Stock Split Changes Little for Japan’s Most Expensive REIT

Even after a 3:1 split, Nippon Prologis still requires a $49,000 buy-in—well beyond most retail investors.

Nippon Prologis REIT’s Stock Split: Japan’s High-Priced REITs Are Slowly Becoming More Accessible

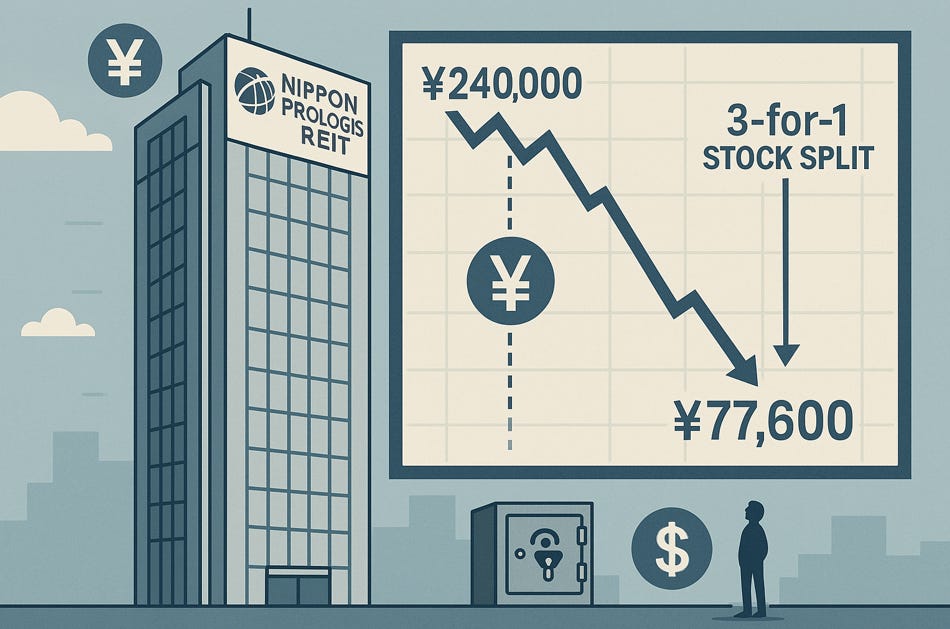

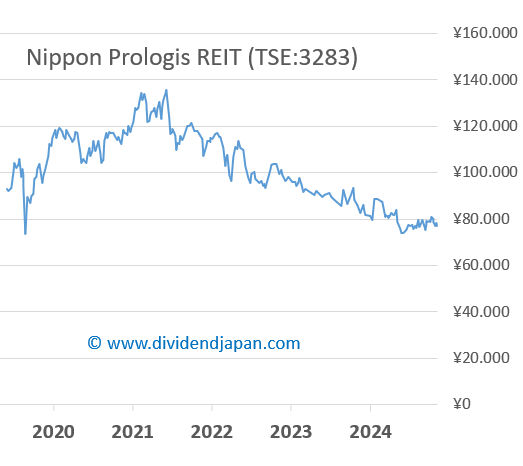

Last week, one of Japan’s most expensive stocks underwent a significant change. Nippon Prologis REIT (TSE: 3283) announced and executed a 3-for-1 stock split, bringing its share price down from nearly ¥240,000 to approximately ¥77,600.

But don’t get too excited just yet. Despite the lower price per share, Japanese investors are still required to buy in units of 100 shares—which means owning Nippon Prologis now still requires an investment of around ¥7.76 million, or roughly $49,000 USD at current exchange rates.

What Does Nippon Prologis REIT Do?

Nippon Prologis REIT specializes in logistics and industrial real estate, primarily high-quality, large-scale distribution facilities across Japan. The REIT is backed by Prologis Inc. PLD 0.00%↑ , a global logistics real estate giant (that started 2025 as one of the 25 stocks in the Dividend Hike Portfolio), and its portfolio plays a critical role in supporting e-commerce and supply chains within Japan’s urban hubs.

With a reliable dividend track record and strategic assets, it’s a favorite among institutional investors—but retail investors have long been priced out.

Why Are Japanese Shares So Expensive?

One of the quirks of the Japanese stock market is that most equities can only be purchased in minimum lots of 100 shares. For lower-priced stocks, this isn’t a huge problem. But for high-flyers like Nippon Prologis, the buy-in cost remains steep—even post-split.

This barrier to entry disproportionately affects smaller investors. It’s not uncommon to see Japanese REITs and blue-chip stocks trading above ¥200,000 per share, making many names inaccessible unless you’re prepared to commit serious capital to a single stock.

For example, as of June 2, 2025, Daiwa House REIT (TSE: 8984) is trading at approximately ¥240,000 per share, making it one of the most expensive stocks on the Tokyo Stock Exchange. Other examples include Japan Real Estate Investment (TSE: 8952) and Nippon Building Fund (TSE: 8951).

So why don’t more companies split their shares?

Interestingly, one reason some Japanese companies keep share prices high is to maintain a sense of prestige—and, according to market lore, to discourage certain “unwanted” shareholders from buying in or attending shareholder meetings. (Yes, organized crime figures, or yakuza, have occasionally been known to crash AGMs.)

A Positive Trend: More Stock Splits Across All Sectors

The good news is that Japan is increasingly embracing stock splits, and not just in tech or real estate. In fact, every year, there are dozens—sometimes over 100—stock splits across all sectors, including industrials, consumer discretionary, healthcare, financials, and more.

This broad, market-wide trend is helping to lower the barrier to entry for retail investors, both domestic and international. For dividend investors and those focused on risk diversification, this is a very positive development.

As more companies bring their share prices down to more accessible levels, a wider range of high-quality Japanese stocks becomes available to investors with smaller portfolios.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders! Investing in Japan isn’t for everyone, given its unique trading hours, large price swings, currency fluctuations, lot size requirements, and limited analyst coverage — yet the country also offers some of the world’s best dividend growth opportunities, with countless hidden gems waiting to be discovered.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.