Buffett stock #3 Itochu Corp: The Consumer-Focused Dividend Growth Giant

Itochu (8001) from Japan impresses with double digit annual dividend hikes

We’re taking a deep dive into Warren Buffett’s five major Japanese trading house investments, with a special focus on their dividends. Today we look at Itochu Corp (8001).

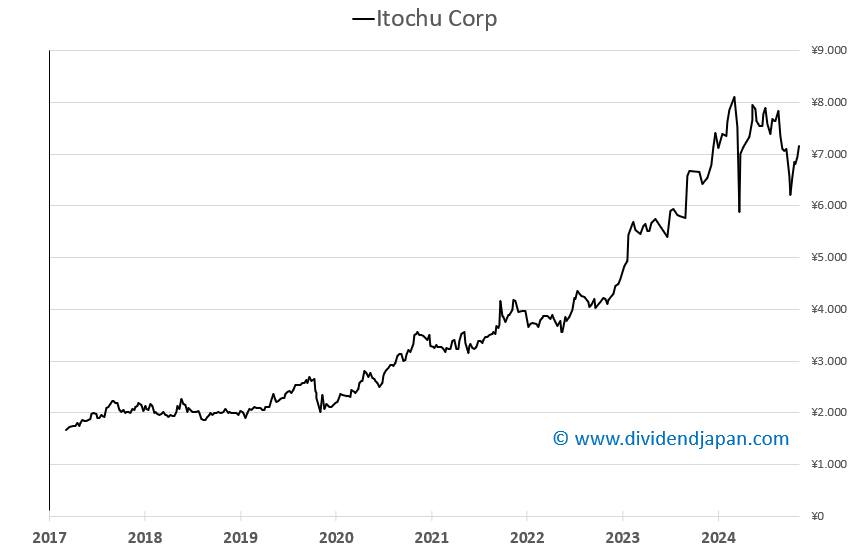

Itochu has an impressive dividend track record, consistently delivering double-digit annual hikes. For FY 2025, they plan a 25% increase, which is particularly remarkable for a company with a current yield of just 2.6%!

As of March 10, 2025, Berkshire Hathaway owns 8.53% of ITOCHU’s outstanding shares, amounting to 135.25 million shares, valued at approximately $6.6 billion.

First we covered Mitsui & Co., and last week, we turned our attention to Marubeni Corporation. Since 2019, Buffett’s Berkshire Hathaway has steadily increased its stake in Japan’s sōgō shōsha—Mitsui, Marubeni, Itochu, Mitsubishi, and Sumitomo—recognizing their strong cash flows, global reach, and shareholder-friendly policies. Today, Berkshire owns between 8.5% and 9.8% of each, with room to grow beyond 9.9%.

These trading houses are diversified conglomerates with operations spanning energy, commodities, retail, and infrastructure. Their financial discipline and ability to navigate international markets make them attractive for long-term investors. But beyond their business strength, how rewarding are their dividends? This week we look at #3: Itochu Corp (ticker/symbol 8001).

Itochu: from Textile Roots to a Global Powerhouse

The history of ITOCHU Corporation dates back to 1858 when its founder, Chubei Itoh, commenced linen trading operations in Osaka. Over the past 160 years, ITOCHU has evolved into one of Japan’s leading sogo shosha, with a strong global presence. Today, the company operates approximately 90 bases in 61 countries, engaging in domestic trading, import/export, and overseas trading of a wide range of products, including textiles, machinery, metals, minerals, energy, chemicals, food, general products, real estate, information and communications technology, and finance. Additionally, ITOCHU is actively involved in business investments both in Japan and abroad.

Unlike some of its competitors, which focus heavily on commodities and industrial infrastructure, ITOCHU has set itself apart through a sharp emphasis on consumer-driven industries. This strategic approach has helped the company maintain resilience, even during periods of economic uncertainty.

A Unique Strategy Among the Sogo Shosha

ITOCHU has built a reputation as one of the best-performing sogo shosha, thanks to its pragmatic approach and strategic acquisitions. The company has developed a broad portfolio of subsidiaries and partnerships spanning retail, fashion, food, pharmaceuticals, the automotive sector, and technology.

A key pillar of ITOCHU’s strategy is its strong presence in consumer markets. The company holds a significant stake in FamilyMart, one of Japan’s largest convenience store chains, and has partnerships with well-known brands such as Dole and Descente. This focus on everyday consumer products provides ITOCHU with stable cash flows and growth opportunities, even in challenging economic conditions.

Furthermore, ITOCHU has established a strong international footprint, with investments and partnerships in China, Southeast Asia, and North America. This global network enables the company to capitalize on emerging trends and market opportunities beyond Japan.

Competition and Market Positioning

Within Japan’s sogo shosha landscape, ITOCHU is one of the most dynamic players, operating in a highly competitive environment. The other four major trading houses—Mitsui & Co., Marubeni, Mitsubishi Corp., and Sumitomo Corp.—each have their own strategic focus and strengths:

Mitsubishi Corp.: The largest of the five, with a broader emphasis on energy and industrial sectors.

Mitsui & Co.: Strong in natural resources and infrastructure.

Sumitomo Corp.: Focused on metals, transportation, and construction.

Marubeni Corp.: Diversified, with a strong emphasis on commodities and agribusiness.

ITOCHU’s competitive advantage lies in its ability to dominate consumer-driven markets and swiftly adapt to changing market conditions. The company is often praised for its efficient capital allocation and strong operational performance.

Why Buffett Is Interested in ITOCHU

Since 2019, Warren Buffett’s Berkshire Hathaway has steadily increased its stake in Japan’s trading houses, and ITOCHU fits perfectly within Buffett’s investment philosophy. The company’s strong cash flows, consistent profitability, and long-term vision make it an attractive investment.

With its focus on consumer goods and strategic investments, ITOCHU is well-positioned for future growth. Its combination of a conservative financial structure, broad diversification, and global presence provides it with a robust market position.

Buffett’s Investment in ITOCHU

Warren Buffett's Berkshire Hathaway has demonstrated a strong commitment to Japan’s trading houses, including ITOCHU.

Initial Investment: In 2020, Berkshire Hathaway began acquiring stakes in Japan's five largest trading companies—Marubeni, Itochu, Mitsubishi, Mitsui, and Sumitomo—initially securing a 5% position in each.

Increased Holdings: By early 2025, Berkshire’s total investment in these firms had reached $23.5 billion, with Buffett signaling his intention to maintain and potentially expand these positions further.

Current Stake: As of March 10, 2025, Berkshire Hathaway owns 8.53% of ITOCHU’s outstanding shares, amounting to 135.25 million shares, valued at approximately $6.6 billion.

With its focus on consumer goods and strategic investments, ITOCHU aligns well with Buffett’s preference for strong cash flow, diversified operations, and long-term value creation.

Fundamentals, valuation and analyst opinion

As of March 31, 2025, Itochu has a market capitalization of ¥11.09 trillion ($74 billion). The stock price for 2025 stands at ¥6,995, reflecting an 11% decline. Despite this, its valuation remains attractive, with a price-to-earnings ratio (P/E) of just 11 for 2025. The company's return on capital invested (ROCI) has remained steady at around 6% annually, and its EBIT margin has consistently hovered around 5% each year.

Key Fundamentals of Itochu as of March 31, 2025

Market Capitalization: ¥11.09 trillion ($74 billion)

Stock Price 2025: ¥6,995 (11% decrease)

Valuation (P/E): 11 for 2025

ROCI: 6% per year (consistent over the past years)

EBIT Margin: 5% per year (steady)

Dividend Yield: 2.6% (2.9% including the expected dividend increase to ¥200 in 2025)

Revenue 2024: ¥14,030 billion (+0.6% growth)

Expected Revenue Growth 2025: +3.5% to ¥14,520 billion

Analyst Ratings:

2 "Strong Buy"

9 "Buy"

2 "Hold"

No "Sell" recommendations

Itochu’s dividend yield is currently 2.6%, which increases to 2.9% when factoring in the expected dividend hike to ¥200 for 2025. For the fiscal year 2024 (ending March), the company's revenue grew by 0.6% to ¥14,030 billion. Analysts predict a 3.5% growth in 2025, bringing revenue to ¥14,520 billion.

Analysts are predominantly positive on Itochu, with 2 "Strong Buy" ratings, 9 "Buy" ratings, and 2 "Hold" ratings. There are no "Sell" recommendations, but then again, who would dare to go against Buffett, right? :D

What about the dividend? Do we like them?

In this series, we’ll examine the dividend statistics for the five Buffett stocks from Japan. While we understand why he’s investing in them—recognizing significant value in the country and large market caps that make them investable for Berkshire —we personally prefer other stocks with stronger dividend growth track records and generally much smaller market caps.

Itochu’s dividend performance, much like Marubeni’s, has been particularly impressive over the past three years. Could this be the Buffett effect? The fact remains that Japanese stocks have made significant strides in dividend growth in recent years, and Itochu is no exception.

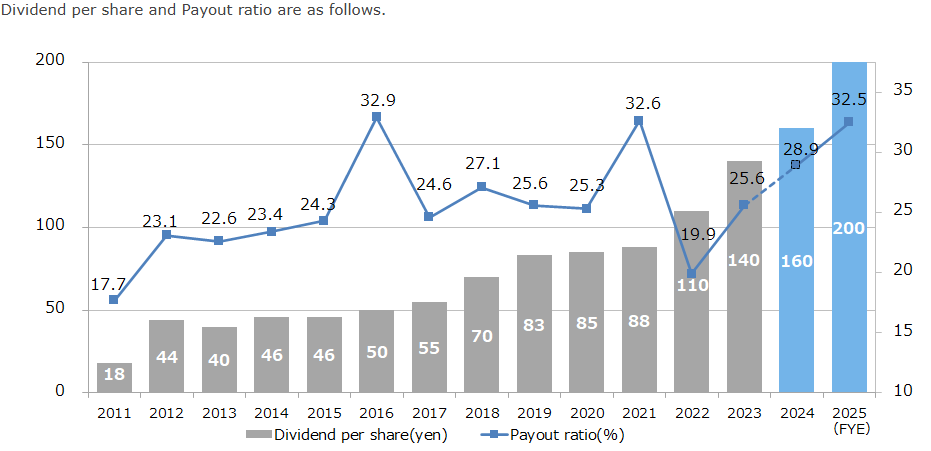

Over the last three years, the Itochu dividend has increased by an average of more than 22% annually. Even better, the company plans a 25% dividend hike in 2025

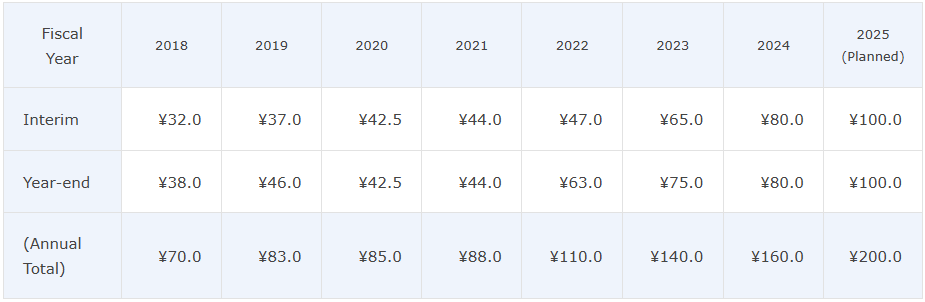

For the fiscal year 2024, the dividend was raised by 14% to ¥160, and for 2025, Itochu plans to increase it further to ¥200. An interim dividend of ¥100 has already been announced, with a matching year-end dividend to follow.

This represents a 25% increase for 2025, aligning with the company’s historical average. This is particularly impressive for a company with a current yield of 2.6% at a stock price of ¥6,995.

FYE 2025 Management Plan (Shareholder Returns)

Total payout ratio: Targeting 50%

Full-year dividend: ¥200 per share (interim: ¥100, year-end: ¥100)

Minimum dividend: ¥200 per share (+¥40 from the previous fiscal year)

Share buybacks: Approx. ¥150 billion

With the expected increase in 2025, the dividend growth won't stop there; we anticipate further dividend increases at Itochu in the coming years, although not at the rapid pace seen in recent years, as such growth is not sustainable, not even in Japan. However, a single-digit annual dividend growth should be achievable for Itochu starting in 2026, as the company continues to build a strong dividend track record.

Thanks for reading Dividend Japan! Subscribe for free to receive new posts and support my work.

Stay tuned as we analyze Buffett’s next Japanese stock pick!

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.