Japanese Stock Market Reaches Record Highs as Political Clarity Returns

Moderate valuations, strong balance sheets, and steady dividends underpin Japan’s rally

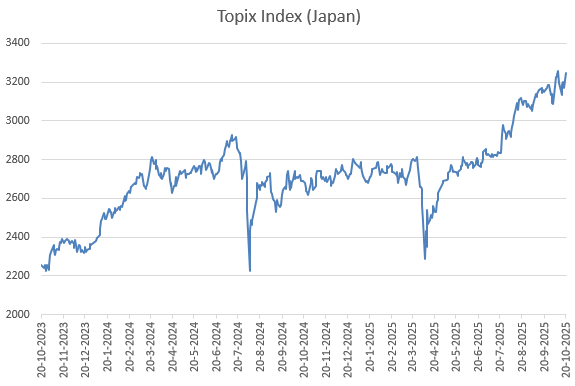

Tokyo, October 20, 2025 — Japan’s equity market climbed to new record levels on Monday as political stability returned and investor confidence strengthened. The Nikkei 225 rose 3.4% to close at 49,185.50, while the TOPIX index gained 2.5% to a historic closing high of 3,248.45.

The rally followed confirmation that Sanae Takaichi, leader of the Liberal Democratic Party (LDP), is set to become Japan’s next prime minister after a coalition agreement with the Japan Innovation Party (JIP). The news ended several days of political uncertainty and supported broad-based gains across financials, information technology, and industrial sectors.

Solid Fundamentals Despite Record Levels

Even at record highs, Japanese equities remain moderately valued. The TOPIX currently trades at a price-to-earnings ratio of about 16.5, with a dividend yield near 2.1% — still competitive compared with major U.S. indices. The index is up 16.6% year-to-date.

Valuations vary widely across sectors. Technology, semiconductor, and AI-related stocks trade at higher multiples, reflecting growth expectations, while defensive companies such as consumer goods and industrials continue to show lower valuations, backed by strong balance sheets, stable earnings, and consistent dividend records.

Analysts note that the combination of solid corporate profitability, shareholder returns, and ongoing governance reforms continues to underpin Japan’s market resilience.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.