Japan’s Semiconductor Star Kioxia Holdings (TSE:285A) Needs a Dividend

A booming share price, low valuation, and strong cash flow beg the question—why no payout yet?

Kioxia Holdings Corporation was established on October 1, 2019, bringing together the memory and SSD businesses under a single umbrella. From the outset, the company has positioned itself as a pioneer in digital storage, committed to accelerating the future of the digital society through its technologies.

Key Points

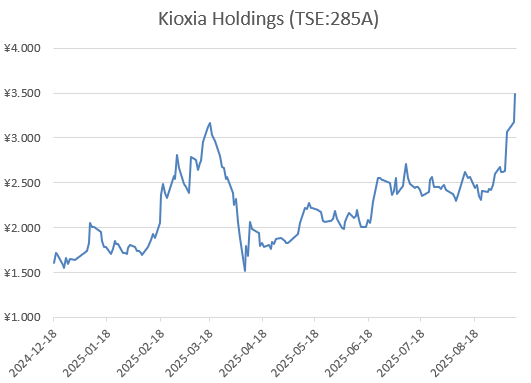

Kioxia shares have surged 112% in 2025, closing at a record ¥3,485 on Sept. 11.

Despite the rally, the stock trades at a forward P/E of just 12.

Revenue and EPS will dip in FY2026, but long-term profit growth remains strong.

With solid cash flow and falling debt, the Japanese semiconductor giant is well placed to start paying a dividend.

At the heart of Kioxia’s identity lies a clear mission: to pursue the potential of memory and create new value. The company sees memory not merely as a component in digital systems but as an essential enabler of safer, more convenient, and more comfortable lives. This philosophy drives its investments in research, development, and product innovation, ensuring that its memory and SSD solutions remain at the cutting edge.

Though the Holdings website emphasizes the broader strategic vision rather than product catalogs, Kioxia’s focus is evident: to be a leader in both enterprise and consumer storage solutions. Its progress is underpinned by a strong emphasis on sustainability and governance. For instance, the company recently announced leadership changes in September 2025 and joined JaCER, Japan’s center for business and human rights dialogue, underscoring its commitment to responsible growth.

Innovation remains central to Kioxia’s story. In August 2025, the company showcased a 5 TB flash memory module capable of 64 GB/s bandwidth, alongside its new enterprise SSDs in the LC9 series, which went on to win a “Best of Show” award at the Future of Memory and Storage (FMS) event. These milestones highlight both technical excellence and industry recognition, strengthening Kioxia’s reputation as a global force in memory solutions.

The Holdings site does not explicitly name competitors, but Kioxia operates in a highly competitive space where a handful of companies dominate the global memory and SSD markets. Its ability to innovate and differentiate—through speed, density, and efficiency—defines how it positions itself in this landscape.

In just a few years since its creation, Kioxia Holdings has evolved from a carved-out business to a key name shaping the way digital memory is developed and deployed. By staying true to its mission of unlocking the potential of memory, the company is not only addressing current demand but also anticipating the needs of tomorrow’s digital world.

From Struggling IPO to Stock Market Star

Kioxia’s corporate journey has been matched by an equally striking performance on the stock market. Listed on December 18, 2024, the IPO initially had a muted reception. But less than a year later, the company has become one of the hottest stocks in Tokyo.

As of September 11, 2025, the share price has surged 112.5% year-to-date, closing at an all-time high of ¥3,485. This rally has lifted Kioxia’s market capitalization to ¥1.88 trillion (about $12.7 billion), cementing its status as a rising star in Japan’s semiconductor sector.

Valuation and Growth Outlook

Despite the breathtaking run, valuation still looks compelling. Kioxia trades at a forward P/E ratio of just 12. Even with revenue projected to dip 4.5% in FY2026 (to ¥1.629 trillion) and EPS expected to fall from ¥519.96 in FY2025 to ¥304, analysts see this as a cyclical pause rather than a structural setback. Looking further out, profits are expected to rebound, with the P/E ratio potentially dropping into the single digits.

The analyst community remains divided—2 Strong Buys, 1 Buy, 4 Holds, and 1 Strong Sell—but the consensus is that Kioxia offers attractive value, even after its extraordinary rally.

The Dividend Question

Yet for all its progress, Kioxia has not taken one crucial step: paying a dividend. Among Japanese semiconductor peers, this makes it an outlier.

Management’s caution is understandable. At the end of FY2025, net debt stood at ¥827.62 billion, and the company is prioritizing deleveraging. With strong free cash flow—¥250 billion in FY2025, though expected to dip to ¥150 billion this year—Kioxia is on track to cut debt below ¥500 billion by FY2028.

Lasertec (TSE:6920) Stock Rebounds After Long Slump

A stock that many investors focused on Japan will be watching with mixed feelings is Lasertec (TSE:6920), the unique semiconductor equipment company that collapsed earlier in 2025 to a low of ¥10,250 after a strong multi-year rally. Since then, the stock has recovered significantly,…

Even so, a small dividend would be entirely feasible. It would send a strong signal to the market, underlining management’s confidence in the company’s long-term earnings power, while aligning Kioxia with global norms in the semiconductor industry.

Conclusion

Kioxia has transformed itself in less than a year—from a tepid IPO debut to a market leader hitting fresh highs. The fundamentals remain strong: low valuation, improving balance sheet, and long-term growth potential in one of the most essential industries of the digital age.

The next logical milestone is clear. It’s time for Kioxia to start paying a dividend. Doing so would not only reward loyal shareholders but also establish the company as a mature, globally credible semiconductor champion.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.

Kioxia closed at 8780 yen today. WOW, just WOW.........

Wow Japan's Semiconductor play Kioxia (285A) hit 6500 yen Today. Almost doubled since we wrote about the stock less than a month ago. https://www.dividendjapan.com/p/japan-stocks-and-semiconductors-surge