A new Dividend Growth Monster from Japan

Fuji Electric (TSE: 6504) continues double digit dividend growth in 2025

One of Japan’s strongest performers lately is Fuji Electric (TSE: 6504), a ¥1.3 trillion ($8.5 billion) industrial powerhouse with deep roots and rising momentum. What’s driving the stock’s surge—and how do its fundamentals and dividend stack up?

Key Points

Fuji Electric hit a 52-week high at ¥8,652

Trades at 15x 2025 earnings with a 2.1% yield

Dividend raised ≥15% annually for 4 straight years

10-year average dividend growth: 13.5%

Fuji Electric: A Century of Industrial Power

Fuji Electric is one of Japan’s long-standing industrial giants, with a history that traces back to 1923. It began as a technology partnership between Furukawa Electric and Germany’s Siemens—hence the name “Fuji,” a blend of Furukawa and jiemensu (the Japanese pronunciation of Siemens). Over the past century, the company has steadily transformed itself from a maker of motors and generators into a diversified powerhouse in energy, automation, and power electronics.

Today, Fuji Electric operates across three core domains: Energy, Industry, and Semiconductors. Its energy business includes clean power systems such as solar energy, fuel cells, and smart grid technologies. In the industrial sector, it provides automation systems, inverters, and control equipment for factories and infrastructure. Its semiconductor division produces power devices—like IGBTs and SiC modules—used in everything from EVs and trains to heavy industrial machinery. The company also has a strong presence in the food and retail sector, supplying vending machines and refrigerated display systems.

Fuji Electric’s current strategy focuses on capturing growth from three global megatrends: decarbonization, digitalization, and electrification. Through its mid-term plan running through FY2026, the company aims to expand both sales and margins by investing heavily in next-generation technologies, smart manufacturing, and selective global expansion, particularly in Southeast Asia and India.

What sets Fuji Electric apart is its ability to combine deep engineering expertise with a disciplined financial profile—qualities that are increasingly appealing to long-term investors. Especially when paired with a shareholder-friendly approach to dividends.

Fuji Electric: Dividend History and Fundamentals

Fuji Electric is Heating Up—And So Is Its Dividend

Stock surges, fundamentals solid, and a quietly compounding dividend story unfolds.

In recent weeks, Fuji Electric (TSE: 6504) has made a sharp move higher—from just under ¥7,000 to a 52-week high of ¥8,652. At current levels, the stock trades at a 2025 P/E of around 15 with a dividend yield of 2.1%.

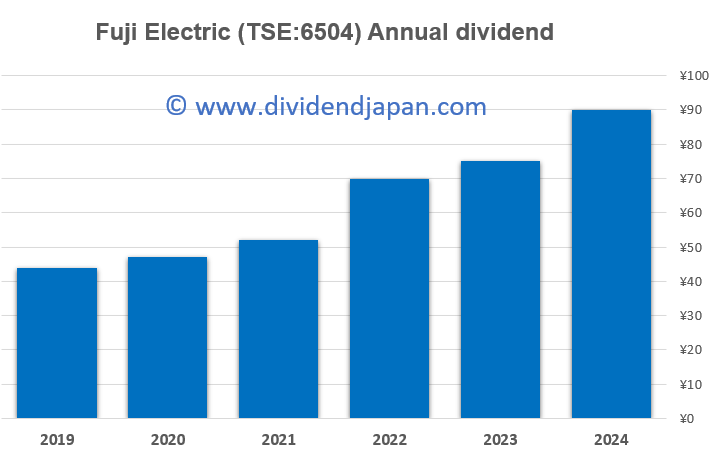

What really sets Fuji Electric apart is its remarkable dividend growth track record. The company has increased its dividend by at least 15% for four consecutive years, and it pays out semiannually. For the most recent fiscal year, a record ¥160 per share will be distributed.

Over the past decade, the company has grown its dividend at an average annual rate of 13.5%—a rare combination of income growth and consistency, especially for a stock yielding over 2% today.

Analyst sentiment is also broadly positive: 3 strong buys, 7 buys, 3 holds, and just 1 sell.

Would you buy Fuji Electric at these levels? Let us know in the comments!

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders! Investing in Japan isn’t for everyone, given its unique trading hours, large price swings, currency fluctuations, lot size requirements, and limited analyst coverage — yet the country also offers some of the world’s best dividend growth opportunities, with countless hidden gems waiting to be discovered.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.