Nissan Chemical Shares Jump 17% After Strong Q3 Results and Record Dividend

Specialty materials drive earnings beat as shareholder returns remain elevated

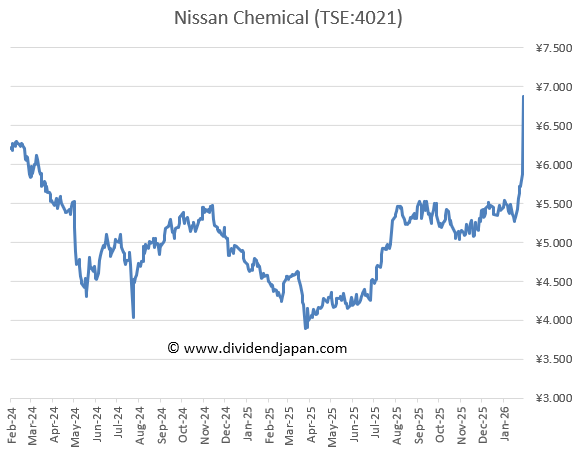

Nissan Chemical (TSE:4021) jumped 17% to ¥6,869 after reporting stronger-than-expected Q3 results, beating internal targets on sales, operating profit and net income. The company also confirmed a record full-year dividend of ¥180, up from ¥174, supported by continued share buybacks. With an operating margin above 22%, low net debt and a dividend yield of around 3%, the results triggered a sharp rebound after several weaker years for the stock.

Key Points in this article

Shares up 17% to ¥6,869 after Q3 results beat expectations

Record full-year dividend of ¥180, up from ¥174

Ongoing large share buybacks, total payout ratio 78.8%

Market cap approx. ¥932bn (~USD 6bn)

Company Overview

Nissan Chemical is a Japan-based diversified materials and life-science group with activities that extend well beyond traditional chemicals. According to the company’s own description, its core businesses include performance materials, agricultural chemicals, pharmaceutical intermediates, functional materials for electronics, and other advanced chemical products.

A significant part of earnings comes from high-margin specialty products, including materials used in semiconductors, displays, and life-science applications, which differentiates Nissan Chemical from more cyclical bulk-chemicals producers.

Financial Performance & Fundamentals

Third-quarter results showed clear improvement. Sales increased by ¥8.7 billion (+15%), operating profit rose ¥2.6 billion (+21%), and net income grew by ¥1.0 billion (+9%). Both sales and operating profit exceeded internal targets, with sales beating expectations by ¥5.8 billion and operating profit by ¥3.4 billion. Net income also exceeded forecasts by ¥3.9 billion.

For the full fiscal year, Nissan Chemical expects full-year sales growth of around 8% in FY2026, reaching approximately ¥271.3 billion, with subsequent years expected to deliver 4–7% annual revenue growth. Operating margins remain strong at just over 22%, while the balance sheet is conservatively structured, with net debt of only ¥13 billion at the end of FY2025.

Based on current estimates, the shares trade at an estimated P/E of just under 19 for FY2026.

Dividend & Capital Returns

Nissan Chemical announced a record full-year dividend of ¥180 per share, up from ¥174 in the previous year. The dividend outlook remains unchanged versus the company’s latest guidance. At the current share price, the dividend yield is around 3%.

In addition to dividends, the company continues to return capital through regular share repurchases. Buybacks totaling ¥10.5 billion were announced and largely completed between March 2025 and February 2026. The total payout ratio is projected at 78.8%, reflecting a combination of dividends and buybacks.

Analyst Overview

Analyst sentiment is constructive. There are no sell ratings, with 2 Strong Buy, 4 Buy and 2 Hold recommendations. The absence of negative ratings reflects confidence in Nissan Chemical’s earnings quality, balance-sheet strength and capital-return policy.

Summary

Nissan Chemical delivered a sharp share-price rebound following strong Q3 results, supported by higher-than-expected sales and profits, a record dividend, and ongoing share buybacks. While the valuation has moved higher and the payout ratio is relatively elevated, the company combines stable revenue growth, very high operating margins, low leverage, and a dividend yield of around 3%, underpinned by a long-standing commitment to shareholder returns.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.