Warren Buffett in Japan – Part 5: Sumitomo Corporation (8053 JP)

The Quiet Powerhouse in Berkshire Hathaway’s Japan Portfolio

When Warren Buffett’s Berkshire Hathaway revealed its investment in Japan’s five major trading houses back in 2020, it caught global investors by surprise. Among these five sōgō shōsha, or general trading companies, was Sumitomo Corporation — a lesser-known name to many outside of Japan, but a historic powerhouse with deep roots in the country’s industrial and commercial development.

We already covered the first four of Buffett’s Japan investments, today we look at #5 Sumitomo (8053 JP). As of March 10, 2025, Berkshire Hathaway was the top shareholder in Sumitomo with 9.3% of the shares outstanding, or 112 million shares with a value of $2.5 billion today on April 20, 2025.

Origins of a Conglomerate

Sumitomo Corporation is a member of the historic Sumitomo Group, one of Japan’s most venerable keiretsu — business conglomerates with interlocking shareholdings and long-standing business relationships. The group traces its origins back to the early 17th century, when a Kyoto-based bookshop evolved into a copper mining and refining business. This copper venture, known as the Besshi Copper Mine, became the foundation for what would become the modern-day Sumitomo Group.

Sumitomo Corporation itself was established in 1919 as Osaka North Harbour Co., Ltd. to develop port facilities and promote trade. It adopted the current name in 1944. Today, it stands as one of Japan’s largest integrated trading companies, engaged in a wide array of businesses from metal products and transportation systems to media, real estate, and energy.

Business Model: A Modern General Trading House

Like its peers Mitsubishi Corporation, Mitsui & Co., Itochu, and Marubeni, Sumitomo is a sōgō shōsha — a unique kind of company that evolved in Japan during the country's rapid post-war industrialization. These firms act as global intermediaries, managing complex supply chains, investing in natural resources, and taking equity stakes in ventures across a range of sectors.

Sumitomo’s operations span six major segments:

Metal Products – Trading and investment in steel products and non-ferrous metals.

Transportation & Construction Systems – Includes automotive, shipbuilding, and aerospace businesses.

Infrastructure – Projects involving electricity, water, and transport infrastructure.

Media & Digital – Telecommunications, IT solutions, and media content businesses.

Living Related & Real Estate – Real estate development, food distribution, and lifestyle businesses.

Mineral Resources, Energy, Chemical & Electronics – Global investments in energy and resource development, along with chemicals and electronics.

The company operates in over 60 countries with a workforce of more than 70,000 employees across its group companies.

Competition in the Trading Space

Sumitomo’s main competitors are the other four large sōgō shōsha that Buffett also invested in: Mitsubishi Corporation, Mitsui & Co., Itochu Corporation, and Marubeni Corporation. These companies compete in overlapping sectors, though each has its own strategic focus and portfolio balance.

While Mitsubishi and Mitsui tend to have a heavier presence in energy and natural resources, Itochu has made notable moves in consumer goods and retail. Sumitomo, for its part, has positioned itself with a diversified portfolio that includes a strong focus on infrastructure and digital innovation, alongside traditional trading operations.

Why Might Buffett Be Interested?

While Buffett hasn’t publicly detailed the specific rationale behind each investment, several characteristics of Sumitomo Corporation — and sōgō shōsha in general — align with his well-known investment criteria:

Stable Cash Flow: Trading houses generate relatively stable cash flows across diversified businesses and geographies.

Undervalued Assets: Japanese trading companies have often traded below book value, potentially offering intrinsic value.

Global Reach: With operations around the world, these firms provide exposure to global economic growth, particularly in emerging markets.

Shareholder Returns: Many Japanese trading companies have shifted toward more shareholder-friendly policies in recent years, including dividend growth and share buybacks.

Deep Moats: The extensive business networks, logistical capabilities, and sectoral expertise create significant barriers to entry.

Sumitomo also embodies a certain conservative corporate culture that aligns with Buffett’s preference for prudent capital allocation and long-term planning.

Sumitomo Fundamental Data as of April 18, 2025

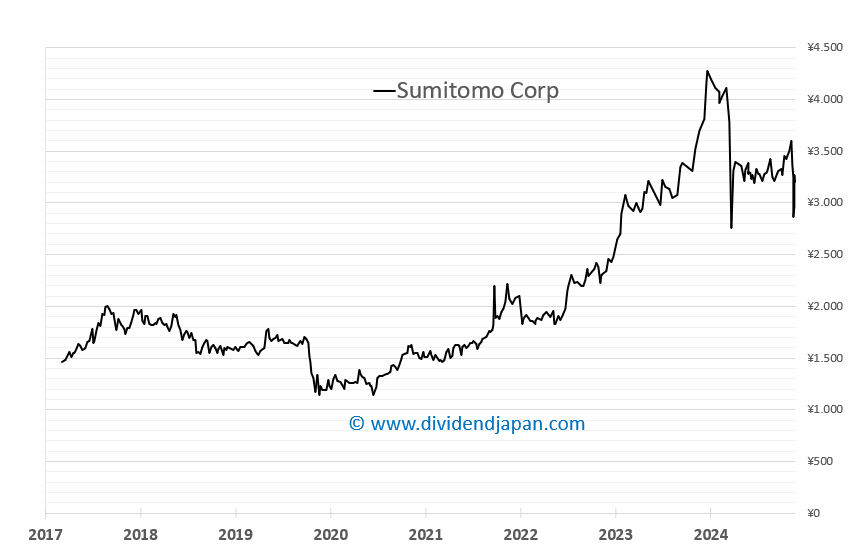

Market Capitalization: ¥3.94 trillion ($27.7 billion)

Stock Price: ¥3,255 (5.5% decrease YTD)

Valuation (P/E): 7 for 2025

ROIC: 4.7% for FY 2024

EBIT Margin: 5.7% in 2024

Dividend Yield: 3.9%

Revenue 2024 (fiscal year ending in March): ¥6,910 billion (+1.4% ); Analysts expect a 4% revenue growth to ¥7,184 billion this year (2025)

Balance sheet: a steady net debt of approximately ¥2.7 billion

Analyst Ratings:

2 "Strong Buy"

5 "Buy"

6 "Hold"

No "Sell" recommendations

Dividend & Buyback Stats

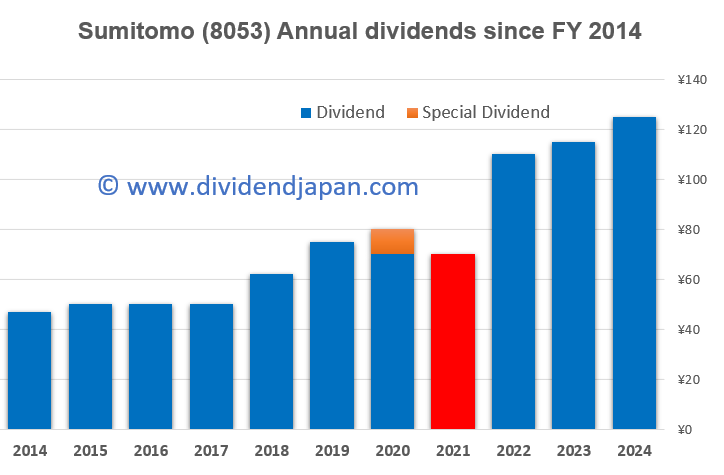

Right now, Sumitomo offers a 3.9% dividend yield at a stock price of 3,255 yen. But damn, compared to the other four stocks we covered, their buybacks are underwhelming.

Dividend growth? Also not impressive — just an 8.7% hike last fiscal year and 4.5% the year before. Sure, a 5-year CAGR of over 10% isn’t bad, but this company has cut its dividend multiple times over the past two decades. We don’t like that, and frankly, the other Buffett picks look a lot better when it comes to buybacks and consistent dividend growth.

Conclusion

Sumitomo Corporation represents a blend of tradition and adaptability — a 400-year-old lineage evolving to meet the challenges of the 21st century. As part of Buffett’s strategic bet on Japan’s trading giants, Sumitomo stands as a testament to the enduring relevance of diversified, globally integrated business models in an increasingly interconnected world. All in all, we're not impressed by Sumitomo's dividend policy or its limited share buybacks. Given its history of dividend cuts and the lackluster capital returns, we understand why the stock trades at a relatively low valuation. Compared to the other Buffett-backed companies we've discussed, Sumitomo is less compelling — those names offer more consistent shareholder returns and appeal to us more at this point.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders! Investing in Japan isn’t for everyone, given its unique trading hours, large price swings, currency fluctuations, lot size requirements, and limited analyst coverage — yet the country also offers some of the world’s best dividend growth opportunities, with countless hidden gems waiting to be discovered.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.