Sanrio Co (TSE: 8136) dividends and stock price keep soaring

Helly Kitty owner from Japan pays a record high dividend in 2025

Sanrio Co., Ltd. is a Japanese entertainment company best known for creating and managing character brands such as Hello Kitty, My Melody, and Cinnamoroll. Its business spans character licensing, social-communication gifts, greeting cards, publishing, digital content, movies, music, live events, restaurants, and theme parks including Sanrio Puroland and Harmonyland.

The company was founded in 1960 by Shintaro Tsuji, originally selling small gift items and stationery designed to make it easier for people to share kindness in everyday life. Guided by the philosophy of “Minna Nakayoku” (“Getting Along Together”), Sanrio grew from a domestic gift business into a global entertainment group. Today its vision, “One World, Connecting Smiles,” reflects its mission to bring joy and emotional connection across cultures.

Summary of Sanrio’s business

Product Sales: Sanrio designs and sells a wide range of merchandise, including gift items, stationery, and apparel, through its own stores, department stores, specialty shops, and e-commerce platforms.

Licensing: The company licenses its character intellectual properties (IPs) to third parties, generating revenue through royalties, especially in international markets.

Entertainment and Theme Parks: Sanrio operates theme parks like Sanrio Puroland and Harmonyland, offering attractions, live shows, and events centered around its characters to enhance brand engagement.

They are also exploring new areas such as digital initiatives, educational services, and Web 3.0 collaborations to diversify revenue.

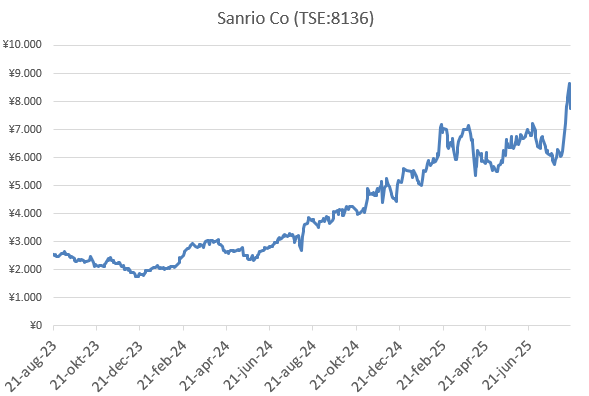

Sanrio has delivered spectacular growth in recent years. In fiscal year 2025, which ended in March, revenue surged 45% to ¥144.9 billion, following two consecutive years of growth above 37%. Remarkable numbers—and they are clearly reflected in the stock price. On August 18, 2025, Sanrio shares reached an all-time high of ¥8,690. For perspective: just five years ago, the stock traded around ¥600.

The company has been a standout performer on the Tokyo Stock Exchange. In 2024, the share price soared 185%, and so far this year it has already gained another 40%. Dividends have also climbed sharply: over the past three fiscal years, payouts increased by an average of 121% per year. For FY 2025, Sanrio raised its dividend by 184% to ¥53. At the current share price, that translates into a modest 0.6% yield—low, but largely the result of the extraordinary stock rally.

Sanrio rewards its shareholders with unique perks. Twice a year, investors receive free admission tickets to Sanrio Puroland or Harmonyland, along with shopping coupons valid at Sanrio stores or online. The number of tickets and coupons depends on the size of the shareholding, with larger holdings granting more benefits. Long-term shareholders (three years or more) can also receive exclusive Sanrio items such as acrylic stands, plush toys, and even invitations to special online events.

Valuation has risen along with performance. For fiscal 2026 (ending March next year), Sanrio trades at an estimated P/E above 39. The company still generates nearly 58% of its revenue in Japan, followed by about 19% from the U.S. Importantly, Sanrio operates with a net debt-free balance sheet. Combined with strong cash flow and solid growth prospects, this should allow for further dividend increases in the coming years.

Analysts remain positive as well, with seven buy ratings, two holds, and no sell recommendations at present.

The question is: would you buy Sanrio at these levels?

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders! Investing in Japan isn’t for everyone, given its unique trading hours, large price swings, currency fluctuations, lot size requirements, and limited analyst coverage — yet the country also offers some of the world’s best dividend growth opportunities, with countless hidden gems waiting to be discovered.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.