Sakura Internet (3778 JP) drops 11% after FY 2025 results

Dividend up 14.3% YOY continuing strong track record

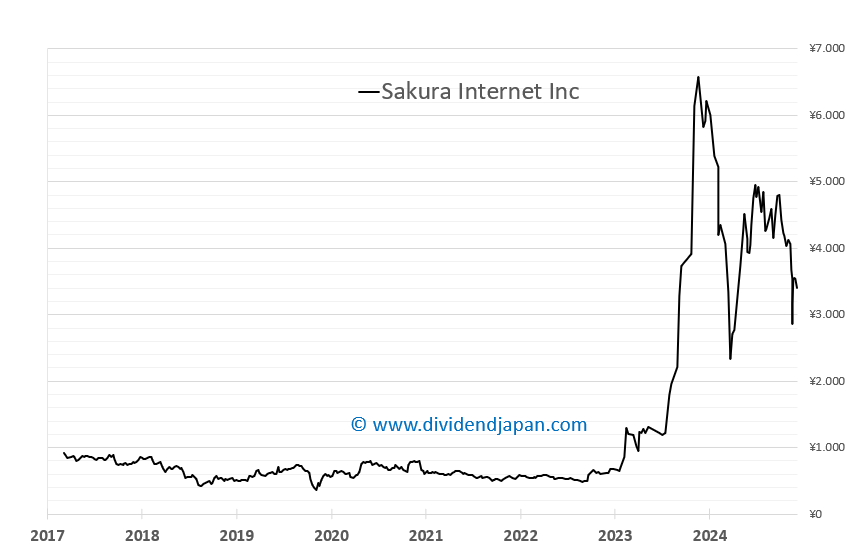

Shares of Sakura Internet (3778 JP) tumbled 10.9% on April 28 in Tokyo, despite the company reporting record financial results for the fiscal year ended March 2024 and ambitious forecasts for the year ahead.

Sakura's consolidated net sales for the year rose by 43.9% year-over-year, reaching 27.13 billion yen. Operating profit surged 368.7% year-over-year to a record 3.38 billion yen, while recurring profit jumped 377.1% to 3.26 billion yen. Net income climbed 334.2% to 2.40 billion yen, with EPS at 61.56 yen versus 15.51 yen the previous year. The company announced a final dividend of 4 yen per share, up from 3.5 yen a year earlier.

At a stock price of 3,355 yen the dividend yield for Sakura Internet is 0.12%. The company hiked its dividend by 14.3% to 4 yen per share.

The growth was fueled by a rapid expansion into GPU cloud services, launched in January 2024. Responding to strong demand for computational infrastructure supporting generative AI applications, the new business quickly established itself as a critical driver of revenue alongside Sakura's traditional cloud services. Aggressive hiring, investments in GPU infrastructure, and securing large-scale projects through group companies contributed to the surge.

Looking ahead, Sakura projects a 28.6% year-on-year increase in consolidated net sales for the fiscal year ending March 2025. The GPU cloud business, now entering its second year, is expected to grow by a striking 149.0% year-on-year, supported by the introduction of cutting-edge hardware like the H200 and B200 GPUs. The company also plans to maintain an aggressive pace of investment — in both human resources and infrastructure — as it seeks to become the de facto standard for generative AI platforms and pursue official government cloud certification by the end of March 2026.

Despite the strong reported results and upbeat outlook, the market reaction was swift and negative. The sharp stock price decline suggests concerns about the heavy upfront investments planned for FY2025, potential margin pressure, and increased competitive intensity in Japan's growing AI infrastructure market. Additionally, while operating profits hit record highs for FY2024, the company is forecasting a decline in operating and recurring profits for the current fiscal year, possibly reflecting the scale of its ongoing investments.

The selloff also highlights a broader dynamic often seen with high-growth tech companies: rapid revenue expansion does not always translate to short-term shareholder returns when aggressive reinvestment strategies dominate the narrative.

As Sakura Internet embarks on its next phase — positioning itself at the center of Japan’s AI and cloud infrastructure build-out — the coming quarters will be a critical test of whether its heavy investments can drive sustainable long-term growth without alienating investors in the meantime.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders! Investing in Japan isn’t for everyone, given its unique trading hours, large price swings, currency fluctuations, lot size requirements, and limited analyst coverage — yet the country also offers some of the world’s best dividend growth opportunities, with countless hidden gems waiting to be discovered.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.