Sumco Shares Plunge 20% After Earnings; Dividend cut again

Sumco Corp (TSE: 3436) reports quarterly losses and lower sales and cuts its annual dividend to an expected 20 yen amid ongoing industry weakness.

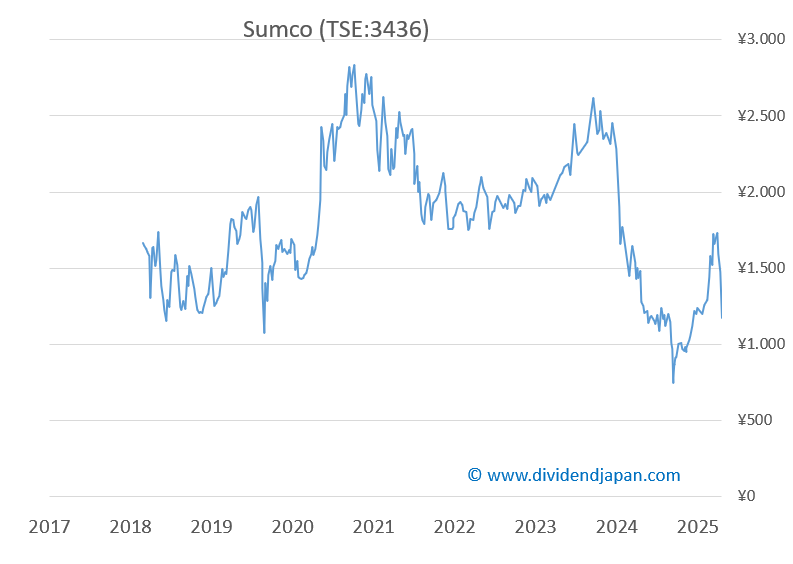

Sumco Corporation (TSE: 3436), a leading Japanese silicon wafer manufacturer, saw its shares tumble 20% to ¥1,176 on Tuesday after releasing third-quarter results that missed sales targets but showed slight operating improvements. The stock has now turned negative for the year, following a steep 44% decline in 2024.

Key Points

Sumco shares dropped 20% to ¥1,176 after Q3 results.

Net sales: ¥99.1 billion (¥1.9 billion below forecast).

Operating profit: −¥1.6 billion (improved ¥1.9 billion vs forecast).

Dividend: expected cut to ¥20 per share for FY2025.

Dividend yield: 1.4%; market cap: ¥411.8 billion.

Earnings Overview

For the third quarter of fiscal 2025, Sumco reported net sales of ¥99.1 billion, missing its forecast by ¥1.9 billion. Operating profit was −¥1.6 billion, an improvement of ¥1.9 billion versus projections, while ordinary profit and net income also came in better than expected at −¥2.6 billion and −¥3.9 billion, respectively.

The EBITDA margin reached 27.6%, beating expectations by 1.8 percentage points. However, for the fourth quarter, Sumco expects net sales of ¥100 billion and a wider operating loss of ¥10 billion, suggesting pressure will continue in the near term.

Dividend and Market Context

Sumco will pay a dividend of ¥20 per share for fiscal 2025, unchanged from last year. This marks the second consecutive year without growth, following a 62% reduction from the ¥81 per share paid in 2022. The current dividend yield stands at 1.4%, and the company remains heavily cyclical, reflecting the volatility of global wafer demand.

At a market capitalization of ¥411.8 billion, Sumco remains one of Japan’s key wafer suppliers alongside Shin-Etsu Chemical and GlobalWafers Japan.

Performance and Outlook

After two difficult years, the stock has been relatively flat in 2025 (−0.6% YTD) despite ongoing weakness in chip production volumes. Analysts expect a modest recovery of around 4% revenue growth in 2025 as inventory adjustments ease. The company’s balance sheet remains stable, though sentiment has clearly weakened across the semiconductor materials sector.

Analyst Sentiment

Analyst views have turned more cautious, with 2 strong buy, 7 buy, 5 hold, 1 sell, and 1 strong sell recommendations. After multiple dividend reductions and shrinking profits, investor confidence remains fragile, underscoring the cyclical nature of Sumco’s business.

At DividendJapan.com, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.