🇯🇵 Kusuri No Aoki: Japan’s Answer to CVS

Drugstore chain with Stronger Growth and a Cheaper Valuation

While U.S. investors often focus on domestic giants like CVS Health CVS 0.00%↑ and Walgreens Boots Alliance WBA 0.00%↑ , Japan's Kusuri No Aoki Holdings (3549:JP) offers a compelling case as a high-growth, well-managed pharmacy chain with a consistent track record of dividend growth and a more attractive valuation.

A Decade of Expansion

Founded in Japan, Kusuri No Aoki has built a network of drugstores that blend pharmacy services with everyday retail — from pharmaceuticals to cosmetics and daily necessities. The company has expanded steadily, both in store count and financial metrics, backed by a consistent long-term vision and operational efficiency.

The company’s fiscal year ends in May, and it has just closed out FY 2024 with strong results:

Revenue grew by 15.3% to ¥436.88 billion

For FY 2025, analysts expect another double-digit growth, pushing revenue toward ¥500 billion

Explosive Earnings Growth

The bottom line is accelerating even faster.

For FY 2025, EPS is expected to grow by over 37% to ¥178 per share

Based on the current share price of ¥3,308, that implies a forward P/E ratio of 18.6

Despite strong earnings momentum, the valuation remains relatively modest — especially in light of the company’s solid balance sheet and growth profile.

Dividend: Quietly Powerful

While the dividend yield is currently modest at 0.4%, Kusuri No Aoki stands out for its consistency and growth rate:

The company pays twice per year

In December, the interim dividend was significantly increased from ¥5.3333 to ¥7

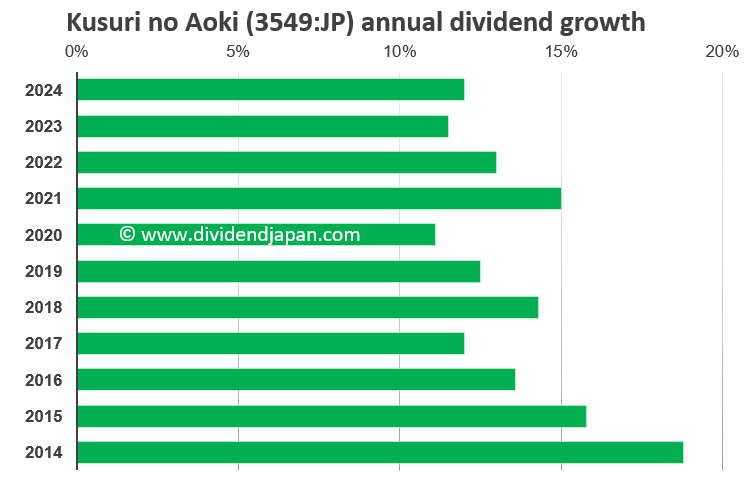

Importantly, the dividend has now grown at double-digit rates for over 10 consecutive years

This makes the stock particularly appealing to investors with a long-term income growth focus, even if the current yield is low.

Analyst Sentiment & Market Cap

The market appears to be taking notice:

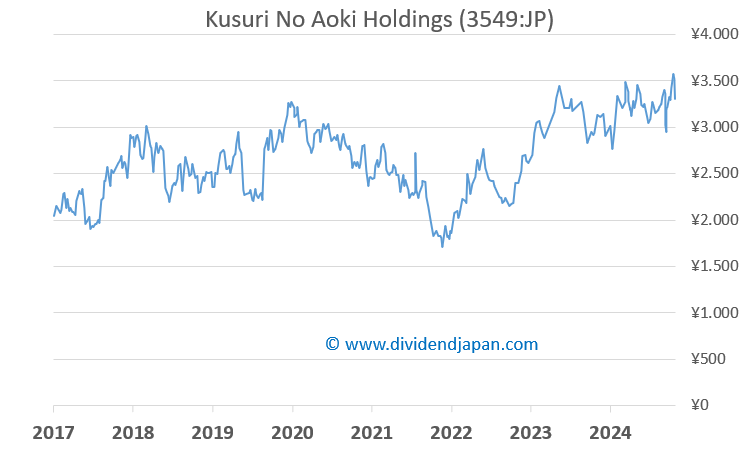

The stock is trading near its all-time high

Market cap stands at approximately $2.4 billion

Analyst ratings: 1 Strong Buy, 3 Buy, 1 Hold, and no Sell recommendations

Final Thoughts

Kusuri No Aoki may not be a household name internationally, but its blend of high growth, dividend discipline, and reasonable valuation makes it a noteworthy player in the global retail pharmacy landscape — especially when compared to slower-growing U.S. peers.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders! Investing in Japan isn’t for everyone, given its unique trading hours, large price swings, currency fluctuations, lot size requirements, and limited analyst coverage — yet the country also offers some of the world’s best dividend growth opportunities, with countless hidden gems waiting to be discovered.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.