Mitsui High-tec (6966): Japanese stock with extreme dividend growth

Buying Opportunity or Red Flag at a 52 week low? Valuation and dividend look good.......

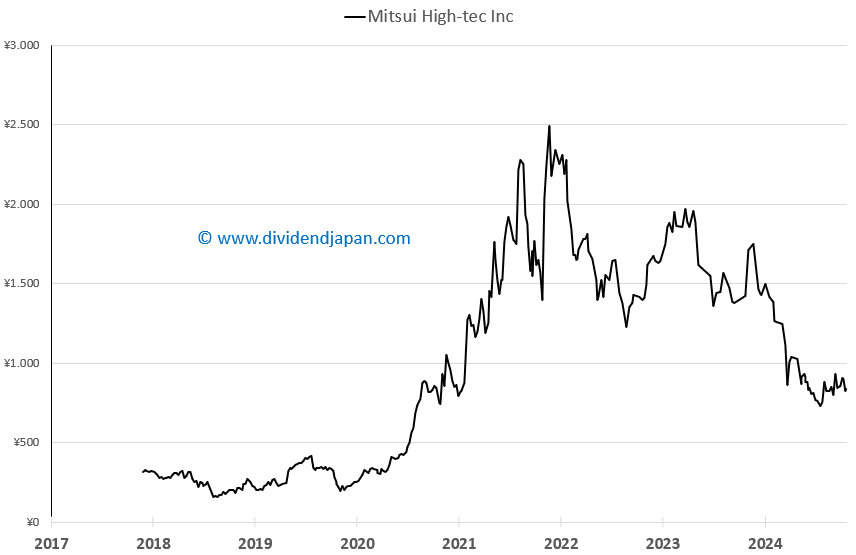

Mitsui High-tec (6966) was one of the biggest losers on the Tokyo Stock Exchange today, March 12, 2025, dropping 10.8%. The stock is now hovering around its 52-week low. This sharp decline raises the question: how is the company fundamentally positioned, and does it present an opportunity for investors? Let's take a closer look at its fundamentals and, of course, its dividend.

What does Mitsui High-tec do?

Mitsui High-tec is a Japanese company specializing in ultra-precision machining technology and die technology. They manufacture high-precision components such as IC leadframes, motor cores, and tool machines. These products play a crucial role in the electronics, automotive, and industrial machinery sectors.

Mitsui High-tec has a 70% global market share in in-vehicle motor cores. Growth in the core motor business comes from HVs and EVs supplied mainly to Toyota Motor Corp (7203). The company generates about half of its sales outside Japan, with growing revenues from Europe, where it completed a plant in Poland in 2020.

History

Mitsui High-tec was founded in 1949 as a subsidiary of Mitsui & Co., Ltd., focusing on precision machining products. In the 1970s, the company developed the Mitsui Automatic Core (MAC) assembly system for laminated cores and began producing IC leadframes.

During the 1980s, Mitsui High-tec expanded into mass production of photo-etched IC leadframes and was listed on the Fukuoka Stock Exchange, later moving to the Second Section of the Tokyo Stock Exchange. In 1991, it was listed on the First Section of the Tokyo Stock Exchange.

In 1997, the company developed die technology for manufacturing motor cores for hybrid vehicles. In 2021, Mitsui High-tec opened a production facility in Poland to better serve the European market.

Competition and Market Position

The market in which Mitsui High-tec operates is competitive. Key competitors include Crane Electronics, JM Canty, Mini-Systems, and Microwave Engineering. However, Mitsui High-tec has a certain ‘moat’ thanks to its advanced technology and long-term customer relationships. The barriers to entry for new players are high, which could be an advantage.

Latest developments and fundamentals

For the year ending January 31, 2025, the company reported sales of ¥214.89 billion, an increase of 9.7% compared to the previous year. However, operating profit declined by 11.6% to ¥16.02 billion, while net profit dropped by 21.4% to ¥12.22 billion.

For the next fiscal year (ending January 31, 2026), the company expects a 7% growth in sales to ¥230 billion, but a further decrease in operating profit (-18.8%) and net profit (-26.3%).

Earnings per share (EPS) amounted to ¥66.86, with an annual dividend payout of ¥72.00 for 2024 and ¥18.00 expected for 2025.

At a stock price of ¥745, Mitsui High-tec offers a dividend yield of 2.4%. The stock trades at an expected P/E ratio of just 10.5 for 2025, which is projected to decrease to 9 next year. Additionally, the company’s revenue growth looks promising; after a 9.7% increase in FY 2025 (ending January), analysts forecast a 15% growth for FY 2026 (the current fiscal year).

Dividend: A Silver Lining?

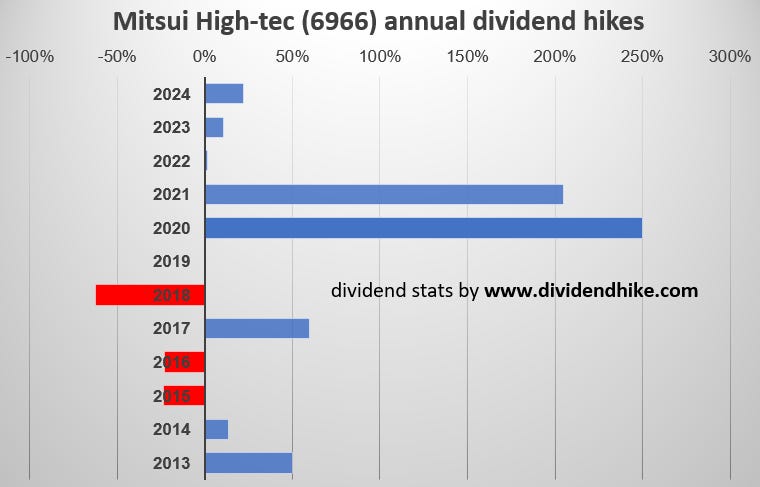

For investors looking for stable income, the company’s dividend policy is an important factor. Mitsui High-tec has historically paid a modest dividend. The key question is whether this payout remains sustainable given current market conditions.

The company recognizes shareholder returns as a key management priority. In terms of dividend payments from retained earnings, the company focuses on expanding investments aimed at strengthening competitiveness and acquiring growth opportunities. To measure the stability of dividends relative to capital, the company has adopted the DOE (Dividend on Equity) ratio as a shareholder return indicator. Taking into account consolidated performance, capital efficiency, and the dividend amount, the basic policy is to make stable and continuous dividends with a target DOE of 3% or more.

The company pays dividends twice a year: an interim dividend and a year-end dividend. In accordance with Article 459, Paragraph 1 of the Companies Act, the company’s Articles of Incorporation allow the board of directors to decide on dividend payments without the need for approval at the general meeting of shareholders.

For the current period’s year-end dividend, the board of directors decided on a payment of ¥12 per share (total dividend: ¥2,196 million), with the payment starting on April 14, 2025. Including the interim dividend of ¥5.6 per share, the total annual dividend for the period will be ¥17.6 per share, with a DOE of 3.1%. (These figures reflect the impact of a stock split on August 1, 2024, at a ratio of 5:1.)

For the next period, the expected annual dividend is ¥18 per share, with a projected DOE of 3.0%.

This means that dividend growth is set to slow down for this fiscal year after significant increases in four of the last five years. Over the past five years, Mitsui has raised its dividend by an impressive average of 71% per year. However, the current dividend of 18 yen represents just a 2.3% increase. That said, it is likely that dividend growth will pick up again in the coming years. In FY 2022, the dividend increased by only 1.6%, but in the years before and after, it saw double-digit growth.

Looking at analyst ratings, the stock has received one "Strong Buy," four "Buy," and one "Hold" recommendation, with an average price target of 1,309 yen—75% above the current share price. This outlook appears positive, but the stock has been under pressure, and it remains a fact that investor information for Japanese stocks is not always optimal, particularly for Western investors. Stay cautious—Japan requires a minimum purchase of 100 shares per transaction.

In the coming months, we will highlight many more promising stocks that trade at lower valuations while offering attractive and growing dividends!

Last but not least: Mitsui High-tec should not be confused with Mitsui & Co (8031), an industrial goods wholesaler with a significantly larger market cap and Warren Buffett as its largest shareholder.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.