Lasertec: Japan’s Dividend Champion on the Rise – Can It Reach Record Highs Again?

Precision, innovation, and EUV expertise driving a standout Japanese semiconductor player

Lasertec Corporation (TSE:6920), a Tokyo-based pioneer in semiconductor and advanced optical inspection systems, has seen its shares surge on the Tokyo Stock Exchange in recent days. Known for delivering high-value, unique products through rapid development, Lasertec has carved out a leading position in the global semiconductor industry.

Lasertec Key Takeaways

Stock rebound: Shares up 40% YTD, with recent double-digit gains above ¥20,000; still below the all-time high of ¥43,000.

Strong fundamentals: P/E 28, ROIC 72% FY 2024, operating margin 48.85%, ¥130B net cash.

Dividend under watch: Payout ~30%, coverage ~350%, yield 1.55%; future growth may slow with EPS projected to drop to ¥754 FY 2026.

Analyst sentiment: Mixed: 4 buy / 9 hold / 3 sell, with an average price target of ¥17,300, below current levels.

Founded in 1960, the company has consistently innovated, focusing on solutions that address critical challenges in semiconductor manufacturing. Its specialized systems, particularly for extreme ultraviolet (EUV) applications, give it a competitive edge and make it an essential partner in the next-generation semiconductor ecosystem.

Dominance in the EUV Market

Lasertec's EUV mask inspection systems are integral to the semiconductor manufacturing process. While ASML leads in EUV lithography equipment, Lasertec's specialized inspection tools complement ASML's offerings, ensuring the precision required for advanced chip production. This niche expertise has solidified Lasertec's position as a key player in the semiconductor supply chain.

Competitive Landscape: Lasertec vs. KLA Corporation

In the realm of semiconductor inspection, Lasertec faces competition from companies like KLA Corporation. However, Lasertec's focus on EUV mask inspection sets it apart, catering to the specific needs of next-generation semiconductor manufacturing. While KLA offers a broader range of inspection solutions, Lasertec's specialized systems provide a unique value proposition in the EUV segment.

Lasertec’s commitment to quality, research, and precision places it in a unique position among global competitors. With a strong track record of growth and dividends, investors are now asking: Can this Japanese dividend champion climb back to its all-time highs?

As the semiconductor sector evolves, Lasertec’s focus on rapid product development and high-value solutions positions it to capture emerging opportunities while maintaining its leadership in EUV inspection technology.

Valuation, dividend and outlook

Lasertec shares have staged a strong comeback in recent weeks, in line with the broader semiconductor sector in Japan and the U.S. Yet Lasertec stands out with two consecutive days of double-digit gains, pushing the stock comfortably above ¥20,000. On Monday, the share closed 10.5% higher, following a 12.5% gain last Friday, September 19. Year-to-date, the stock is up 40%, giving it a market capitalization of roughly $13.5 billion. Still, the all-time high of over ¥43,000 from a few years ago remains far away.

Looking at the fundamentals, Lasertec trades at an estimated P/E of 28 for 2025. Last year, its ROIC reached an impressive 72%, while analysts project it to drop to 25% this year. Operating margin for the last fiscal year (ending June 2025) was 48.85%, and the dividend payout remains stable at around 30%, with dividend coverage close to 350%. After a 17.8% revenue increase in 2025, analysts expect a 15% revenue decline for the current fiscal year.

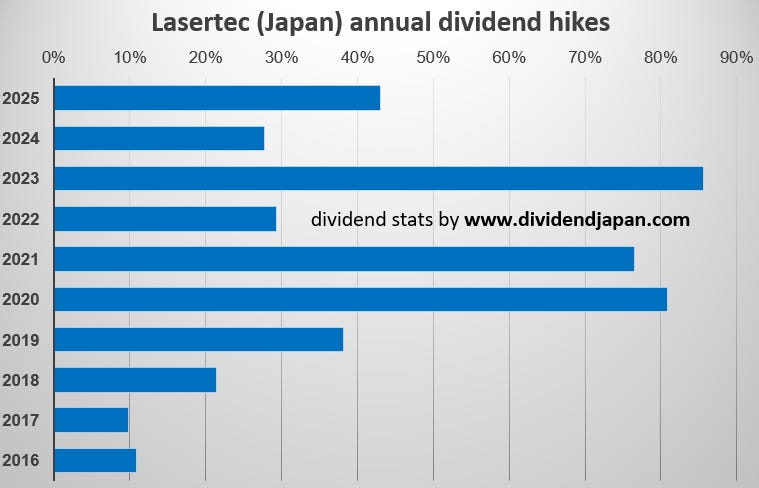

On the positive side, the balance sheet is very strong, with ¥130 billion in net cash. The current dividend yield is 1.55%, and Lasertec has shown strong dividend growth in recent years. Whether this growth continues will largely depend on earnings development over the coming years. With expected profit declines in 2026, it is quite possible that the dividend could decrease next year. EPS is projected at ¥754, down from ¥938 for fiscal year 2025. If Lasertec maintains its payout ratio, the dividend would likely fall slightly.

Analysts remain divided: 4 recommend buying, 9 recommend holding, and 3 recommend selling, with an average price target of ¥17,300, well below the current level of ¥21,195.

Conclusion: We are uncertain about the dividend trajectory in the coming years, though Lasertec’s track record so far has been very strong. Given the expected declines in revenue and earnings, a rapid return to record highs seems unlikely. Meanwhile, competitor KLA is firing on all cylinders with its stock near an all-time high and remains a core holding in the dividend growth portfolio for good reason.

Last week we already discussed semiconductor peer Disco Corp (TSE:6146), another dividend growth champ from Japan with a dominant market share.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.