Investing in Japan: Everything you need to know

Why Japan’s stock market stands out for global investors with dividend growth, unique companies, stock splits and trading rules and many undiscovered gems

Japan remains one of the most fascinating equity markets in the world. It is home to global household names in automobiles, consumer goods, and retail, but also to thousands of under-the-radar small caps and a fast-growing set of technology firms. For international investors, Japanese stocks offer a unique mix of tradition and modernization: unusual market structures, distinctive valuation features, and increasingly attractive shareholder returns.

Key Points in this article

Split trading hours with a midday break

High share prices but frequent stock splits

IPOs outnumber delistings, market keeps expanding

Strong dividend culture with rising payouts

Yen weakness: risk for investors, boost for exporters

TOPIX: lower valuation, higher yield than S&P 500

A Market Like No Other

Japan remains one of the most fascinating equity markets in the world. It is home to global household names in automobiles, consumer goods, and retail, but also to thousands of under-the-radar small caps and a fast-growing set of technology firms. For international investors, Japanese stocks offer a unique mix of tradition and modernization: unusual market structures, distinctive valuation features, and increasingly attractive shareholder returns.

Unique Trading Hours and Market Structure

The Tokyo Stock Exchange (TSE) follows a schedule unlike any other. Trading is split into two separate sessions with a break in the middle:

Morning session: 9:00 AM – 11:30 AM (JST)

Afternoon session: 12:30 PM – 3:00 PM (JST)

For European investors, trading happens overnight:

During daylight saving time: 2:00 AM – 8:30 AM CET

In winter: 1:00 AM – 7:30 AM CET

Adding to the challenge, Japan observes 15–20 public holidays per year, when the exchange is closed.

High Share Prices, Lot Sizes—and Endless Stock Splits

A distinctive feature of the Japanese market is its share price structure. Many blue chips trade at very high nominal levels.

Example: Fast Retailing (9983), parent of Uniqlo, when trading at around 46,970 JPY per share. With mandatory trading units of 100 shares, investors need nearly 4.7 million JPY (≈ $31,000 USD) to buy just one lot.

This makes diversification hard for smaller investors. But Japan has found a way to ease the barrier: stock splits. Nowhere else in the world are they so frequent—well over 100 each year, almost monthly. This steady stream of splits lowers share prices and broadens accessibility. Today, most of listed Japanese companies trade below 10,000 JPY per share, making them attainable even for modest portfolios. But especially most of the bigger, better known names, are trading above 10,000 JPY, including Nintendo, Daikin, Fast Retailing and Keyence.

A Strong Dividend Culture

Dividend investors will find plenty to like in Japan. Unlike U.S. tech firms, Japanese companies—even in tech—often pay dividends, with many adopting dividend growth policies.

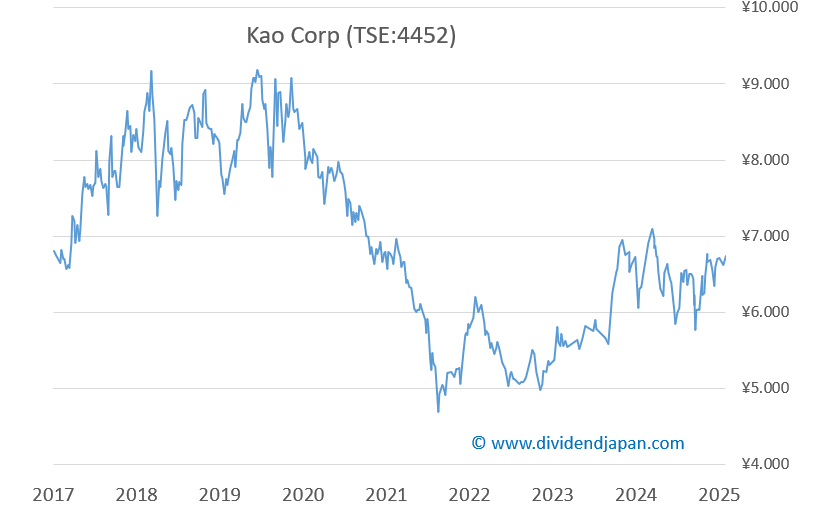

A standout is KAO Corporation (4452), consumer goods group behind John Frieda, Kanebo, and Molton Brown. Founded in 1887, it has raised its dividend for 35 consecutive years, offers a yield of about 2.2%, and has a market cap around $20B. With a P/E near 25, KAO shows how tradition and steady shareholder rewards can go hand in hand.

Sectors Beyond the Obvious

While Japan is known for cars, trading houses, and pharmaceuticals, investors, industrial giants and banks also find:

Semiconductors and globally relevant software companies

AI-companies, drone/robot makers, and space and defense tech firms

Retail giants like Fast Retailing expanding across Asia

Fast growing medtech companies and biotech boomers

Consumer product makers that you have never heard of before

Even Warren Buffett has raised his exposure to Japanese equities. Meanwhile, M&A activity is rising, with North American firms and private equity playing an active role.

Keiretsu and the Legacy of Abenomics

Japan’s keiretsu—interconnected corporate networks with cross-shareholdings—still shape governance and complicate M&A. But Abenomics (2012–2020) shifted the landscape, with reforms that pushed companies toward higher dividends and buybacks. Combined with a weaker yen and renewed foreign inflows, this helped Japanese equities recover from decades of stagnation after the 1980s bubble burst.

Market Shape: Giants and Thousands of Small Caps

Japan’s market counts about 4,000 listed companies. Only a fraction matter globally:

Biggest company: Toyota Motor: market cap ≈ $296B

An estimated fewer than 100 companies exceed $10 B

Thousands of small caps < $500M

Hundreds of Microcaps with a market cap less than $10M

Most microcaps lack analyst coverage, show high volatility, and publish little beyond Japanese filings. Yet Japan is unique: IPOs consistently outnumber delistings. The investable universe keeps growing, unlike many European markets.

Currency Risk: The Weak Yen

The yen has steadily lost value in recent years and stems from ultra-low Japanese rates versus higher U.S. and European yields. Yet it boosts exporters, who earn abroad and translate revenues back into more yen. For companies tied to Asia’s growth, this currency weakness can actually be a long-term advantage.

Indices: Nikkei 225 vs. TOPIX

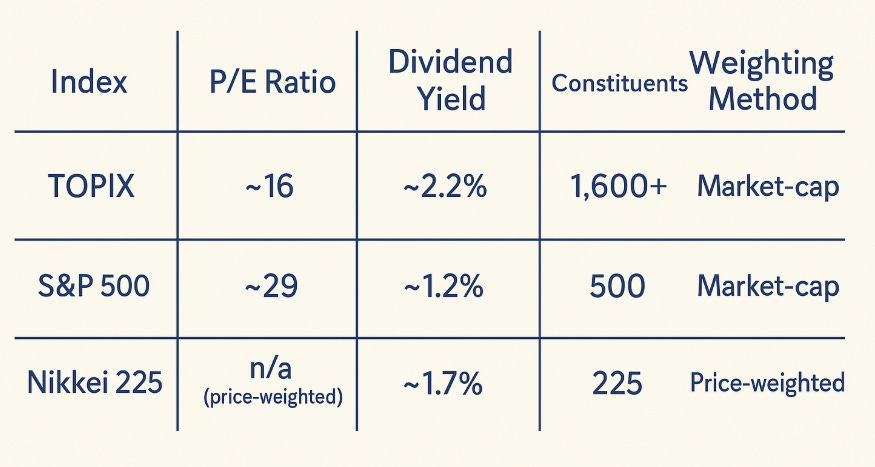

The Nikkei 225, like the Dow Jones, is price-weighted and often misleads. The TOPIX, covering 1,600+ companies, is market-cap weighted and more representative.

Today, the TOPIX trades at a P/E that’s about half of the S&P500, and yields 2.2% versus the S&P’s 1.2%. With dividend growth even better for most big companies in Japan compared to their US largecap peers, Japan combines lower valuations with faster rising payouts and higher yields.

Conclusion

Investing in Japan means adapting to:

Unusual trading hours and many holidays

High share prices and lot sizes—but endless stock splits

A strong and expanding dividend culture

A vast, ever-growing universe of small caps and IPOs

Currency risk that doubles as an opportunity

Attractive valuations, with TOPIX still cheap vs. U.S. stocks

Japan may not resemble Wall Street or Frankfurt, but that’s exactly why it deserves a place in a diversified portfolio. With global leaders like Toyota, steady dividend payers like KAO, and a constant pipeline of emerging tech names, Japan offers investors both tradition and opportunity.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.