OM2 Network Co (TSE: 7614) – Japan’s integrated meat & restaurant group stepping into dividend focus

Founded in 1958, from poultry farm to retail and restaurant chain under S Foods’s umbrella

OM2 Network Co, founded in 1958, began as a poultry farm before expanding into meat retail stores and later restaurant operations. The company now trades on the Tokyo Stock Exchange and has grown into a diversified meat retail and dining group operating under well-known brands such as Niku no Okubo and Center Farm. Since 2005, OM2 has been a subsidiary of S Foods Co., Ltd., which currently owns 48.9% of the company.

Despite a negative market backdrop, the stock surged nearly 20% today to ¥1,892, with no specific news explaining the sudden move.

Key Points

Founded in 1958; evolved from poultry farm to meat retail and restaurant operator

Subsidiary of S Foods since 2005 with 48.9% ownership

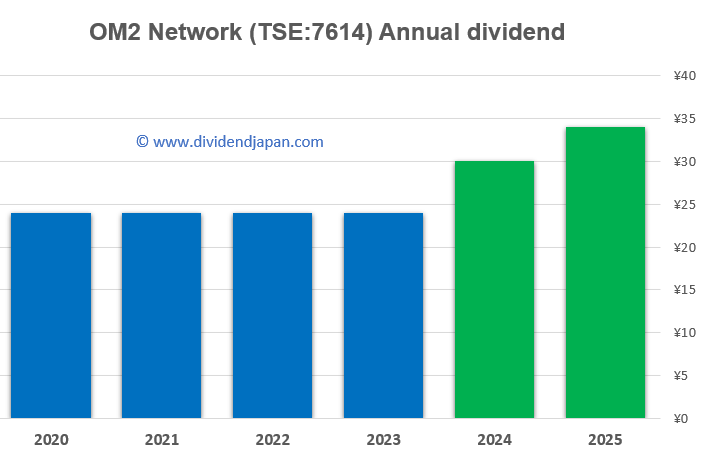

Dividend growth has been stable to rising; latest annual payout ¥34 (+13.3% YoY)

Market capitalization is only ¥13.4 billion (~USD 86 million)

OM2 Network operates a nationwide portfolio of meat retail stores and restaurants. Its main revenue comes from meat retail under the Niku no Okubo and Center Farm brands. The company also runs deli and restaurant businesses under names such as Hanaya Meisai, Yakiniku no Guyuta, and Japan-based outlets of Outback Steakhouse.

The company’s business model is anchored in essential consumer goods, with meat sales forming the core of its revenue. Restaurant and delicatessen operations complement this base, with the meat-retail segment accounting for the largest portion of total sales.

Recent Financial Performance

For the six months ended July 31, 2025, OM2 Network reported:

Sales: ¥17.30 billion (+8.6% YoY)

Operating profit: ¥542 million (-25.0% YoY)

Recurring profit: ¥651 million (-18.9% YoY)

Net profit: ¥404 million (-21.5% YoY)

EPS: ¥60.70

For the fiscal year ending January 2026, the company forecasts:

Sales: ¥35.50 billion (+8.3% YoY)

Operating profit: ¥1.48 billion (+0.4% YoY)

Net profit: ¥910 million (-17.2% YoY)

EPS: ¥136.69

In the previous fiscal year, revenue increased from ¥32.109 billion to ¥32.778 billion. ROIC has ranged between 6% and 8% in recent years, while operating margin has been stable between 4.5% and 5.8%.

Dividend

OM2 Network pays one annual dividend each April, with the ex-dividend date typically falling at the end of January.

The latest dividend of ¥34 represents an increase of roughly 13.3% year-on-year, giving a yield of approximately 1.9% at a share price of ¥1,829.

The payout ratio for FY 2025 was 20.6%, up from 15.1% the year before, leaving room for potential future increases.

Ownership

Since 2005, OM2 Network has been part of S Foods Co., Ltd. (TSE: 2292), which now holds 48.9% of the company’s shares and integrates OM2 into its broader meat production and distribution ecosystem. There is currently no analyst coverage for OM2 or S Foods.

Market Context

Japan’s food retail and restaurant sector remains highly competitive, with cost pressures from raw materials, energy, and labor. Despite these challenges, OM2 continues to expand selectively, open new stores, refurbish existing ones, and maintain product safety and quality standards.

While today’s sharp share-price rise has no identifiable news trigger, the company’s stable performance, long operating history, consistent dividend growth, and low payout ratio may be attracting increased interest.

At DividendJapan.com, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.