Why Nearly 50 Japanese Companies Just Split Their Stocks

More than 50 stock splits at the end of March 2025 in Japan

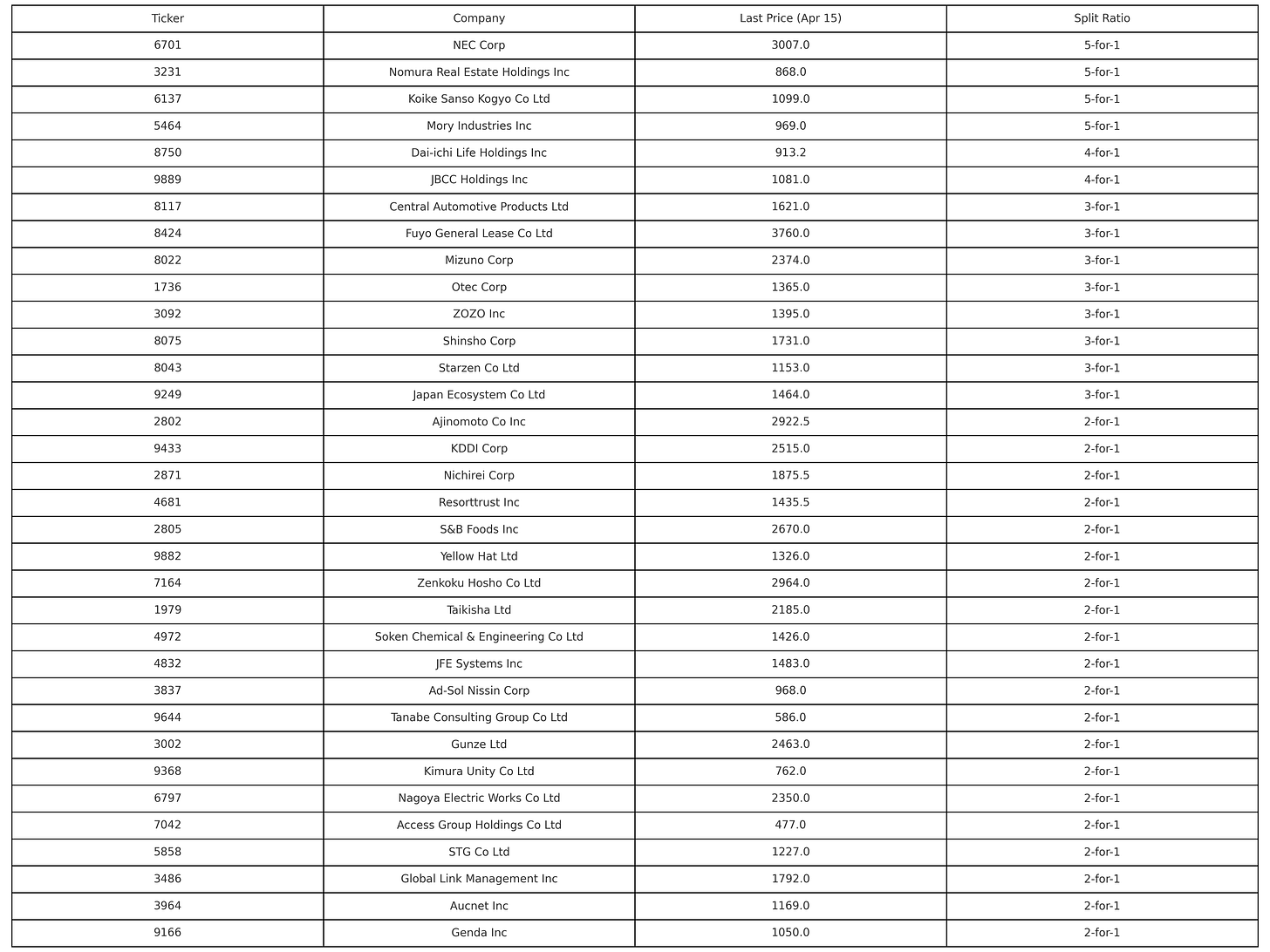

At the end of March 2025, Japan’s stock market witnessed a remarkable phenomenon: nearly 50 companies carried out stock splits within the same week, most of them on March 28. This wave of splits, involving firms across diverse industries—from tech to food to finance—signals a growing strategic shift among Japanese corporates. But what’s behind this coordinated timing, and why are stock splits especially impactful in Japan?

A stock split is a corporate action where a company increases its total number of outstanding shares by issuing additional shares to existing shareholders. For example, in a 5-for-1 split, shareholders receive five shares for every one they previously held, and the price per share drops to one-fifth of its original value. Importantly, the company’s total market value remains unchanged. The move is largely symbolic on paper, but it can have real effects in the market.

Nowhere are these effects more relevant than in Japan, where stock market mechanics differ from those in places like the US or Europe. In Japan, shares are typically traded in units of 100, meaning an investor cannot simply buy a single share. If a stock trades at ¥3,000, the minimum investment to buy in is ¥300,000—roughly $2,000. That kind of entry point is steep for many individual investors and creates a natural barrier to broader participation.

By splitting their shares, companies lower the price per unit and thereby make their stock more accessible to retail investors. This not only democratizes ownership but also tends to boost trading liquidity, since more participants are able to buy and sell smaller lots of shares.

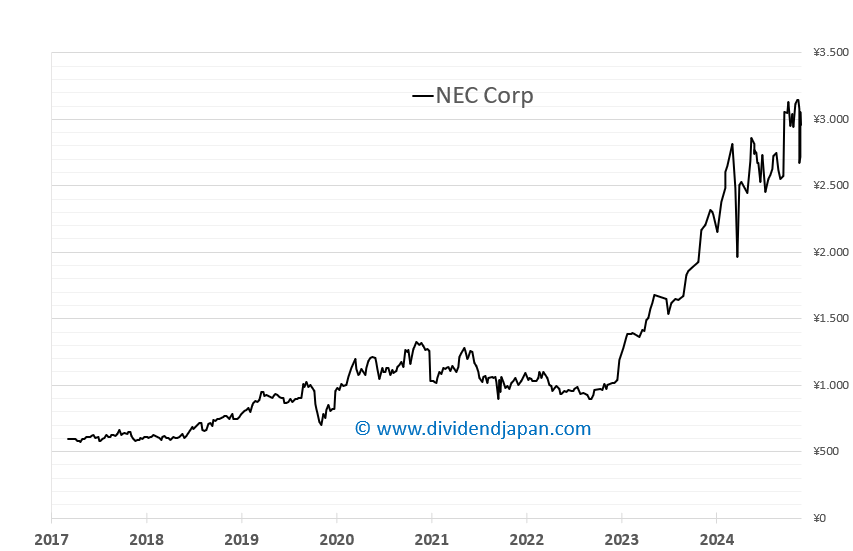

This is exactly what we saw in late March. For instance, NEC Corp (ticker: 6701) split its shares 5-for-1, bringing its post-split share price down to a more accessible level from ¥3,007. Similarly, Koike Sanso Kogyo (6137), Mory Industries (5464), and Nomura Real Estate Holdings (3231) each executed 5-for-1 splits, while Dai-ichi Life Holdings (8750) chose a 4-for-1 ratio. Other major names like Ajinomoto (2802) and KDDI Corp (9433) went for 2-for-1 splits, significantly reducing the capital needed to enter a position in those stocks.

NEC Corp (Ticker: 6701)

Last stock price (April 15, 2025): ¥3007

Stock split date: March 28, 2025

Split ratio: 0.20 (5-for-1)

Mizuno Corp (Ticker: 8022)

Last stock price (April 15, 2025): ¥2374

Stock split date: March 28, 2025

Split ratio: 0.33 (3-for-1)

Dai-ichi Life Holdings Inc (Ticker: 8750)

Last stock price (April 15, 2025): ¥913.2

Stock split date: March 28, 2025

Split ratio: 0.25 (4-for-1)

ZOZO Inc (Ticker: 3092)

Last stock price (April 15, 2025): ¥1395

Stock split date: March 28, 2025

Split ratio: 0.33 (3-for-1)

KDDI Corp (Ticker: 9433)

Last stock price (April 15, 2025): ¥2515

Stock split date: March 28, 2025

Split ratio: 0.50 (2-for-1)

Even e-commerce giant ZOZO Inc (3092) joined the trend with a 3-for-1 split. These changes are not isolated events; they are part of a broader pattern aimed at engaging a wider base of investors and enhancing share liquidity. Especially as Japan’s retail investor base grows, companies are increasingly recognizing the need to make their shares more approachable.

This surge in stock splits is not just a quirk of timing—it reflects deeper shifts in how Japanese firms are thinking about market accessibility and capital dynamics. While a stock split doesn’t change a company’s fundamentals, it can have a meaningful psychological and practical impact for investors.

In a market where high share prices can be a real hurdle due to the unit-based trading system, splits like these are more than cosmetic—they’re a door opener.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.