🚀 Investing in Japan’s Final Frontier: Publicly Listed Space Companies

Inside the rise of Japan’s space sector: new listings, big ambitions, and growing investor caution

As the global space economy enters a new era of commercial expansion, Japan is quietly building momentum as one of Asia’s most active players. From moon missions to orbital cleanup to radar satellites, Japanese space companies are pursuing some of the most critical frontiers in this fast-evolving industry.

Key points from this article

Government-Driven Growth – Japan is pouring public funds into its space sector (including a ¥600 billion Space Strategy Fund), helping startups scale in a VC-light environment.

IPO Wave Underway – Five space startups have gone public in two years, with Axelspace set to IPO in June 2025. Investor interest is growing, but profitability remains distant for most.

Synspective Leads the Pack – Among listed players, Synspective (code: 290A) stands out with strong share performance (+176% YTD), projected profitability by 2026 (P/E 22), and backing from giants like Mitsubishi Electric.

This post explores the key publicly traded companies in Japan’s space sector and unpacks what’s driving — and sometimes restraining — their growth. We also take a look at what’s coming next, including a highly anticipated IPO.

Japan’s private space sector has long been the domain of large industrial conglomerates. While more than 100 startups are now active in the field, most remain unprofitable, and the few that have gone public (see below) show mixed performance on the stock market.

What’s giving momentum to these ventures is strong backing from the Japanese government, which is ramping up its postwar defense posture in response to China’s rising technological and military influence. Companies like Axelspace — and others eyeing a public debut — are relying on this strategic support to help attract investor interest.

📈 Space Economy: Global and Japanese Growth Trajectory

🌍 Global Outlook

According to the World Economic Forum (2024), the global space economy is projected to grow from $630 billion in 2023 to $1.8 trillion by 2035, driven by:

Falling launch costs

Proliferation of satellite services

Expansion in communications, Earth observation, and defense

Emerging niches such as in-orbit servicing and lunar logistics

🇯🇵 Japan's Space Industry

Japan’s domestic space industry is currently valued at around ¥4 trillion ($27.8 billion). The government aims to double this to ¥8 trillion ($52 billion) by the early 2030s. Notably:

A new ¥600 billion Space Strategy Fund has been established to support commercial ventures in satellites, rockets, and infrastructure.

Growth forecasts include:

11.1% CAGR for Japan's space tech market through 2030

Nearly 3x growth for satellite manufacturing over the same period

Government backing is particularly critical in Japan, where private funding alternatives are limited compared to the U.S. venture capital ecosystem.

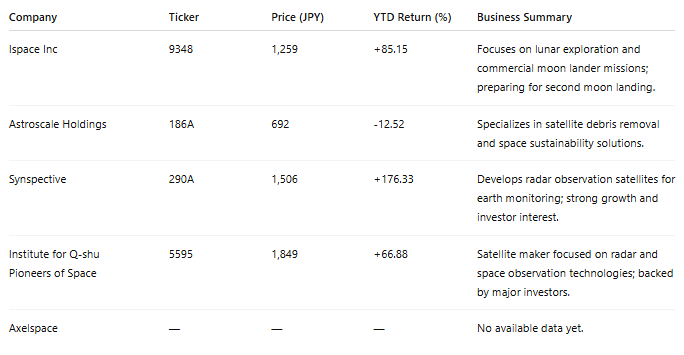

🛰️ Publicly Traded Space/Satellite Companies in Japan

🌕 Ispace Inc. (Code: 9348)

Focus: Lunar exploration and landers

Founded: 2010 | IPO: 2023

Ispace emerged from the Google Lunar XPRIZE as Team HAKUTO and now develops robotic landers for moon missions. Its flagship HAKUTO-R program aims to enable payload delivery, exploration, and eventual resource extraction.

A second moon landing attempt is expected soon, following a recovery in its share price after post-IPO volatility.

Ispace reported triple digit revenue growth in the last two years with sales expected to grow by 42% for FY 2026 (ending next March). The company does not make a profit and is not expected to do so in the next couple of years.

Peers: Astrobotic, Intuitive Machines, national agencies like NASA/ESA

🛰️ Astroscale Holdings Inc. (186A)

Focus: Orbital debris removal and satellite servicing

Founded: 2013 | IPO: 2024

Astroscale develops technologies for cleaning up space debris, extending satellite lifespans, and enabling deorbiting. It partners with JAXA, ESA, and satellite operators to maintain long-term orbital sustainability.

Despite strong mission relevance, its shares are down ~40% since debut — underscoring investor caution around business models with longer paths to profitability. Actually, the stock trades near its all time low currently at 692 yen.

Astroscale is not profitable and is not expected to report a profit in the next couple of years. Revenue is expected to more than double for FY 2025.

Peers: ClearSpace, D-Orbit, Northrop Grumman (servicing segment)

🛰️ Institute for Q-shu Pioneers of Space Inc. (5595)

Focus: SAR (Synthetic Aperture Radar) microsatellites

Founded: 2005 | IPO: 2023

iQPS was founded in 2005 by emeritus professors at Kyushu University, based on Kyushu University’s satellite development technology, with the goal of establishing space industry in Kyushu,Japan. Engaged in space technology development that contributes to the advancement of humanity, in collaboration with honorary professors, engineers, entrepreneurs, and supported by more than 25 partner companies all over Japan, mainly in northern Kyushu.

The company operates small, high-resolution radar satellites capable of imaging Earth in all weather and lighting conditions. It’s planning a full constellation of 36 satellites for near real-time observation, covering any point on earth.

iQPS is expected to make a profit within two years, resulting in an estimated p/e of 115 for 2026. Revenue is expected to almost double in 2025.

Peers: ICEYE, Capella Space, Synspective (see below)

Market Response: iQPS shares are up 67% in 2025 at 1,849 yen, signaling strong market interest in revenue-generating, data-centric satellite applications. The stock however is down form its 2024 high of more than 4,500 yen.

🛰️ Synspective Inc. (290A)

Focus: SAR (Synthetic Aperture Radar) microsatellites for Earth observation

Founded: 2018 | IPO: 2024

Overview:

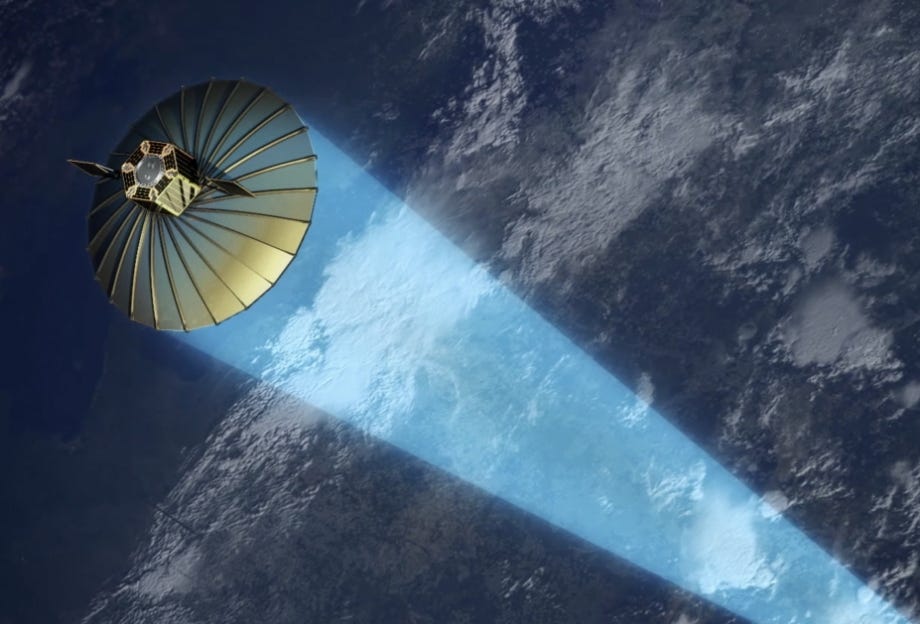

Synspective develops compact SAR satellites designed to provide high-resolution imaging regardless of weather or lighting. SAR satellites, unlike optical ones, utilize radar technology, enabling them to acquire detailed information about the Earth's surface regardless of day, night, or weather conditions.

Their data supports urban planning, disaster response, infrastructure monitoring, and environmental management. The company now has a market cap of $1,1 billion (167 billion yen). Synspective is a direct competitor to Institute for Q-shu Pioneers of Space.

Positioning:

The company aims to deploy a constellation of satellites to deliver frequent, on-demand radar imagery, targeting both domestic and international markets.

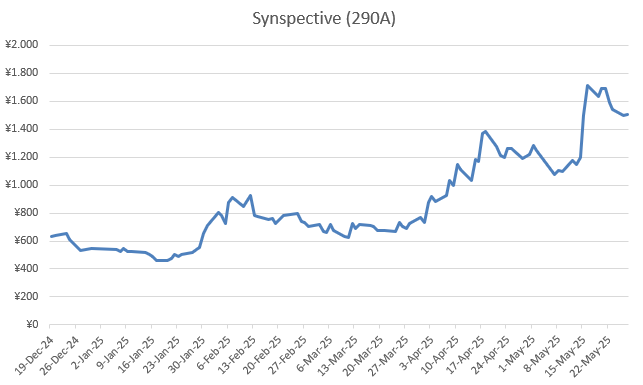

Synspective actually is expected to make a profit next year with an estimated p/e of just 22 for FY 2026. Not surprisingly, the stock is up 176% YTD trading close to its all time high at 1,506 yen. On May 21, Synspective stock touched its record high of 1,820.

Revenue is expected to jump from 2,3 billion yen in 2024 to 38 billion yen in FY 2029. This explains investor interest for Synspective.

One of the biggest shareholders in Synspective is Mitsubishi Electric (6503), one of the biggest companies in Japan with a market cap of 6,5 trillion yen ($45,3 billion). Mitsubishi Electric stock currently trades near its all time high.

Market Response:

Since its 2022 listing, Synspective’s shares have done very well, reflecting growing investor confidence in its scalable satellite data business model.

Competitors:

iQPS (Japan), ICEYE (Finland), Capella Space (US)

🎯 Summary:

Synspective (290A) is a more integrated, analytics-driven Earth observation company. It not only delivers SAR data but also adds value through proprietary insights tailored to urban development and disaster monitoring.

iQPS (5595) focuses on building a cost-effective, high-frequency SAR satellite network. Its compact satellites enable more frequent Earth imaging at lower operational costs.

While both target the fast-growing SAR market, Synspective operates at a more enterprise and solution-oriented level, whereas iQPS emphasizes agility, affordability, and scale.

📡 SKY Perfect JSAT Holdings Inc. (9412)

Focus: Satellite communications

Founded: 2007 | Listed: Long-established

Japan’s largest satellite operator provides geostationary telecom infrastructure for broadcasting, broadband, and mobile networks. It serves both commercial and government markets and is increasingly targeting disaster-resilient and maritime communications.

SKY Perfect JSAT is a shareholder/investor in Institute for Q-shu Pioneers of Space (5595)

Peers: SES, Intelsat, SpaceX (LEO competition)

🔧 IHI Corporation (7013)

Focus: Aerospace and rocket propulsion

Founded: 1853 | Listed: Long-established

Industrial heavyweight IHI supplies propulsion systems and aerospace components, including for Japan’s H-IIA and H3 launch vehicles. Though not a pure-play space company, its strategic role in the country's launch capabilities gives it long-term relevance.

Peers: Mitsubishi Heavy Industries, ArianeGroup

🔭 What’s Next: Axelspace Eyes June IPO

One of the most closely watched upcoming listings is Axelspace, a Tokyo-based satellite imaging company founded in 2008. The company has launched five small Earth observation satellites and plans to expand its in-house data platform significantly with seven new launches in 2026.

According to sources familiar with the matter (Reuters, May 2025):

The IPO is expected to be approved later this month and may occur in June 2025.

Axelspace’s valuation could be comparable to Synspective (¥121B) and iQPS (¥72.5B).

Major investors include Mitsui & Co. and ANA Holdings. Please note that we discussed Mitsui earlier on as on of the trading houses that Warren Buffett invests in

SMBC Nikko Securities is leading the offering.

This would be the fifth Japanese space startup to go public in two years, reflecting a national strategy to bolster private space ventures through public capital access.

Context:

Over 100 space startups now operate in Japan, most still pre-profit.

Government subsidies are filling gaps left by a less mature venture ecosystem compared to the U.S.

Investor sentiment is increasingly cautious, focusing on business feasibility and long-term profitability.

🧭 Final Thoughts

Japan’s space startup ecosystem is experiencing real — if uneven — momentum. While government support remains vital, the market is becoming more selective, with investors scrutinizing unit economics, scale potential, and commercial execution. As Axelspace prepares to join the public ranks, its reception may serve as a bellwether for a maturing second wave of Japanese space IPOs.

If there’s one company currently making a strong impression, it’s Synspective — backed by prominent investors, solid growth, and a projected path to profitability by 2026. While none of the companies discussed here offer dividends today, Synspective stands out as a likely candidate to change that in the future.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders! Investing in Japan isn’t for everyone, given its unique trading hours, large price swings, currency fluctuations, lot size requirements, and limited analyst coverage — yet the country also offers some of the world’s best dividend growth opportunities, with countless hidden gems waiting to be discovered.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.