📈 Liberta Co. (TSE: 4935): A Sentiment-Driven Rocket With No Fuel — And Big Dreams

The best performing stock from Japan in 2024 is flying high again

Liberta (code: 4935): Wild Moves, Big Dreams, and Zero Fundamentals

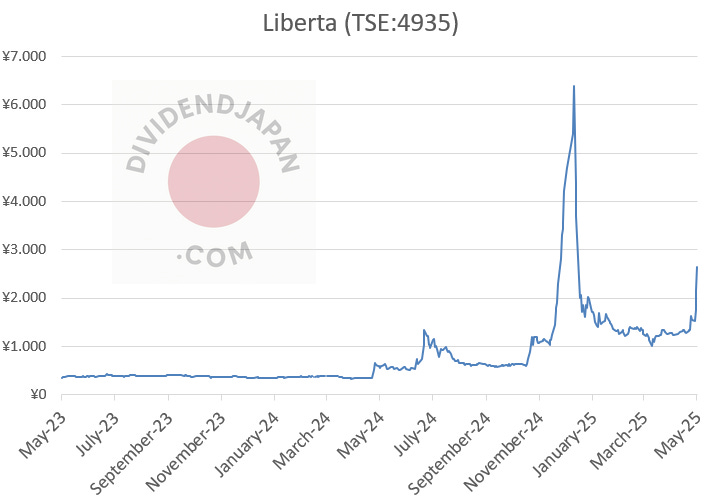

Liberta Co., Ltd. is back in the spotlight—and not for any fundamental reason. This small cap stock was the #1 stock in Japan in 2024 with a stunning 1,261,4% gain. The stock however tanked big time early 2025, giving back most of the massive gains from last year.

Key Points

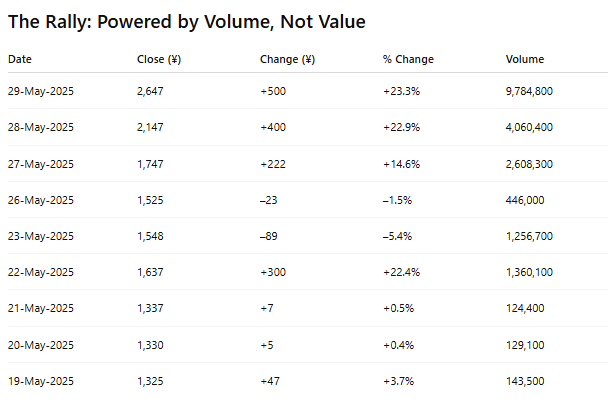

Liberta Co., Ltd. (4935) has surged 165% in just over a week, hitting multiple daily limit-up moves — without any news.

With a 1,261.4% gain Liberta was the best performing stock in Japan in 2024

Trading volumes skyrocketed from under 150,000 shares to nearly 10 million on May 29.

The company remains unprofitable, with a net loss of ¥128 million last quarter.

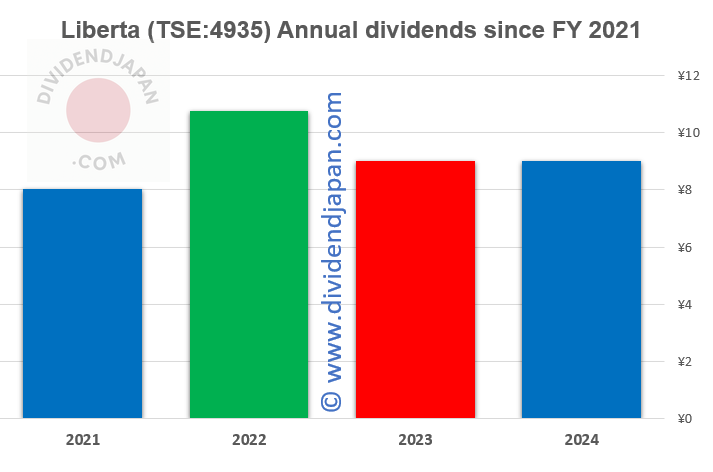

Despite growing sales (¥8.64B in FY2024, +22% YoY), Liberta cut its dividend two years ago

Liberta is a small-cap consumer goods marketer, known for quirky beauty, hygiene, apparel, and imported watch brands.

The current rally appears to be entirely sentiment-driven, reflecting the speculative nature of Japan’s microcap market.

Market cap ~$110 million, no analyst coverage, no catalysts — just pure momentum.

After crashing from a January high of ¥6,600 to a low of ¥1,000 in April, the stock is now roaring higher again, closing at ¥2,647 on May 29. That’s a 100%+ surge in under two weeks, with daily limit-up moves and exploding trading volumes… all with zero material news.

This is Japan's speculative side in full view: when a low-float small-cap starts moving, logic and fundamentals get left behind.

What Does Liberta Do?

Liberta is a Japan-based consumer goods company engaged in the planning, sales, and distribution of:

Beauty & personal care products: peeling foot care (Baby Foot), deodorants, shaving goods, quasi-drugs

Household & toiletry products: cleaners, sanitizers

Functional apparel: cooling (FREEZE TECH), warming (HeatMaster) clothing

Imported watches & eyewear: brands like Luminox, Libenham, ThinOptics

Processed foods, health goods, and educational toys

Their products are sold via department stores, drugstores, mass retailers, mail-order and e-commerce.

Financial Snapshot: Growing Sales, Persistent Losses

While the stock defies logic, the underlying business has shown steady topline growth:

FY2023 (Dec): ¥7.09 billion in revenue

FY2024 (Dec): ¥8.64 billion revenue (+21.9% YoY)

FY2025 (Forecast): ¥11.00 billion revenue (+27.4% YoY expected)

Despite the growth, Liberta remains unprofitable:

Latest Quarterly Results (Q1 FY2025 – 3 months ending Mar 31):

Revenue: ¥1.60 billion (–3.0% YoY)

Operating loss: ¥176 million

Net loss: ¥128 million (EPS: –¥21.43)

Full-Year Forecast (FY2025):

Operating profit: ¥345 million

Net profit: ¥161 million

EPS: ¥26.93

Dividend: ¥10.00 (only paid in Q4)

💡 Note: The company cut its dividend in 2023 from ¥10 to ¥9 per share, despite revenue growth—current yield sits at just 0.3%.

Liberta Co., Ltd. surged by ¥500 (+23.3%) to ¥2,647 on May 29, 2025, hitting the daily price limit for the second consecutive day. This rally is part of a broader speculative trend, with trading volumes escalating from 124,400 shares on May 21 to nearly 9.8 million on May 29, despite the company reporting a net loss of ¥128 million for Q1 2025.

Trading volumes have exploded from ~120,000 to nearly 10 million shares daily—a clear signal that speculative money has flooded in. The ¥500 daily price limit has been hit multiple times, feeding FOMO among traders.

So What’s Going On?

No analyst coverage. Market cap (~$110 million) keeps it under the radar.

No earnings surprise. They're still in the red.

No catalysts. No product news, M&A, or guidance updates.

Tiny float, huge momentum. This is a classic small-cap sentiment play.

In Japan, where price limits are enforced and speculative microcap rallies aren’t uncommon, Liberta has become the latest poster child for irrational exuberance.

What Liberta Believes

Despite the chaotic stock action, Liberta’s own mission is deeply idealistic—and frankly, endearing. Here’s how the company describes itself:

"Planning for joy, making the world more interesting.

'Happiness' is a universal need.

The joy of finding a product you’ve been searching for, the joy of sharing it, the joy of creating it together.

Not just satisfaction or gratitude, but excitement! Thrill! Wow!

Creating sensory delight as a professional marketing company—we strive to bring the world joy and excitement."

The name “Liberta” is derived from the word “freedom,” reflecting the company’s belief in creativity and open-mindedness. They actively recruit people regardless of background, nationality, education, or age—valuing individuality and rejecting prejudice.

Final Thoughts

Liberta is real. Their sales are growing. Their vision is ambitious. But their current market performance? Pure sentiment. This stock has no business doubling in a week, but here we are.

📉 They’re still losing money.

💸 They cut their dividend in 2023.

📊 They have no institutional support.

And yet—this stock will almost certainly keep making headlines in the coming days and weeks. Whether it’s the day’s top gainer or biggest loser, Liberta is where volatility lives. We would not be surprised to see a couple of more days with big gains for this stock, eventually followed by (another) big drop.

For now, Liberta is less about fundamentals and more about fantasy. But in the world of microcaps (and Japan has many of these), that’s often all you need.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders! Investing in Japan isn’t for everyone, given its unique trading hours, large price swings, currency fluctuations, lot size requirements, and limited analyst coverage — yet the country also offers some of the world’s best dividend growth opportunities, with countless hidden gems waiting to be discovered.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.

Liberta up 15% today at 4000 yen. BOOM! #japan #dividends

Liberta closed up 8% today at 2957 yen.