Omni-Plus System (7699.JP) dividend growth picks up in 2025

📉 One of Tokyo's Biggest Losers Today with a 5.7% dividend yield

Omni-Plus System Limited, a Singapore-headquartered distributor of engineering plastics, closed down 7.5% on the Tokyo Stock Exchange today at ¥652, making it one of the sharpest decliners in the Japanese market. The decline brings the stock's dividend yield to 5.7%, with a price-to-earnings ratio now at just 7. The company’s market capitalization currently sits just under $100 million USD.

📦 Business Overview

Omni-Plus operates in a single segment centered on engineering plastics, with activities spanning both distribution and development/manufacturing:

Distribution: 66% of revenue comes from catalog-based and general-purpose (generic) products not requiring proprietary compounding.

Development & Manufacturing: Customized, high-durability, heat-resistant plastic compounds, often co-developed with brand manufacturers and research bodies such as A*STAR in Singapore. Production operations are located in Johor Bahru, Malaysia via Nihon Pigment Sdn. Bhd.

🏢 Structure

As of December 2024, the group comprised:

25 consolidated subsidiaries

1 joint operation

2 equity-method affiliates

The business is consolidated under the Singapore-based Omni-Plus System Group.

📊 Latest Financials (Q3 FY2025)

Revenue: $282.8 million (+24.4% YoY)

Gross Margin: 14.1% (up from 13.6%)

Net Profit: $13.7 million (vs. $10.4 million in prior-year Q3)

Operating Cash Flow: +$7.0 million

Capex + M&A Outflows: -$9.2 million

Financial Cash Flow: +$5.9 million (boosted by $16.7M in new loans)

Key drivers behind revenue growth included strong customer demand and acquisitions, notably of International Material Supplier Co., Ltd. (IMS Group), which contributed $27.5 million in sales. Profitability was supported by increased gross profit and reduced operating expenses, partially offset by higher financial and tax costs.

💰 Capital & Leverage

Total assets: up $24.9M YoY

Total liabilities: up $16.7M (notably through interest-bearing debt and deferred taxes)

Total equity: $84.0M (up from $75.7M), reflecting retained earnings growth

Cash & equivalents: $67.0M as of Dec 31, 2024 (+$8.0M YoY)

📈 Outlook

The company maintains a full-year forecast of:

Revenue: $368.6 million (+18.8% YoY)

Net Profit: $13.8 million (+31.5% YoY)

Growth is expected to be driven by ASEAN expansion, new product launches, and the IMS acquisition, which strengthens its position in Greater China. Management remains cautious amid persistent geopolitical tensions and elevated interest rates, but continues to express confidence in hitting all full-year targets for the first time since listing.

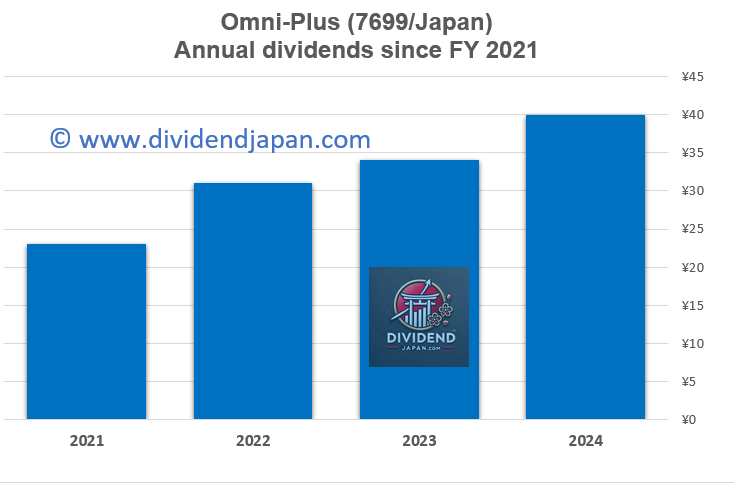

On January 7, 2025, Omni-Plus declared a final dividend of 28 yen; the total dividend of 40 yen for 2024 marks a strong 17.6% increase compared to 2023. At a share price of 652 yen, the dividend yield stands at a striking 5.7%. Moreover, the dividend has now been raised by roughly more than 10% for three consecutive years.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders! Investing in Japan isn’t for everyone, given its unique trading hours, large price swings, currency fluctuations, lot size requirements, and limited analyst coverage — yet the country also offers some of the world’s best dividend growth opportunities, with countless hidden gems waiting to be discovered.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.