Japan’s Semiconductor Giants Bounce Back in June 2025

While U.S. chip stocks set new records, Japan’s Lasertec (TSE: 6920) and Disco (TSE: 6146) are now catching up

Japan's Semiconductor Sector Continues Its Recovery: Spotlight on Disco Corp and Lasertec

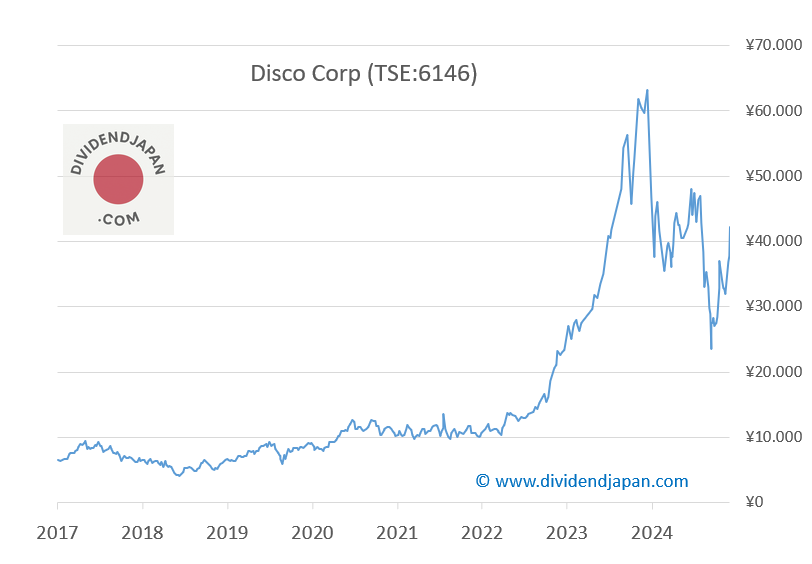

The rebound in Japan's semiconductor sector is accelerating, in parallel with the ongoing strength of U.S. peers—many of which have recently reached or are nearing all-time highs. However, Japanese companies in the same sector remain well below their 2024 peaks. A clear catch-up rally appears to have started.

Key Points

Disco Corp surged 7.5% to ¥42,020, nearly doubling from its April low of ¥22,604.

Lasertec and Disco show strong dividend growth, averaging over 20% annually.

Japanese chip stocks are rebounding but still trail U.S. peers like Nvidia and Broadcom.

Disco holds a niche monopoly in wafer processing tools with a $28B market cap.

Previously, we highlighted the recovery in Lasertec (TSE:6920), which recently doubled in value from ¥10,000 to nearly ¥20,000. Today, attention also turns to Disco Corporation (TSE: 6146), which closed 7.5% higher at ¥42,020. This stock was still trading around ¥26,000 in mid-April, having reached its 2024 low of ¥22,604 in early April. The near doubling in just a few months is remarkable.

This recovery may come as less of a surprise when considering the significantly higher valuations of U.S. peers such as KLA Corporation KLAC 0.00%↑ , Lam Research LRCX 0.00%↑ , Monolithic Power MPWR 0.00%↑ , Applied Materials AMAT 0.00%↑ , Broadcom AVGO 0.00%↑ , and Nvidia NVDA 0.00%↑ —as well as the strong dividend histories of certain Japanese firms.

Lasertec stands out for its consistent dividend increases and strong track record. Disco Corp also has an exceptional dividend growth profile. Like Lasertec, Disco holds a near-monopoly in a unique semiconductor niche and has raised its dividend aggressively for years. For FY 2024, the dividend was increased by 34.5%, and over the past 10 and 20 years, Disco has averaged annual dividend growth of more than 20%—surpassing even many U.S. semiconductor stocks.

Disco's current market capitalization is approximately €26 billion, or about $28 billion USD, and the stock is now slightly positive year-to-date. This underlines how sharply it had fallen earlier in 2024. At current levels, the dividend yield is approximately 1.1%, which compares favorably against American semiconductor firms in terms of dividend growth momentum.

Disco Corp estimates for FY 2025/2026 (March)

Revenue growth 3.8% to 408,05 billion yen ($2.6 billion) for 2026

FY 2025 revenue growth of 27.9%

ROIC of 53.9% for FY 2025

Estimated p/e of 36 for FY 2026

Analyst recommendations: 4x strong buy, 7x buy, 9x hold, no sell ratings

For context: Disco Corporation develops, manufactures, and sells precision processing equipment and tools used for cutting, grinding, and polishing semiconductor wafers and electronic components. Its proprietary technologies are widely used in wafer dicing and thinning processes, making it a critical supplier within the global semiconductor value chain.

While this strong rebound is noteworthy, the sector still shows some divergence—Renesas (TSE:6723), for instance, experienced a sharp decline yesterday following its earnings release.

We will continue to monitor developments in Japan's semiconductor sector closely.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders! Investing in Japan isn’t for everyone, given its unique trading hours, large price swings, currency fluctuations, lot size requirements, and limited analyst coverage — yet the country also offers some of the world’s best dividend growth opportunities, with countless hidden gems waiting to be discovered.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.