Japan’s Billion-Dollar Dividend Giants

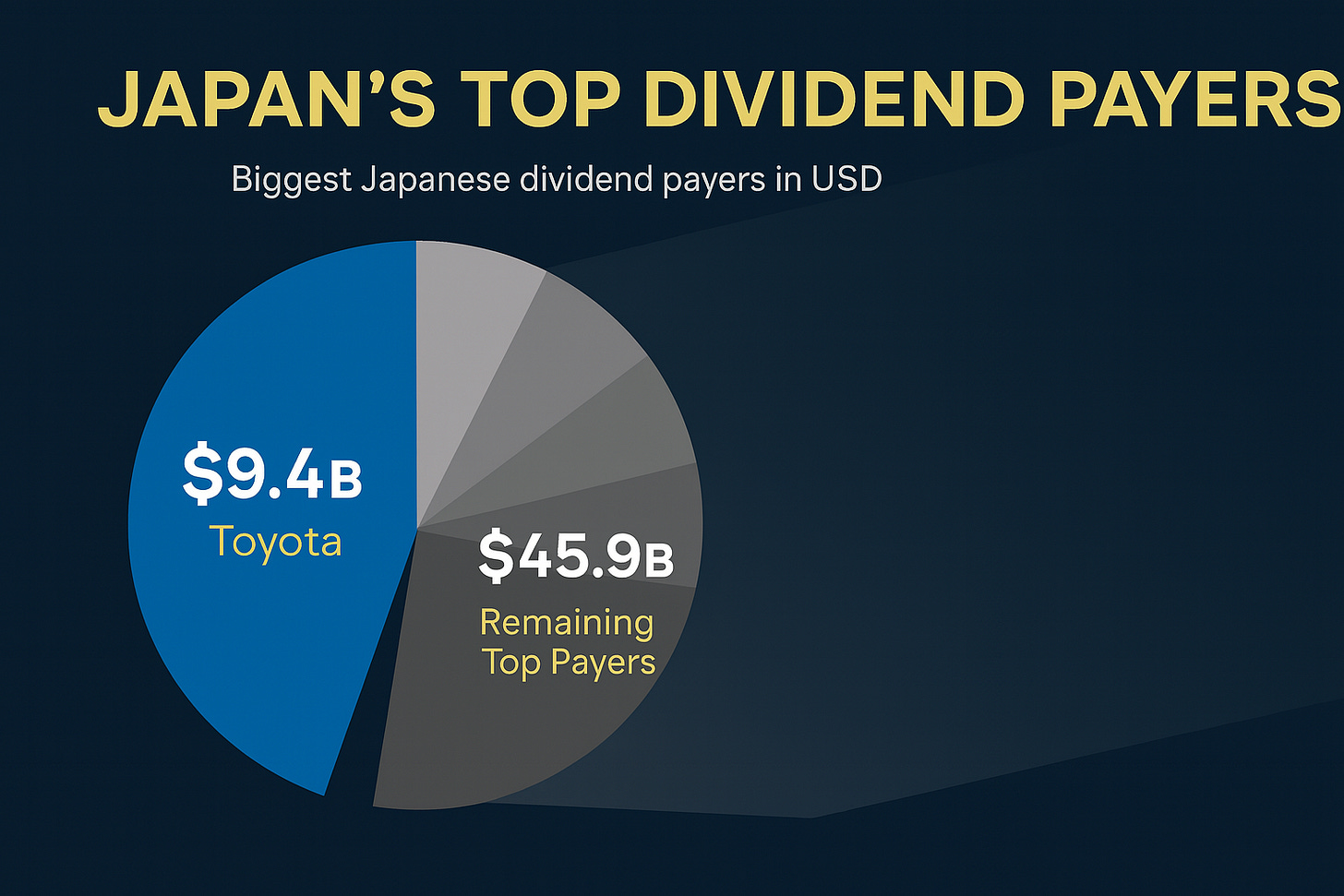

Nearly 30 Japanese companies now distribute over $1 billion in annual dividends

While Japan is often associated with technological innovation, precision manufacturing, and a culture of corporate conservatism, its dividend landscape tells a story of quiet strength and growing shareholder returns.

Nearly 30 Japanese companies now distribute over $1 billion in annual dividends—measured in U.S. dollars—underscoring the country’s evolution into a dividend powerhouse.

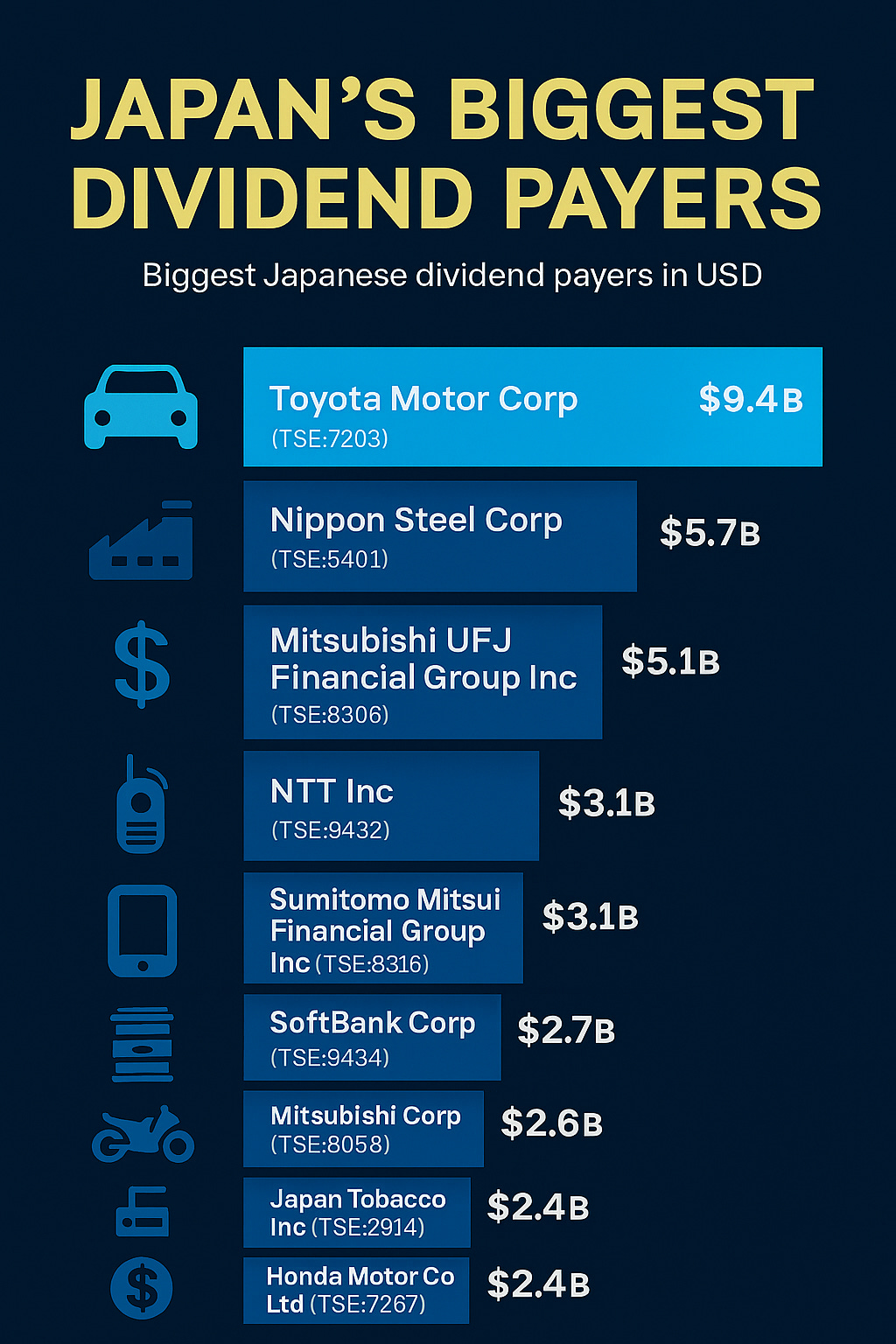

🚗 Toyota: The Undisputed Dividend Champion

At the top of the list stands Toyota Motor Corp (TSE:7203), the world’s largest automaker by revenue. With a market cap of $301.7B, Toyota returns an eye-watering $9.4B annually to shareholders. As of October 10, its share price stood at ¥2,899, offering a dividend yield of 3.1%. Its scale, global reach, and consistent profitability make it the anchor of Japan’s dividend ecosystem.

🏗️ Steel and Finance: Japan’s Heavyweight Payers

The second-largest dividend payer is Nippon Steel Corp (TSE:5401), distributing $5.7B annually—despite a market cap of just $21.2B. Its share price of ¥600 reflects a generous 5.3% yield, highlighting its shareholder-friendly capital allocation.

Japan’s megabanks are also major contributors:

Mitsubishi UFJ Financial Group (TSE:8306): $5.1B dividend, ¥2,285 share price, 2.8% yield

Sumitomo Mitsui Financial Group (TSE:8316): $3.1B, ¥3,991, 3.1% yield

Mizuho Financial Group (TSE:8411): $2.3B, ¥2,355, 2.7% yield

These financial giants are increasingly aligning with global norms on capital returns, offering stable and growing dividends.

📡 Telecom and Trading Houses: Quietly Dominant

Telecom players deliver consistent cash flows:

NTT Inc (TSE:9432): $3.1B, ¥153, 3.4% yield

KDDI Corp (TSE:9433): $2.0B, ¥4,222, 4.6% yield

SoftBank Corp (TSE:9434): $2.7B, ¥215, 4.0% yield

Meanwhile, trading conglomerates ride global cycles:

Mitsubishi Corp (TSE:8058): $2.7B, ¥3,577, 2.8% yield

Itochu Corp (TSE:8001): $2.1B, ¥4,756, 2.9% yield

Mitsui & Co (TSE:8031): $1.9B, ¥3,714, 2.7% yield

Marubeni Corp (TSE:8002): $1.0B, ¥1,060, 1.4% yield

Sumitomo Corp (TSE:8053): $1.0B, ¥3,805, 2.5% yield

🏭 Industrial Icons and Global Brands

Japan’s industrial backbone also plays a key role:

Honda Motor Co (TSE:7267): $2.4B, ¥4,904, 4.1% yield

Tokyo Electron (TSE:8035): $1.8B, ¥29,280, 2.0% yield

Komatsu Ltd (TSE:6301): $1.2B, ¥2,198, 2.9% yield

Denso Corp (TSE:6902): $1.2B, ¥4,422, 3.6% yield

Hitachi Ltd (TSE:6501): $1.3B, ¥5,325, 4.4% yield

Canon Inc (TSE:7751): $1.4B, ¥1,711, 3.4% yield

Even Nintendo Co Ltd (TSE:7974), known for its creative prowess, returns over $1.0B to shareholders. Its share price of ¥12,385 reflects a modest 1.0% yield, emphasizing growth over income.

💊 Pharma, Insurance, and Chemicals: The Diversifiers

From healthcare to insurance and chemicals:

Takeda Pharmaceutical (TSE:4502): $2.1B, ¥8,539, 2.3% yield

Chugai Pharmaceutical (TSE:4519): $1.1B, ¥5,325, 2.9% yield

Tokio Marine Holdings (TSE:8766): $2.2B, ¥6,328, 2.7% yield

MS&AD Insurance (TSE:8725): $1.5B, ¥3,068, 4.7% yield

Japan Tobacco (TSE:2914): $2.6B, ¥1,556, 4.4% yield

Shin-Etsu Chemical (TSE:4063): $1.4B, ¥3,369, 3.0% yield

Japan Post Bank (TSE:7182): $1.4B, ¥5,020, 2.1% yield

📈 A New Era for Japanese Income Investors

This cohort of dividend titans reflects a broader shift in Japanese corporate governance. With increasing pressure from global investors and domestic reforms encouraging capital efficiency, Japan is no longer just a land of cash-rich companies—it’s becoming a fertile ground for income-focused portfolios.

For dividend investors seeking geographic diversification, currency exposure, and stable cash flows, Japan’s billion-dollar dividend club offers a compelling proposition.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.

The trading conglomerates section is particulary interesting because people often overlook that Itochu Mitsubishi Mitsui Marubeni and Sumitomo collectively return over $9 billion annually in dividends despite trading at reasonable valuations. What's remarkable is how these sogo shosha have transformed from commodity traders to diversified holding companies with stakes across energy tech infrastructure and consumer assets which makes their dividend streams more resilient than most people realise. The 2.5 to 3.0 percent yields might seem modest compared to telecoms at 4 plus percent but the compounding power comes from steady growth in the underlying busines portfolios rather than just maintaining existing cash flows. Your broader point about Japan evolving from cash hoarding to active capital returns captures the structural shift that makes Japanese equities compelling for income investors who previously ignored the market.