Japan’s Top-Performing Dividend Stock in 2025: Kitoku Shinryo Co (TSE:2700)

Japan’s Largest Rice Wholesaler Sees a 303% Stock Surge in 2025

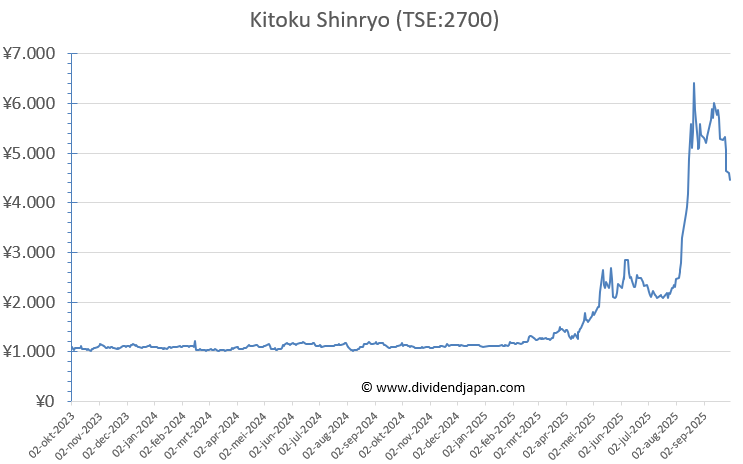

Kitoku Shinryo Co., Ltd., Japan’s largest rice wholesaler by sales volume, has seen its share price surge 303 % in 2025, making it the top-performing dividend stock in our universe. The Tokyo-based group, which handles the equivalent of 4.4 billion bowls of rice annually, reached a record high of ¥6,600 in late August before easing to around ¥5,320 at the end of September.

Key Points

Share price up 303 % YTD, peaking at ¥6,600 in August

Dividend +20 % in 2025 — first increase in years

Interim payout jumps to ¥20 from ¥12; special dividend of ¥14 in 2024

Trades at 10× earnings, with a 0.6 % yield at ¥5,320

Regulatory changes or food safety standards could add unforeseen pressures

On September 24, 2025, the Tokyo Stock Exchange imposed a margin trading restriction on Kitoku Shinryo

Founded over a century ago, Kitoku Shinryo is Japan’s largest rice wholesaler by volume, operating at the core of the nation’s staple food supply. The company buys, processes, and distributes rice across Japan and abroad, while expanding into related areas such as feed, eggs, and value-added rice products. Its long-standing commitment to quality and safety has made it a trusted name in Japan’s food distribution sector.

The remarkable surge in Kitoku Shinryo’s share price this year can be traced to several factors documented in the company’s official reports. First, the company posted strong earnings growth: in the first half of 2025, consolidated revenue rose from ¥59 billion in 2024 to ¥84 billion, while net income attributable to shareholders reached ¥3.7 billion, a year-on-year increase of more than 240 %. Second, management raised the annual dividend by 20 percent, including a substantial increase in the interim dividend from ¥12 to ¥20, alongside a special dividend of ¥14 in 2024. This marked the first dividend increase in several years and bolstered investor confidence. Finally, a five-for-one stock split improved accessibility for retail investors. Together, these factors drove strong demand for the stock, explaining the 303% year-to-date price surge in 2025.

In the first half of fiscal 2025, Kitoku Shinryo reported consolidated revenue of ¥84 billion, up from ¥59 billion a year earlier. Operating profit rose to ¥5.26 billion, and net income reached ¥3.7 billion, a year-on-year gain of more than 240 %. The company also strengthened its balance sheet, with its equity ratio improving from 37.3 % to 38.9 %.

Dividend and Fundamentals

Reflecting this momentum, management lifted the annual dividend by 20 %, the first increase in several years. The interim dividend jumped to ¥20, while last year’s special dividend of ¥14 rewarded shareholders during a period of strong recovery. Despite the dramatic rally, Kitoku Shinryo trades at a price-to-earnings ratio of around 10, underscoring modest valuation metrics even after record gains. Its operating margin and return on invested capital remain relatively low for the sector, yet the payout ratio in 2024 was conservative — suggesting room for flexibility in future distributions.

Cautionary Notes and Short Interest

Despite the strong stock performance, several risks remain. Kitoku Shinryo’s business depends on fluctuating agricultural and raw material prices, including rice, packaging, and transportation. The company’s ability to fully pass on cost increases is limited. Regulatory changes or food safety standards could add unforeseen pressures, although official statements confirm the company’s products have not been affected by recent cadmium concerns. Consumer trends and competition, both domestic and international, also influence performance. Additionally, operating margins and ROIC remain moderate, even as the payout ratio in 2024 was low, leaving room for flexibility but indicating structural limitations in profitability.

Recent data from Kabutan indicates that short interest in Kitoku Shinryo has declined. As of September 19, 2025, the number of shares sold short fell by 1.3% compared with the previous week, suggesting a reduction in bearish sentiment (en.kabutan.com).

On September 24, 2025, the Tokyo Stock Exchange implemented a margin trading restriction on Kitoku Shinryo. Under the new rules, customers must maintain a margin ratio of at least 50%, with 20% held in cash, likely in response to heightened volatility and trading activity in the stock (jpx.co.jp).

These developments highlight that while Kitoku Shinryo has seen substantial share price gains, regulatory oversight and investor attention remain elevated, reflecting both the interest and potential risks associated with the stock.

Conclusion

Kitoku Shinryo’s exceptional 2025 performance reflects a combination of strong earnings growth, disciplined balance sheet management, strategic product development, and renewed dividend initiatives. The company reported a 240% increase in net income in H1 2025, increased its annual dividend by 20%, raised the interim dividend to ¥20, and executed a five-for-one stock split, all of which contributed to heightened investor demand. As Japan’s largest rice wholesaler, distributing billions of bowls of rice annually, Kitoku Shinryo remains a central figure in the country’s staple food market, even as investors weigh profitability and operational limitations alongside its record stock gains.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.