Japan’s Exceptional Dividend Increases in 2025

From 300% hikes to sustained triple-digit dividend growth

Japan stands out in 2025 as the clear global outlier in dividend growth, with more than 20 Japanese stocks already doubling their dividend within our dataset alone — a scale that is not even remotely matched by the US or Europe.

Key points in this article

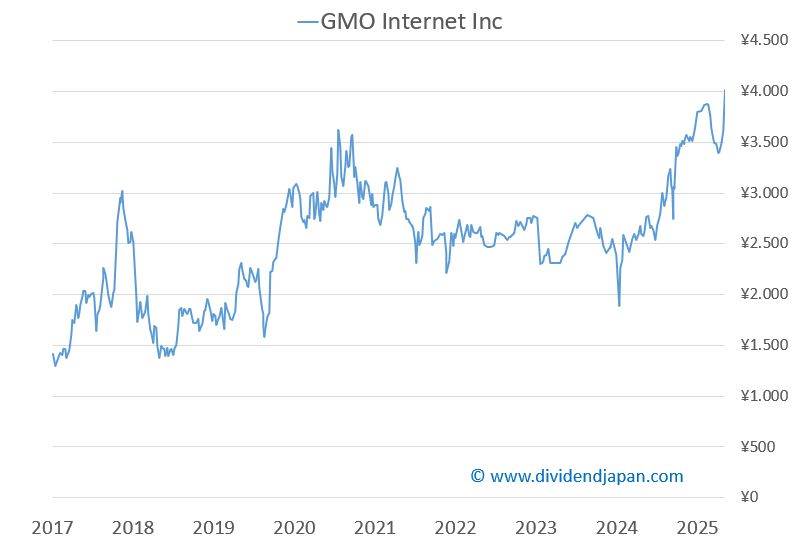

GMO Internet (TSE:4784): dividend +430.0% to 6.9 yen; yield 1.4%; share price 3,964 yen (+48.0% in 2025)

MODEC (TSE:6269) and Mitsui E&S Holdings (TSE:7003): both dividend +300.0%; yields 0.9% and 0.7%

Mitsui E&S Holdings (TSE:7003): share price 5,424 yen (+194.0% in 2025); market cap ~$3.5bn; forward P/E 17.5

Sanrio (TSE:8136): dividend +184.0% to 53 yen after +58.5% (2024) and +121.0% (2023); yield 1.3% gross; P/E 24; market cap ~$8bn

What immediately stands out is how concentrated extreme dividend growth is in Japan this year. Within our own database, more than 20 Japanese companies have raised their dividend by over 100% in 2025. By comparison, only seven US stocks doubled their dividend this year, and these are mostly volatile payers with short or inconsistent payout histories. Europe shows a similar picture, with nine stocks meeting the same threshold.

Biggest dividend hikes in Japan in 2025

GMO Internet: +430%

Modec: +300%

Mitsui E&S: +300%

Square Enix Holdings: +240%

Kokusai Electric: +236%

The biggest hikes above are based on our own research and selection

Importantly, this is still not the full picture. We currently track more than 2,500 listed Japanese companies, but dividend data for 2025 has so far been updated for roughly 1,000 names. That means the real number of dividend increases above 100% could ultimately be 40 or even 50 companies. The conclusion is hard to ignore: Japan delivers, by a wide margin, the largest pool of strong dividend growers among major global markets in 2025.

Extreme dividend hikes are no longer isolated cases

This development no longer comes as a surprise. Japanese companies are increasingly focused on shareholder returns, and many newly listed firms begin paying dividends relatively soon after their IPO once profitability is established. At the same time, Japan is rapidly building longer dividend track records, with a growing number of companies that have increased dividends for ten consecutive years or more, including Kao Corporation, one of the very few genuine Dividend Aristocrats in Japan.

Looking at individual cases makes the scale of this shift even clearer. GMO Internet (TSE:4784) raised its dividend by 430.0% to 6.9 yen per share. While the dividend had been sharply reduced the year before, this increase follows several years of strong dividend growth prior to that adjustment. The company operates internet infrastructure, hosting, and online services, primarily in Japan, making this a case of volatility across cycles rather than a one-off payout.

GMO Internet Inc. (4784 JP) Shares Surge 19.3% on Tokyo Stock Exchange

GMO Internet Inc. (formerly GMO AD Partners Inc.) was once again one of Japan’s top gainers on April 16, 2025, posting a strong share price increase of over 19%—its second consecutive day of sharp gains. On Tuesday, the stock had already closed 15% higher.

Two additional names posted dividend increases of 300.0% in 2025. MODEC (TSE:6269) designs, builds, and operates floating production systems for the offshore energy sector, while Mitsui E&S Holdings (TSE:7003) is active in shipbuilding and industrial machinery. Both stocks have seen exceptionally strong share price performance this year, which explains why dividend yields remain relatively modest despite the headline growth figures.

Sanrio shows what sustained dividend acceleration looks like

One of the most striking dividend stories remains Sanrio (TSE:8136). Best known globally for Hello Kitty, the company raised its dividend by 184.0% in 2025 to a record 53 yen per share, following increases of 58.5% in 2024 and 121.0% in 2023. Few companies globally show three consecutive years of triple-digit dividend growth, making Sanrio a clear outlier even within Japan’s already exceptional dividend landscape.

Sanrio Co (TSE: 8136) dividends and stock price keep soaring

Sanrio Co., Ltd. is a Japanese entertainment company best known for creating and managing character brands such as Hello Kitty, My Melody, and Cinnamoroll. Its business spans character licensing, social-communication gifts, greeting cards, publishing, digital content, movies, music, live events, restaurants, and theme parks including Sanrio Puroland and…

What sets Japan apart in 2025 is not just the number of dividend increases, but how normalised extreme dividend growth has become. In other developed markets, triple-digit hikes remain rare and often tied to irregular payouts. In Japan, they increasingly reflect multi-year improvements in profitability, payout discipline, and capital allocation.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders! Investing in Japan isn’t for everyone, given its unique trading hours, large price swings, currency fluctuations, lot size requirements, and limited analyst coverage — yet the country also offers some of the world’s best dividend growth opportunities, with countless hidden gems waiting to be discovered.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.