Is Lifedrink (TSE:2585) the new dividend star from Japan?

Stock price and dividend growth are soaring for soft drinks and tea products maker

Japanese beverage maker Lifedrink Company Inc. has been on a remarkable growth trajectory over the past few years, delivering eye-popping returns for shareholders. Known for its range of soft drinks and tea products, the company combines strong revenue growth with rising dividends, making it one of Japan’s most intriguing mid-cap stocks. With impressive recent performance and robust analyst sentiment, Lifedrink is drawing increasing attention from domestic and international investors alike.

Lifedrink Company Inc. (TSE:2585), established on March 28, 1972, is a Japanese company specializing in the manufacture and sale of soft drinks and tea products. Headquartered in Osaka, with a Tokyo office, Lifedrink has grown into a significant player in Japan's beverage industry.

Product Portfolio

Lifedrink's product range includes:

Soft Drinks: Natural water, green tea, oolong tea, and carbonated water drinks.

Tea Products: Black oolong tea, barley tea, rooibos tea, and domestic tea leaves.

Functional Beverages: Products with functional claims and seasonings.

The company operates multiple manufacturing plants across Japan, including locations in Yamanashi, Shizuoka, Mie, Wakayama, Kyoto, Fukuoka, and Kagoshima. These facilities produce a variety of beverages, ensuring a diverse and high-quality product lineup.

Corporate Structure and Leadership

Lifedrink is led by President and Representative Director Kuniaki Okano. The company employs approximately 715 individuals. The board of directors includes Chairman Ryoichiro Minagawa and outside directors Hirohide Omi, Jun Yamamoto, and Yuka Hada.

Market Position and Financial Performance

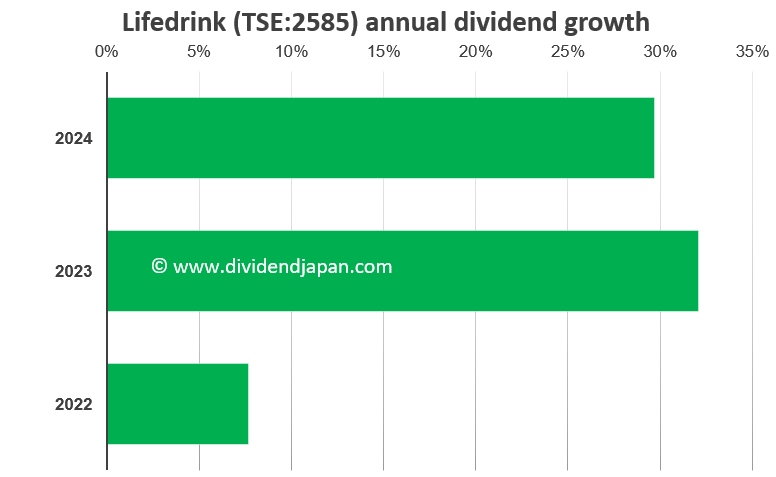

Operating primarily in Japan, Lifedrink has established a strong presence in the domestic beverage market. The company has delivered exceptional shareholder returns over the past three years, with an average stock price increase of more than 100% per year. Its dividend has also grown sharply, reflecting consistent profitability.

Currently trading at 2,626 yen, Lifedrink has an estimated P/E of 30 for 2025 and a modest dividend yield of 0.5%. Revenue growth remains robust, with FY2025 (ending March) sales rising 16.5% to 44.54 billion yen, and analysts expect 17% growth in FY2026.

Analyst sentiment is generally positive, with 1 strong buy and 2 hold recommendations, and no sell ratings. Lifedrink’s market capitalization is approximately $930 million, underscoring its position as a mid-sized but high-growth company in Japan’s beverage sector.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders! Investing in Japan isn’t for everyone, given its unique trading hours, large price swings, currency fluctuations, lot size requirements, and limited analyst coverage — yet the country also offers some of the world’s best dividend growth opportunities, with countless hidden gems waiting to be discovered.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.