Japan's Sushi Chain Food & Life (3563) keeps growing the dividend

Leading Conveyor Belt Sushi Chain Food & Life Companies delivers strong growth

Food & Life Companies Ltd.: A Deep Dive into Japan's Leading Conveyor Belt Sushi Chain

Food & Life Companies Ltd. has grown into one of Japan’s most influential players in the food and beverage industry, particularly in the world of conveyor belt sushi. Originally founded as Sushiro Global Holdings in 1984, the company has expanded far beyond its origins, operating both domestically and internationally. Today, it is recognized as a leader in sushi innovation, with a strong presence across multiple brand names

The company operates across several key segments, each contributing to its robust performance. Here’s a breakdown of Food & Life’s core business areas:

Domestic Sushiro Business: Oversees conveyor belt sushi restaurants across Japan.

Overseas Sushiro Business: Manages Sushiro’s international operations.

Kyotaru Business: Focuses on take-out sushi and other related restaurants.

Other Segment: Includes Sasugidama, a sushi izakaya-style dining experience.

Financial Performance: Strong Growth Across the Board

Food & Life Companies has shown impressive financial results. For the three months ending December 31, 2024, the company achieved notable growth:

Sales: ¥99.14 billion (+15.9% YoY)

Operating Profit: ¥9.58 billion (+56.4%)

Pretax Profit: ¥9.34 billion (+62.9%)

Net Profit: ¥6.13 billion (+88.2%)

Earnings Per Share (EPS): ¥54.18 (up from ¥28.15)

For the full fiscal year 2024, Food & Life Companies saw a 19.7% increase in revenue, reaching ¥361.1 billion, and they are projecting a 13.6% growth for 2025, bringing that total to ¥410 billion. With continued double-digit growth expected in both revenue and EPS, the company is set for a promising future.

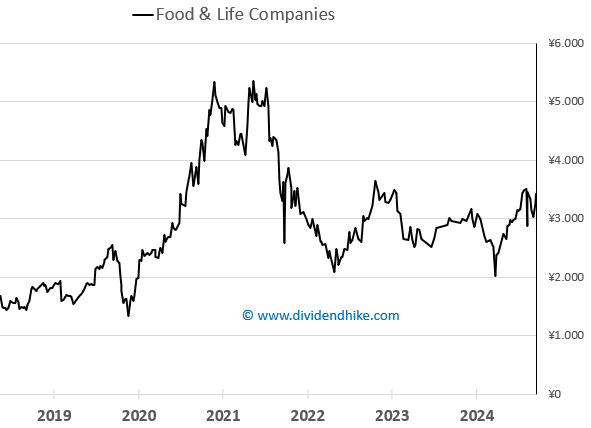

Despite its strong financial position, the company’s net debt stood at ¥165.25 billion at the end of 2024, which is expected to decline over time. However, the P/E ratio for fiscal year 2025 is relatively high at 30, indicating high market expectations.

Competitive Landscape

In the conveyor belt sushi market, Food & Life Companies faces competition from several key players:

Kura Sushi: A major rival, operating both in Japan and internationally.

Sushi Yama: Known for Nordic-inspired sushi with a focus on sustainable sourcing.

Wasabi: A global sushi restaurant chain with operations across multiple markets.

Key Stats & Figures:

Market Capitalization: ¥480.5 billion (~$3.1 billion)

Dividend Yield: 0.8%

Dividend Frequency: Annually

2025 Dividend: ¥30 (up from ¥22.50 in 2024)

Largest Shareholder: Nomura Asset Management (4.5%)

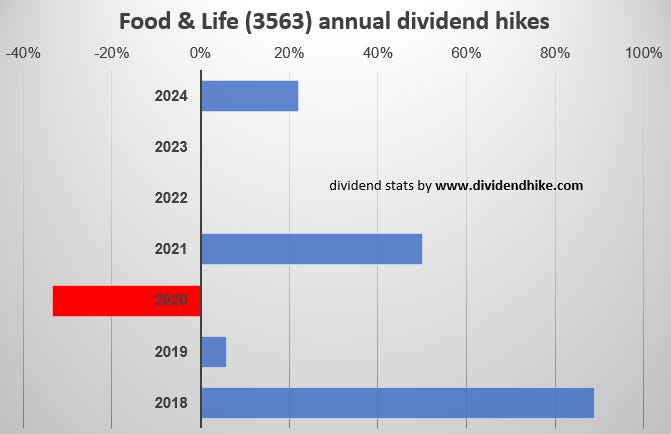

Dividend History:

FY24/9: ¥30.00 (Dividend Payout Ratio: 23.5%)

FY23/9: ¥22.50 (Dividend Payout Ratio: 32.4%)

FY22/9: ¥22.50 (Dividend Payout Ratio: 72.2%)

FY21/9: ¥22.50 (Dividend Payout Ratio: 19.8%)

FY20/9: ¥15.00 (Dividend Payout Ratio: 27.0%)

The 2025 dividend marks the highest ever for the company, a reflection of its strong recovery and growth post-pandemic. The dividend payout ratio has varied over the years but generally remains within a reasonable range, reinforcing Food & Life’s commitment to rewarding its investors.

Shareholder Benefits

Food & Life Companies offers unique benefits to its Japanese shareholders in the form of discount coupons that can be redeemed at various company-operated restaurants. These include all Sushiro, Sugidama, and Kyotaru establishments (except select branches). The benefits are extended to shareholders who meet the following criteria:

Long-term Shareholders: Those holding shares for at least three consecutive years receive additional coupons, increasing their total benefits based on the number of shares they hold. For example:

A shareholder with 200 shares for 3+ years would receive ¥3,300 in coupons.

A shareholder with 200 shares but selling within 3 years would receive ¥2,200 in coupons.

The coupons can be used during business hours and combined with other discounts, though they’re not valid for online orders or delivery services. They provide an attractive incentive for investors who are looking to engage with the brand beyond just financial returns.

Conclusion

Food & Life Companies Ltd. is a powerhouse in Japan’s conveyor belt sushi market, with its remarkable financial growth, impressive dividend history, and unique shareholder perks. With strong international expansion, a robust competitive strategy, and a commitment to quality, the company is well-positioned to continue its growth. Whether you're a sushi lover or an investor, keeping an eye on Food & Life Companies offers exciting potential for the future.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.