🏆 Japan's $100 Billion Club: The Four Giants Driving the Nikkei in 2025

Toyota, Sony & more: Japan’s biggest stocks: Top-10 biggest market caps in June 2025

While U.S. and Chinese tech behemoths often steal the spotlight, Japan quietly maintains a powerhouse of corporate titans. As of June 6, 2025, only four Japanese companies have crossed the $100 billion market cap mark — but the broader top 10 reveals the diversity and depth of Japan Inc. From automakers to banks, from chipmakers to retailers, here's a look at Japan’s most valuable publicly listed companies in 2025.

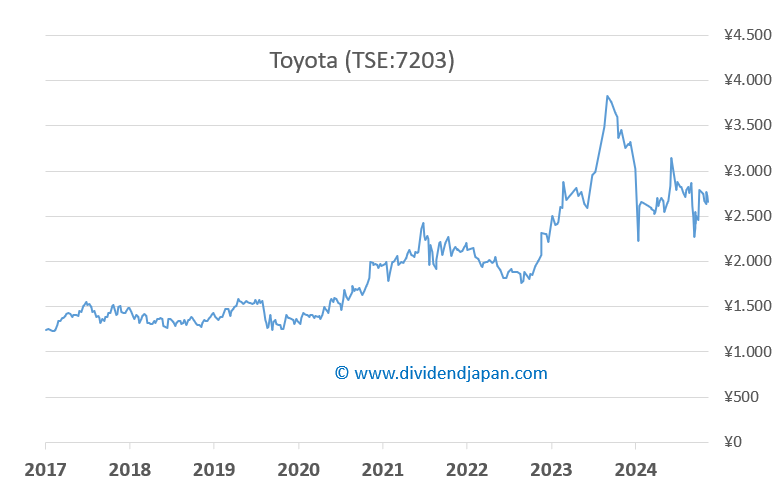

1. Toyota Motor Corp (TSE:7203)

Market Cap: ~$278.4 billion (¥42.088 trillion)

Dividend Yield: 3.4%

Japan’s industrial crown jewel. Toyota leads the global auto industry in scale and innovation, with expanding investments in electric, hybrid, and hydrogen mobility. The company is also active in robotics and AI-driven mobility services.

2. Mitsubishi UFJ Financial Group Inc (TSE:8306)

Market Cap: ~$156.7 billion (¥23.694 trillion)

Dividend Yield: 3.3%

The largest bank in Japan and a major global financial institution. MUFG spans consumer, corporate, and investment banking, with a strong presence in the U.S. (through Union Bank and Morgan Stanley) and Southeast Asia.

3. Sony Group Corp (TSE:6758)

Market Cap: ~$156.0 billion (¥23.432 trillion)

Dividend Yield: 0.5%

A global leader in entertainment and technology. Sony's empire includes gaming (PlayStation), music, movies, semiconductors (image sensors), and financial services. It thrives on intellectual property and high-margin tech.

Of course, we also know everything about the dividend history of these 10 stocks; subscribe to DividendJapan and we promise that all of these stocks will eventually appear in our analyses, including dividend history and recent developments.

4. Hitachi Ltd (TSE:6501)

Market Cap: ~$122.1 billion (¥18.493 trillion)

Dividend Yield: 1.1%

A former hardware giant turned industrial digital powerhouse. Hitachi provides IT solutions, energy systems, rail infrastructure, and digital transformation services, particularly through its Lumada platform.

5. Fast Retailing Co Ltd (TSE:9983)

Market Cap: ~$102.7 billion (¥15.577 trillion)

Dividend Yield: 1.0%

The parent company of Uniqlo, Fast Retailing is Asia’s largest apparel retailer. It’s known for minimalist, affordable fashion and a high-efficiency supply chain. Global expansion and sustainability initiatives are key themes.

6. Nintendo Co Ltd (TSE:7974)

Market Cap: ~$102.3 billion (¥15.471 trillion)

Dividend Yield: 1.0%

One of the most iconic names in gaming. Nintendo’s franchises — from Mario to Zelda — have global cultural value. Hardware innovation (like the Switch) and digital distribution have kept the Kyoto-based company highly profitable.

7. Nippon Telegraph and Telephone Corp (NTT) (TSE:9432)

Market Cap: ~$94.8 billion (¥14.292 trillion)

Dividend Yield: 3.3%

Once Japan’s state telecom monopoly, NTT is now a sprawling group covering telecom services, data centers, and system integration. It plays a key role in Japan’s digital infrastructure and 5G rollout.

Of course, we also know everything about the dividend history of these 10 stocks; subscribe to DividendJapan and we promise that all of these stocks will eventually appear in our analyses, including dividend history and recent developments.

8. Keyence Corp (TSE:6861)

Market Cap: ~$93.4 billion (¥14.242 trillion)

Dividend Yield: 0.6%

A global leader in factory automation sensors, measuring instruments, and vision systems. Keyence operates on a fabless model with ultra-high margins and direct sales — often cited as Japan’s most efficient company.

9. Sumitomo Mitsui Financial Group Inc (TSE:8316)

Market Cap: ~$93.0 billion (¥14.043 trillion)

Dividend Yield: 3.4%

Another banking heavyweight, SMFG is known for its strong domestic position and growing international reach, particularly in Asia. It focuses on commercial lending, wealth management, and digital banking transformation.

10. Recruit Holdings Co Ltd (TSE:6098)

Market Cap: ~$84.2 billion (¥12.802 trillion)

Dividend Yield: 0.3%

Best known globally for owning Indeed and Glassdoor, Recruit is a hybrid of traditional HR services and digital platforms. It also runs domestic staffing and marketing businesses, with strong data-driven operations.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders! Investing in Japan isn’t for everyone, given its unique trading hours, large price swings, currency fluctuations, lot size requirements, and limited analyst coverage — yet the country also offers some of the world’s best dividend growth opportunities, with countless hidden gems waiting to be discovered.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.