Japan’s Trading Houses & Their Dividends: #1 Mitsui & Co (8031)

Deep Value, Strong Moats, and Rising Payouts – Are These Dividend Stocks Worth Holding? In this post we look at the dividend history and prospects for Warren Buffett investment Mitsui & Co.

Warren Buffett has steadily increased his stake in Japan’s five major trading houses—Mitsui & Co. (8031, we will highlight this stock in this post), Marubeni Corp. , Itochu Corp., Mitsubishi Corp., and Sumitomo Corp.—recognizing their capital efficiency, global reach, and shareholder-friendly policies. But beyond their business strength, how attractive are their dividend payouts?

In this deep dive (and additional posts later on), we’ll explore each company’s history, business model, competitive moat, and most important dividend history and appeal to see if these Japanese conglomerates are as rewarding for income investors as they are for Buffett.

Warren Buffett has built a significant stake in Japan’s five major trading houses—Mitsui & Co., Marubeni Corp., Itochu Corp., Mitsubishi Corp., and Sumitomo Corp.—marking a rare expansion of his investment focus beyond the U.S. Since 2019, Berkshire Hathaway has steadily increased its holdings, now owning 8.5% to 9.8% of each firm, with room to grow beyond 9.9%.

These companies, known as sogo shosha, are diversified conglomerates with global operations in energy, commodities, retail, and infrastructure. Their scale, strong cash flows, and ability to navigate international markets provide a durable moat, making them attractive for a long-term investor like Buffett.

A Closer Look at the Five Trading Giants

Mitsui & Co. (Founded 1876)

A powerhouse in energy, chemicals, and logistics, Mitsui has a strong presence in natural resources and industrial solutions. Its global partnerships and disciplined capital allocation create a competitive edge.Marubeni Corp. (Founded 1858)

With roots in the textile trade, Marubeni has expanded into agriculture, energy, and machinery. Its extensive supply chain network and diversified investments make it a resilient player.Itochu Corp. (Founded 1858)

One of the most consumer-focused of the five, Itochu excels in retail, food, and textiles. Known for its strategic acquisitions, it has a strong foothold in global trade and distribution.Mitsubishi Corp. (Founded 1950, roots in 1870)

The largest of the five, Mitsubishi has interests in automobiles, mining, energy, and industrial finance. Its vast ecosystem and ability to scale operations reinforce its long-term stability.Sumitomo Corp. (Founded 1919, roots in 1590s)

With a legacy spanning centuries, Sumitomo has strengths in metals, transportation, and infrastructure. Its disciplined risk management and broad industry exposure create a strong moat.

Why Buffett Likes Them

Buffett has praised these firms for their capital efficiency, strong management, and shareholder-friendly policies, aligning with his preference for durable, cash-generating businesses. With $23.5 billion invested as of late 2024, his bet on Japan’s trading houses signals confidence in their ability to thrive for decades.

What about the dividend? Do we like them?

In this post, we’ll examine the dividend statistics for the five Buffett stocks from Japan. While we understand why he’s investing in them—recognizing significant value in the country and large market caps that make them investable for Berkshire —we personally prefer other stocks with stronger dividend growth track records and generally much smaller market caps. Today we analyze one stock: Mitsui Co Ltd (8031). The next couple of weeks we will dive into the other four Buffett stocks.

Buffett’s Japan Play #1: Mitsui Co. – Dividend Powerhouse or Overvalued Holding?

In this first installment of our deep dive into Warren Buffett’s five Japanese stock picks, we start with Mitsui Co.

Over the past four years, Mitsui’s stock has enjoyed a remarkable run—partly fueled by Buffett’s interest. With a market capitalization of approximately $56 billion, Mitsui is one of the few Japanese companies large enough to attract Berkshire Hathaway’s attention. Many Japanese stocks fall below the $1 billion market cap threshold, making them inaccessible for Buffett’s investment style. Mitsui, however, meets the size requirement and has certainly capitalized on this rare opportunity.

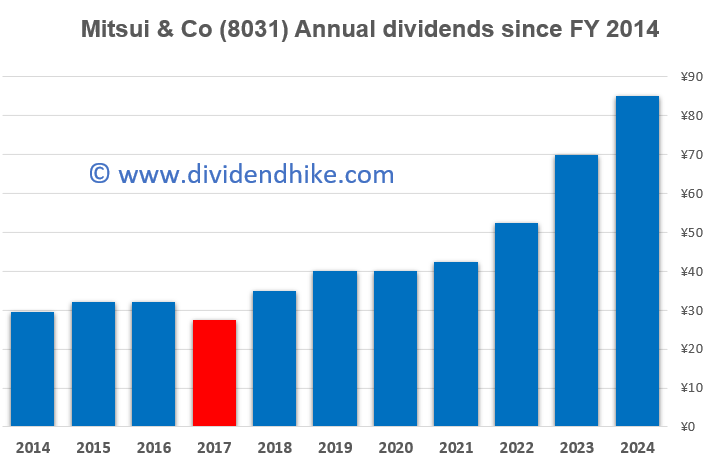

One of Mitsui’s standout features is its aggressive share buyback program and impressive dividend growth over the last three years—averaging more than 20% per year. This aligns with a broader trend in Japan, where dividend growth across sectors has surged over the past five years. For the last fiscal year, Mitsui increased its dividend by 21%, bringing it to 85 yen per share. At a current share price of 2,890 yen, the dividend yield remains attractive at 3.2%.

However, we expect dividend growth to slow in the coming years. A more conservative estimate of 5% to 10% annual growth seems realistic—still a solid rate for a stock yielding over 3%.

Looking at Mitsui’s free cash flow (FCF), there appears to be room for dividend expansion. For fiscal year 2024 (ending March), Mitsui generated 193.50 yen per share in FCF, comfortably covering the 85 yen dividend. Analysts forecast a substantial FCF increase to 334 yen per share for fiscal 2025, indicating Mitsui could maintain or even grow its dividend. That said, Mitsui’s FCF has historically been volatile, fluctuating significantly year over year, which introduces an element of uncertainty.

It’s also worth noting that Mitsui cut its dividend back in fiscal 2017. While its 10-year compound annual growth rate (CAGR) of over 10% is respectable, Japan offers stocks with even stronger dividend growth records.

This year, Mitsui has experienced a 13% decline, with shares currently trading at 2,890 yen. The stock’s price-to-earnings (P/E) ratio of 9 for 2025 isn’t unusual for Japanese holding companies, but other financial metrics raise concerns. Mitsui’s return on invested capital (ROIC) has averaged around 4%, and its EBIT margin of 4–5% is on the lower end for this sector.

So, what’s the market sentiment? Currently, 14 analysts cover Mitsui, with 8 recommending a 'buy', 6 advising to 'hold', and none suggesting to sell.

Our Take: Mitsui offers an appealing dividend yield and has a solid track record of dividend growth, but the slowing growth rate, unstable cash flow, and weak profitability metrics suggest caution. While Buffett may see long-term value in Mitsui’s size and market position, investors looking for stronger dividend growth might consider other Japanese stocks.

Fun fact: Mitsui High-tec (6966) (discussed last week on Dividend Japan) is a specialized precision components manufacturer focusing on industries like electronics, medical devices, and semiconductors. It operates independently but benefits from its relationship with Mitsui & Co., one of Japan’s largest trading companies with diverse global investments. While Mitsui & Co. may have an ownership stake or influence, Mitsui High-tec manages its own operations and strategy, leveraging Mitsui & Co.’s extensive global network.

Stay tuned as we analyze Buffett’s next Japanese stock pick!

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.