Japanese Automakers Soar as Trump Announces Major U.S.-Japan Trade Deal

Mazda +17.8%, Subaru +16.6%, Toyota +14.3%, Mitsubishi +13.0%, Honda +11.2%.

Shares of Japanese automakers surged on Wednesday July 23, 2025, following the announcement of a landmark trade agreement between the United States and Japan, brokered by former U.S. President Donald Trump. The deal includes a significant reduction in American import tariffs on Japanese goods and a massive investment package aimed at bolstering U.S. strategic industries.

Key Points:

U.S. import tariffs on Japanese goods cut from 25% to 15%, with immediate reductions on autos and auto parts.

Japanese automakers rally sharply: Mazda +17.8%, Subaru +16.6%, Toyota +14.3%, Mitsubishi +13.0%, Honda +11.2%.

Toyota remains Japan’s largest publicly traded company with a market cap of about $284 billion USD.

Under the terms of the agreement, U.S. import tariffs on Japanese goods will be reduced from 25% to 15%, effective immediately. Most notably, tariffs on Japanese automobiles and auto parts—long a sticking point in trade relations—will be cut right away, sparking a rally in Japan’s auto sector.

Mazda Motor Corp. (TSE:7261) led the gains, surging 17.8% to ¥994, up ¥150 on the day, marking its biggest one-day jump in over a decade. Subaru Corp. (TSE:7270) followed closely, climbing 16.6% to ¥2,939, an increase of ¥418.50. Toyota Motor Corp. (TSE:7203)—Japan’s largest automaker—rose 14.3% to ¥2,855, gaining ¥358.

Other major players also saw notable gains: Mitsubishi Motors Corp. (TSE:7211) rose 13.0% to ¥440, up ¥50.70, while Honda Motor Co. Ltd. (TSE:7267) increased 11.2% to ¥1,650, a rise of ¥165.50.

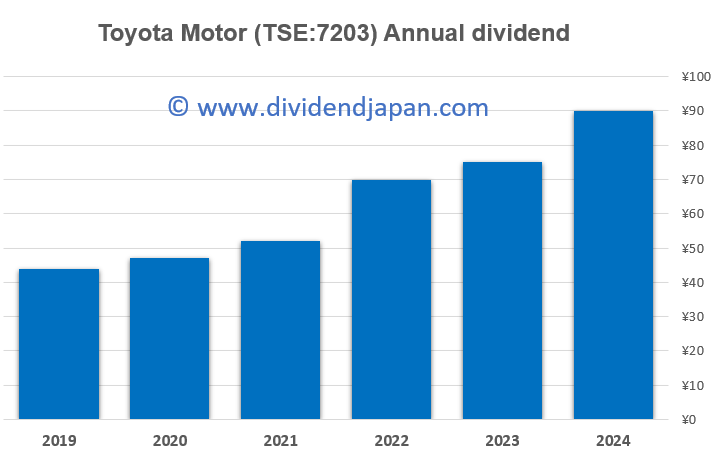

Toyota paid a ¥90 dividend for FY 2024, up 20% from last year and the fifth consecutive year of increases. The current dividend yield for Toyota is 3.6% with the stock price down 19% YTD in 2025.

In terms of market capitalization, Toyota remains the dominant force with an estimated value of approximately €262 billion (around $284 billion USD), making it by far the largest publicly traded company in Japan. Honda holds a solid position with a market cap of roughly €50.5 billion (~$54.7 billion USD). Subaru stands at about €12.5 billion (~$13.6 billion USD), Mitsubishi Motors at €3.7 billion (~$4.0 billion USD), and Mazda at approximately €3.6 billion (~$3.9 billion USD).

In a surprise move, Japan has also agreed to launch a $550 billion investment and loan package for the U.S., aimed at strategic sectors such as pharmaceuticals, semiconductors, and clean energy. The initiative will include both direct investments and long-term financing tools to support American industry and infrastructure.

“This deal represents a new era of U.S.-Japan economic cooperation,” Trump said during a televised announcement. “It’s a win-win for American workers and Japanese industry.”

Japanese Prime Minister Fumio Kishida hailed the agreement as “a milestone for bilateral relations” and emphasized the long-term benefits of deeper industrial ties with the United States.

Market analysts were quick to highlight the implications. “Lower tariffs mean a meaningful boost to Japan’s automotive export margins,” said Nomura strategist Takashi Arai. “It also signals a more stable trade environment, which is exactly what the market wanted to see.”

The Tokyo Stock Exchange's automotive sub-index surged over 9% on the day, with parts suppliers and smaller manufacturers also posting substantial gains.

As both Washington and Tokyo embrace closer economic alignment, investors are now watching for further details on the rollout of the Japanese investment package—and whether additional sectors may benefit from similar trade concessions in the months ahead.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders! Investing in Japan isn’t for everyone, given its unique trading hours, large price swings, currency fluctuations, lot size requirements, and limited analyst coverage — yet the country also offers some of the world’s best dividend growth opportunities, with countless hidden gems waiting to be discovered.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.