Disco Corp (TSE:6146): Japan’s Leading Semiconductor Equipment Grower

Dominant market position, strong financials, and a record-setting dividend make Disco a stock to watch

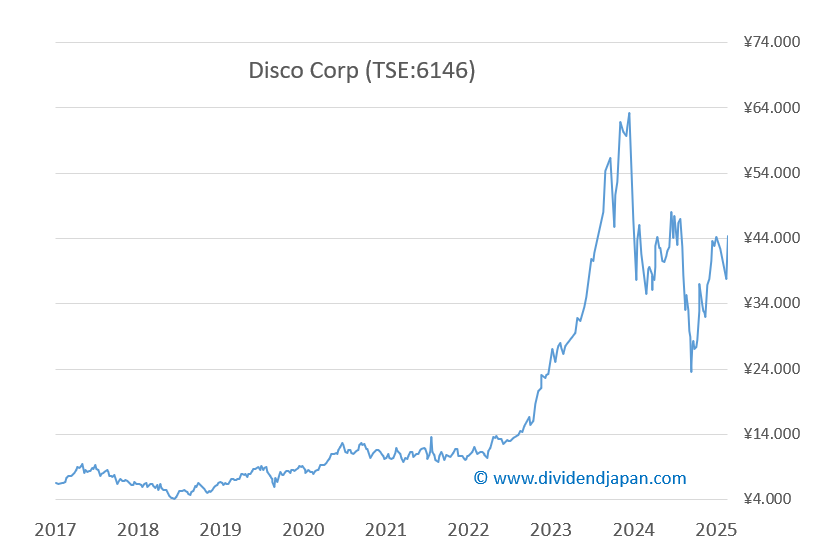

One stock that has captured our attention is Japan’s Disco Corp (TSE:6146), a near-monopoly in precision semiconductor equipment, including dicing saws, laser saws, grinders, polishers, and surface planers. Despite a sharp sell-off earlier in 2025 that brought the share price down to ¥22,640, the stock has staged a remarkable rebound, climbing to ¥45,300 in recent days.

Key Points:

Strong Growth: Analysts expect 6–10% annual growth, supported by Disco’s near-monopoly in semiconductor equipment.

Financial Strength: Debt-free with more cash than liabilities and an ROIC of 54% in 2025.

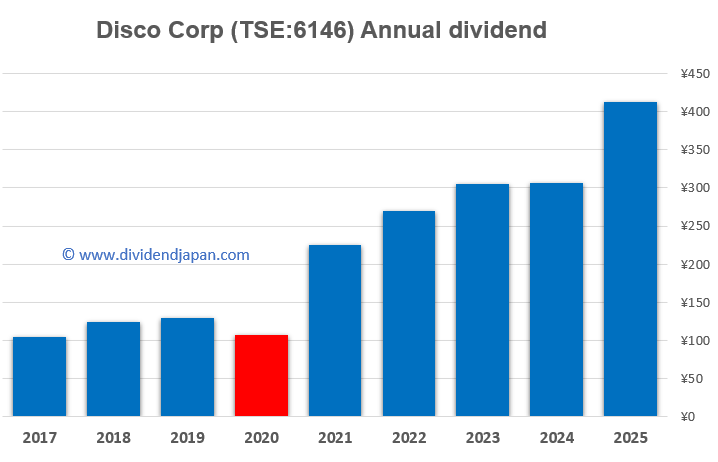

Dividend Track Record: Total dividend up 34.5% in 2025, with 10-year average growth of 22%, unusual for the sector.

With a market capitalization of $33 billion, Disco combines a dominant market position with solid long-term growth potential. For 2025, the stock offers a dividend yield of 1% and trades at a P/E of 38—highlighting both its premium valuation and its leadership in a critical technology niche.

Business and history

DISCO Corporation (TSE:6146) develops and manufactures precision cutting, grinding, and polishing machines, along with the consumable tools (blades, wheels, etc.) used in these systems. Their equipment plays a critical role in processing semiconductors and other electronic components. Beyond machinery, DISCO also provides services such as maintenance, training, leasing, trade in pre-owned machines, and recycling/disassembly solutions.

What makes DISCO unique is its integrated approach to “Kiru, Kezuru, Migaku”—cutting, grinding, and polishing. The company not only produces the consumables but also the machines in which they are used, creating complete solutions with tight quality control. DISCO has a long history of innovation, dating back to the 1950s and 60s, when it pioneered ultra-thin cutting wheels and later expanded into dicing saws and grinders. Today, it is also known for advanced technologies such as stealth laser dicing.

Founded in 1937 in Hiroshima as Dai-Ichi Seitosho Company, the firm initially produced grinding wheels before evolving into a global leader in semiconductor processing tools. Over the decades, it expanded internationally and continuously broadened its product portfolio, while maintaining a strong focus on technological precision and quality standards.

In terms of competition, DISCO is widely recognized as the market leader in dicing saws and wafer grinders, holding a dominant share in certain segments. While it does not enjoy a full monopoly, its position is highly secure due to deep specialization, proprietary technology, and its integrated business model. Competitors such as Tokyo Seimitsu (Accretech) and Advanced Dicing Technologies (ADT) exist, but DISCO is generally seen as the benchmark in its field.

In short, DISCO is a globally respected niche leader that combines decades of expertise, continuous innovation, and a unique full-solution approach—making it an indispensable player in the semiconductor supply chain.

The Disco Corp Dividend

As mentioned, Disco currently has a dividend yield of nearly 1%. While low, this is consistent with a high-growth company that has significantly increased its dividend in recent years.

DISCO distributes surplus funds twice a year via interim and year-end dividends. Both include a performance-linked dividend of 25% of half-year net income, while the year-end dividend may also include an additional dividend equal to one-third of surplus funds after funding requirements, unless there is a loss.

In June 2025, Disco paid a year-end dividend of ¥289, up substantially from ¥231 in 2024. The interim dividend nearly doubled, rising from ¥76 to ¥124. Overall, the total dividend increased by 34.5% to a new record of ¥413. It is likely that Disco will continue to raise dividends in the coming years. Over the past 10 years, the company’s average annual dividend growth was more than 22%, an exceptionally high rate for a semiconductor company.

Fundamentals and valuation

For 2025, the stock offers a dividend yield of 1% and trades at a P/E of 38—highlighting both its premium valuation and its leadership in a critical technology niche. This July we already discussed Disco’s Q1 earnings.

In fiscal year 2024 (ending March 31, 2025), Disco Corporation achieved a record revenue of ¥393.313 billion, representing a 27.9% increase compared to the previous year, when revenue was ¥307.554 billion (disco.co.jp).

This strong growth was driven by robust demand for precision processing equipment, partly fueled by emerging applications such as generative AI. The company benefited from its near-monopolistic position in the market for saw and grinding tools for the semiconductor industry.

Analysts forecast Disco to grow at an impressive 6–10% annually over the coming years—remarkable for this sector. The company’s balance sheet is a standout: completely debt-free, with more cash on hand than liabilities. Equally impressive are Disco’s metrics, including a ROIC of 54% in 2025 and robust profit margins. The main caveat is the high valuation, with a P/E near 40 at the current share price. Would we buy? Timing is key. On a dip, Disco’s combination of market dominance and financial strength makes it highly attractive. Just a few weeks ago, it traded slightly above ¥37,000; now it has surged to around ¥45,000, nearing its yearly high.

Analyst sentiment remains largely bullish: 5 strong buys, 8 buys, 7 holds, and only 1 sell. The average price target aligns with the current price, suggesting limited short-term upside—but with Disco’s dominant position, the long-term story remains compelling.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.