Warren Buffett in Japan – Part 4: Mitsubishi Corporation (8058 JP)

Berkshire Hathaway’s bet, but not our buy: here’s why

In our ongoing series on Warren Buffett’s five Japanese investments, we’ve already covered Marubeni, Mitsui, and most recently Itochu. Today, we turn our focus to Mitsubishi Corporation (trading under symbol/code: 8058), arguably the most iconic of the group and a core holding in Berkshire Hathaway’s Japanese portfolio.

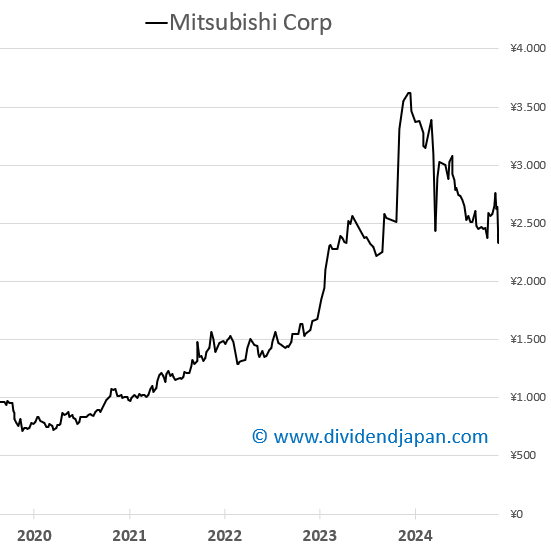

On April 10th, 2025, Mitsubishi’s stock jumped 6.7% following the tariffs pause announced by Donald Trump. Despite today’s move, the stock remains down 1.5% year-to-date. Its market capitalization stands at approximately $66 billion, with a dividend yield of 3.5%.

Berkshire Hathaway currently owns 9.67% of Mitsubishi Corporation, a stake totaling 389 million shares—valued at around $6.8 billion USD. This puts Buffett’s team among the company’s largest shareholders and signals a long-term commitment to the Japanese trading house.

A Legacy of Scale and Adaptability

Though Mitsubishi Corporation was officially established in 1950, its roots go much deeper—back to the 19th-century industrialist Yataro Iwasaki, founder of the original Mitsubishi zaibatsu. Over the decades, the company evolved into one of Japan’s most powerful and diversified trading houses, or sōgō shōsha.

These companies are unique to Japan. They operate as sprawling intermediaries, connecting supply chains across industries, countries, and currencies. Mitsubishi Corporation exemplifies this with a global presence and operations in everything from energy and infrastructure to consumer goods and finance.

What makes Mitsubishi particularly noteworthy is its sheer breadth. It is often considered the most diversified—and at times, the largest—of the Japanese trading companies by revenue. Unlike western conglomerates, Mitsubishi is deeply embedded in the operations of its affiliates and partners, not just as a financier but as an active participant.

The Business

Mitsubishi’s operations span an impressive range of sectors. Its core segments include natural gas, mineral resources, industrial infrastructure, automotive and mobility, chemicals, and food. But it also has significant interests in power solutions, consumer industries, and next-generation fields like digital innovation and carbon management.

This broad exposure offers a built-in form of diversification, but also presents challenges in terms of capital allocation and complexity. In recent years, Mitsubishi has focused more on streamlining its portfolio and enhancing returns on equity—moves that haven’t gone unnoticed by Buffett and other long-term investors.

Competitors and Context

Mitsubishi Corporation operates in a small club of powerful trading companies, alongside names like Itochu, Mitsui, Marubeni, and Sumitomo. Each has carved out slightly different strategic focuses, but all share a similar multi-sector, global DNA.

What sets Mitsubishi apart is its size, history, and influence. Where Itochu leans heavily into consumer goods and retail, Mitsubishi maintains a broader industrial footprint. It’s also often first in line when major Japanese infrastructure, energy, or strategic export projects are in play.

Why Buffett Bought In

Buffett’s move into Japan’s trading houses in 2020 surprised many. It was his first large-scale investment in the country and a rare instance of allocating capital into diversified conglomerates—something he’s traditionally avoided in the U.S.

So why now, and why these firms?

For one, valuations were compelling: low price-to-book ratios, strong cash flows, and historically conservative balance sheets. But more importantly, these companies offer long-term exposure to global trade, commodities, and infrastructure development—all areas that align with Berkshire’s philosophy of durable businesses with strong moats.

Buffett has also praised the management of the Japanese trading houses, highlighting their shareholder-friendly policies, including stock buybacks and rising dividends. Mitsubishi is no exception: its strategy in recent years has leaned increasingly toward capital efficiency and long-term value creation.

Dividend and Fundamentals for Mitsubishi Corp

Mitsubishi currently offers a dividend yield of 3.5%. Its fundamentals remain solid, supported by a balanced portfolio of businesses and a management team that has increasingly focused on improving shareholder returns.

Although Mitsubishi is often highlighted as one of Warren Buffett’s key Japanese holdings, a closer look at the fundamentals reveals that it’s far from a strong investment case.

The stock trades at a seemingly attractive P/E of 10, but that low valuation is largely a reflection of underwhelming performance. Mitsubishi’s Return on Invested Capital is just 3.2%, and its EBIT margin is a mere 2.9%—figures that signal poor operational efficiency and a weak ability to generate value from its business.

Even more concerning is the clear downward trend in revenue. For FY 2024, revenue declined by 9.3%, and analysts expect a further drop of 4.2% in FY 2025. This is not a temporary dip—it points to systemic challenges in Mitsubishi’s core operations. A 3.5% dividend yield may seem attractive on the surface, but it does little to offset the lack of growth and weak fundamentals.

The balance sheet is relatively stable, with net debt of about ¥4 billion, but stability alone doesn’t make up for declining performance and weak returns.

Market sentiment reflects this reality. Out of 13 analysts, only 3 have a Buy or Strong Buy rating, while the vast majority—10 analysts—recommend simply holding. This suggests that the investment community sees little near-term upside and is cautious about the company’s trajectory.

In short, despite Buffett’s endorsement and a decent dividend, Mitsubishi lacks the core qualities of a compelling investment: strong returns, healthy growth, and operational efficiency. Based on the numbers, this is not a stock we would feel confident backing.

Mitsubishi Fundamental Data as of April 10, 2025

Market Capitalization: ¥9.77 trillion ($66 billion)

Stock Price 2025: ¥2,566 (1.5% decrease YTD)

Valuation (P/E): 10 for 2025

ROIC: 3.2% for FY 2024

EBIT Margin: 2.9% in 2024

Dividend Yield: 3.5%

Revenue 2024 (fiscal year ending in March): ¥19,568 billion (-9.3% decline); Analysts also expect Mitsubishi to report a lower revenue for FY 2025.

Expected Revenue Growth 2025: -4.2% to ¥18,739 billion

Balance sheet: a steady net debt of approximately ¥4 billion

Analyst Ratings:

1 "Strong Buy"

2 "Buy"

10 "Hold"

No "Sell" recommendations

Dividend & Buyback Stats

The good things about Mitsibishi, that we do like a lot, is the dividend and buybacks;

The company is buying back a lot of its own shares every year, peaking in FY 2024 with 4.7% of shares outstanding repurchased; for FY 2025 Mitsubishi is expected to buy back more than 4% of its own shares.

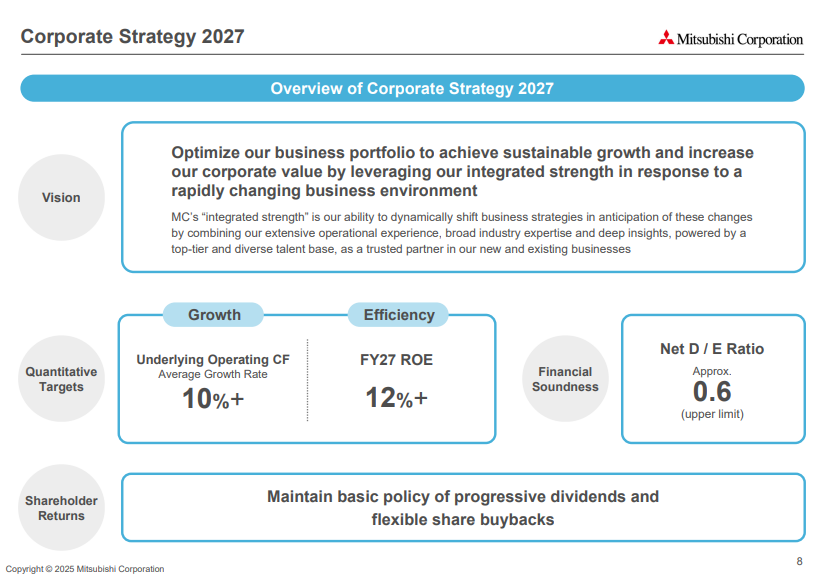

We will maintain our basic policy of progressive dividends and flexible share buybacks. (source: Mitsubishi Corporate Strategy 2027 presentation)

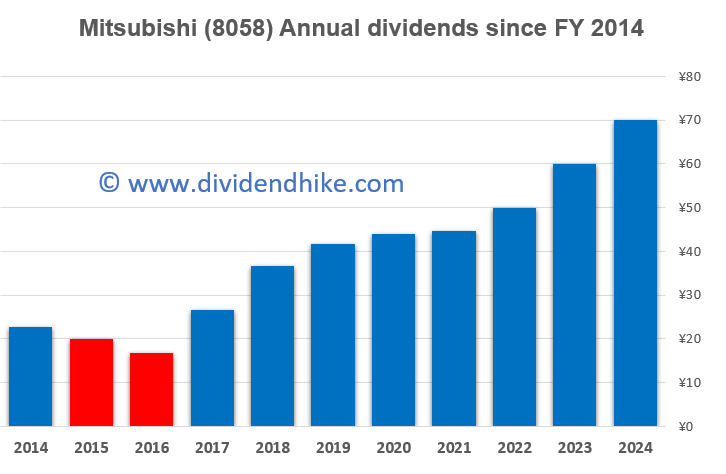

We also like the dividend with strong growth in the last three years; however Mitsubishi has a weak dividend track record with only 8 consecutive years of increases coming on the back of double digit dividend cuts in both FY 2016 and FY 2015.

The other Buffett investments boast stronger dividend track records, and given the abundance of dividend growth gems in Japan with far more consistent and robust dividend increases, we’re not particularly impressed by Mitsubishi's dividend history.

Wrapping Up

While Mitsubishi Corporation may appear to be the most “classic” of Buffett’s five Japanese picks—large, conservative, and historically significant—the fundamentals tell a different story today. The company is facing shrinking revenues, low margins, and low returns on capital. Rather than a resilient industrial giant, Mitsubishi looks more like a slow-moving conglomerate struggling to create shareholder value in a changing economic landscape.

To be honest, we believe there are many far better investment opportunities in Japan—many of which have smaller market caps, stronger dividend growth, and most importantly, superior fundamentals and growth rates. We’ll reveal our top picks later this year on Dividend Japan.

In the final installment of this series, we’ll explore Sumitomo Corporation, the fifth and final member of Buffett’s Japanese big five—and perhaps the most quietly intriguing of them all.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders! Investing in Japan isn’t for everyone, given its unique trading hours, large price swings, currency fluctuations, lot size requirements, and limited analyst coverage — yet the country also offers some of the world’s best dividend growth opportunities, with countless hidden gems waiting to be discovered.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.