Kurabo Industries (TSE: 3106): Japan’s Hidden Billion-Dollar Gem

A small-cap star quietly delivering double-digit gains and surging dividends

Kurabo Industries (TSE: 3106): A Quiet Billion-Dollar Winner Investors Missed

Few Japanese small caps have rewarded shareholders as handsomely as Smart clothing and robotics company Kurabo Industries Ltd. over the past three years. The stock, now approaching a market capitalization of nearly $1 billion, has quietly outperformed much of the Tokyo market.

Year-to-date the Kurabo shares are up +29%, building on a remarkable +98.8% gain in 2024 and +33.5% in 2023.

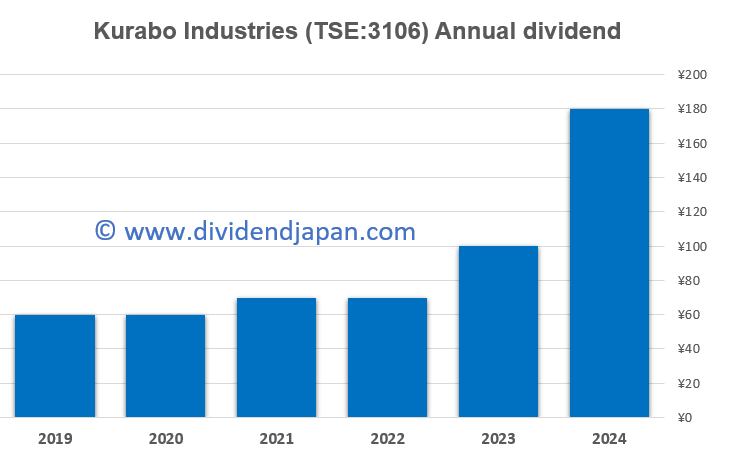

Dividends, too, have been lifted aggressively in recent years, underscoring management’s shareholder-friendly stance. And yet, the stock is followed by no analysts – a fate it shares with many Japanese small caps.

Key Points:

Share price up +29% YTD, +98.8% in 2024, +33.5% in 2023

Market cap nearing $1 billion, trading at ~10x earnings

Dividends rising rapidly, reflecting shareholder-friendly strategy

No analyst coverage despite strong results and growth momentum

At around 10 times earnings, Kurabo remains inexpensive by global standards. That makes the company’s rally all the more striking: not only has the stock delivered eye-catching price performance, but it has done so without the valuation excesses often seen elsewhere.

Kurabo Industries was founded in 1888 in Kurashiki, Japan, originally as a cotton spinning company. Over the decades, it expanded into textiles, chemicals, food services, advanced technology, electronics, biomedical, and real estate. Notable milestones include becoming Japan’s first denim manufacturer in 1970, launching an electronics division in 1976, and entering the biomedical field in 1982. The company adopted the name Kurabo in 1988 and has maintained a focus on innovation, quality, and social contributions, including cultural and scientific initiatives. Kurabu now has 5 business segments with consolidated net sales of 151.3 billion yen. The Kurabo Group has offices, plants, and affiliated companies in Japan and six other countries, including Brazil, Thailand, and Indonesia. The total number of group companies and their bases in Japan and overseas is 70.

Recent Results: Steady Progress, Surging Profits

In the first quarter of FY2026 (April–June 2025), Kurabo reported:

Net sales: ¥35.7 billion (–0.4% YoY)

Operating profit: ¥2.15 billion (+4.4% YoY)

Ordinary profit: ¥3.02 billion (+3.9% YoY)

Net profit: ¥5.17 billion (+167.1% YoY)

The bottom line was flattered by extraordinary gains from the sale of cross-shareholdings, but the underlying operations also showed resilience despite a sluggish Japanese economy and ongoing geopolitical headwinds.

Segment Highlights

Chemical Products: Sales slipped (–5.8% YoY) on weaker semiconductor-related demand, though automotive interior materials and nonwovens for filters held firm. Operating profit fell 26.0% to ¥0.8 billion.

Textiles: Net sales declined 4.6% to ¥11.8 billion, with uniforms and casual clothing weaker. Preparation costs for the closure of the Anjo Plant led to an operating loss of ¥0.25 billion.

Advanced Technology: A bright spot. Net sales surged 25.9% to ¥5.3 billion, and operating profit more than doubled to ¥1.15 billion, driven by semiconductor equipment, infrastructure systems, and strong demand for factory automation.

Food & Services: Net sales grew 10.1% to ¥2.4 billion, with solid demand for freeze-dried foods and hotels supported by domestic and inbound tourism. Operating profit jumped 77.9% to ¥0.13 billion.

Real Estate: Sales rose modestly (+5.0%) to ¥0.9 billion, though profit edged down due to higher repair expenses.

Management’s Focus: “Accelerate ’27”

Kurabo is executing on its medium-term management plan, “Accelerate ’27”, launched in April 2025. The strategy is simple but ambitious:

Expand high-profit growth businesses

Reinforce core earnings power

Create new businesses, supported by strong R&D

The reorganization of business segments this year reflects management’s intent to sharpen focus on high-potential areas such as advanced technology and life sciences, while maintaining stable earnings from traditional chemical products and textiles.

Dividend and buybacks

Kurabo has been a buyback machine in the last couple of years buying back more than 5% of its shares on average in each of the past four years. On top of this the company continues to hike its dividend with a 5 year CAGR of 24.6%.

The FY 2024 dividend was hiked by a whopping 80% to a record high 180 yen per share, with a 42.9% dividend hike in the year before. The current dividend yield is 2.4% for Kurabo Industries at a stock price of 7420 yen, thanks to the massive dividend hikes in line with the surging stock price.

Why Was This Missed?

Despite the stellar share price gains, rising dividends, and clear strategic direction, Kurabo remains virtually invisible to international investors. The lack of analyst coverage, a common issue among Japanese small caps, means that even a company on the cusp of becoming a billion-dollar enterprise can escape attention.

The irony is striking: while global investors chase growth stories at lofty valuations, Kurabo offers robust earnings momentum, double-digit returns for shareholders, and a valuation multiple that looks more like a value stock than a growth darling.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.