Meet Japan’s Hidden Dividend Star: Oracle Japan (TSE:4716) Tops Payout Records

How Oracle’s Japanese arm combines strong profitability, rising dividends, and cloud ambitions

Oracle Corp Japan, the Tokyo-listed subsidiary of Oracle Corporation (NYSE: ORCL 0.00%↑ ), mirrors its U.S. parent’s global success in databases and cloud technology while carving out a steady growth path in the Japanese market. With consistent revenue expansion, high returns on invested capital, and record dividends, the company continues to attract attention from investors seeking exposure to Japan’s technology sector. Backed by Oracle’s global innovation and a growing domestic demand for cloud and AI, Oracle Corporation Japan blends financial stability with strategic growth initiatives.

Key Takeaways from This Article

Oracle Corporation Japan delivers stable 6–7% revenue growth and analysts forecast another ~7% for FY2026.

High profitability with ~33% EBIT margin and ROIC above 60%, in line with prior years.

Record dividend of ¥190 per share in 2025 (+9%), payout ratio 40%, yield ~1.3%.

Backed by Oracle Corp (U.S.), which owns ~74% of the Japanese subsidiary.

Company Overview

Oracle Corporation Japan (Oracle Japan in short) is the Japanese subsidiary of Oracle Corporation, the American multinational renowned for its leadership in cloud computing, database management, and enterprise software. Headquartered in Minato, Tokyo, and employing more than 2200 people, Oracle Japan serves as the company’s strategic presence in Japan, bridging the innovative technologies developed in the US with the needs of local businesses and government agencies.

The subsidiary operates closely under the umbrella of Oracle Corporation, aligning with its global mission while addressing Japan-specific requirements, such as strict data sovereignty and security standards.

It was founded in 1985 as Oracle Corporation Japan (日本オラクル株式会社) and has been independently listed on the Tokyo Stock Exchange (TSE: 4716) since 2000.

Oracle Corporation in the U.S. is the majority shareholder, holding approximately 74% of the shares.

This means Oracle Japan operates independently on the stock market, but it is closely connected to its U.S. parent in terms of technology, products, and strategy.

Products and Strategic Initiatives

Oracle Japan’s key offerings include Oracle Cloud Infrastructure (OCI), which powers secure and reliable datacenters in Tokyo, and Oracle Fusion Cloud Applications, helping companies optimize operations across finance, supply chain, human resources, and other areas, often leveraging built-in AI for enhanced productivity. The company also provides subscription and data management platforms and partners with local firms like Fujitsu to launch initiatives such as Oracle Alloy, designed to keep data within national boundaries.

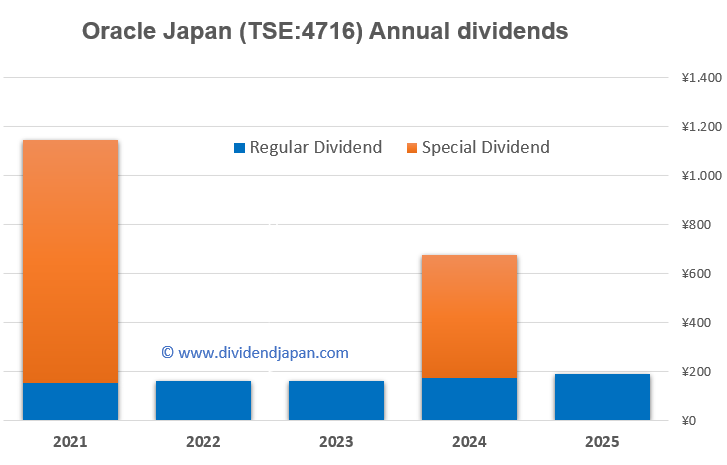

Oracle Japan combines smaller regular payouts (growing every year) with much larger special dividends, such as ¥500 in 2024 and ¥992 in 2021.

In April 2024, Oracle Japan announced an investment exceeding $8 billion over the next decade to expand its cloud infrastructure and strengthen local teams, reflecting the growing demand for cloud and AI solutions in the region.

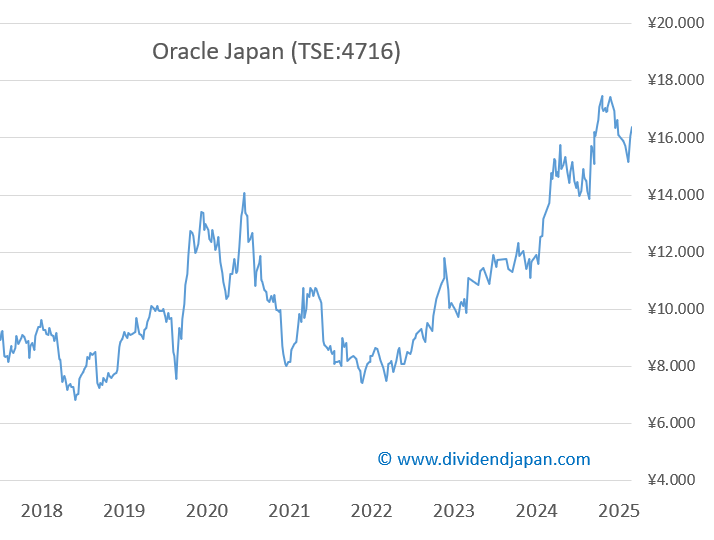

Market Position and Stock Performance

From a financial perspective, Oracle Japan currently has a market capitalization of approximately 1.95 trillion yen (roughly 13 billion USD). Its stock has gained around 8% in 2025, a modest increase compared with the stronger performance of its US-listed parent, Oracle Corporation (ORCL). This highlights that while Oracle Japan benefits from the global strength and technology of its parent company, its stock performance is more subdued, reflecting local market dynamics and investor sentiment.

Lasertec: Japan’s Dividend Champion on the Rise – Can It Reach Record Highs Again?

Lasertec Corporation (TSE:6920), a Tokyo-based pioneer in semiconductor and advanced optical inspection systems, has seen its shares surge on the Tokyo Stock Exchange in recent days. Known for delivering high-value, unique products through rapid development, Lasertec has carved out a leading …

Revenue and Profitability

Revenue has shown stable growth of 6–7% annually over the past years, and analysts expect a 7% increase for fiscal year 2026. For the first quarter ending August 31, 2025, Oracle Japan reported revenue of ¥66.28 billion, operating profit of ¥21.13 billion, pretax profit of ¥21.37 billion, and net profit of ¥14.81 billion. Earnings per share were ¥115.65, slightly lower than the ¥119.99 in the prior year.

Oracle Japan is effectively a debt-free company, with more cash than liabilities on its balance sheet. Analysts expect EPS of ¥512 for 2026, implying a P/E ratio just under 30. Operational efficiency remains high, with a return on invested capital (ROIC) of 61.2% and an EBIT margin of nearly 33%, consistent with historical levels.

Dividend Policy

Oracle Japan has been progressively increasing its dividend, reflecting a shareholder-friendly approach. For 2025, the dividend was ¥190 per share, a new record and more than 9% higher than in 2024. The payout ratio for the year was 40%. In 2024, the company distributed an extra dividend of ¥500 alongside the ordinary dividend of ¥174. At a current share price of ¥15,230, the dividend yield is approximately 1.3%, notably higher than that of its US parent.

Oracle Japan combines smaller regular payouts (growing every year) with much larger special dividends, such as ¥500 in 2024 and ¥992 in 2021.

Oracle Corporation itself owns about 74% of Oracle Japan, reinforcing the strategic alignment and backing between the two companies.

Analyst Coverage

Six analysts currently follow Oracle Japan:

1 Strong Buy

2 Buy

3 Hold

0 Sell

Summary

Oracle Japan combines the technological strength and strategic direction of its US parent with a locally tailored approach, delivering consistent revenue growth, operational efficiency, strong ROIC, and a disciplined dividend policy. Its financial stability, market position, and continued investment in cloud and AI make it a compelling component of Oracle Corporation’s global portfolio.

Would you buy Oracle Japan? Let us know in the comments below this article!

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.