividend yield and strong dividend history

Would You Buy?

Gunze’s diversified revenue streams and global footprint provide a natural hedge against cyclical downturns. While margins could improve, the company’s solid balance sheet and huge dividend payout—backed by four straight “Buy” recommendations—make it a compelling income play.

So, would you add Gunze Ltd. to your portfolio for its yield and stability? Let us know your thoughts below!

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders! Investing in Japan isn’t for everyone, given its unique trading hours, large price swings, currency fluctuations, lot size requirements, and limited analyst coverage — yet the country also offers some of the world’s best dividend growth opportunities, with countless hidden gems waiting to be discovered.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.