Oriental Consultants: 4% yield with 42.5% annual growth

A 1957-founded global consultancy from Japan delivering strong earnings and exceptional dividend growth

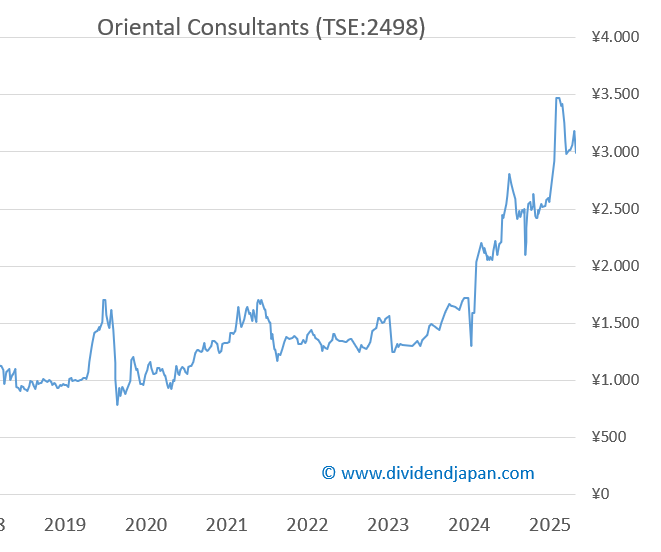

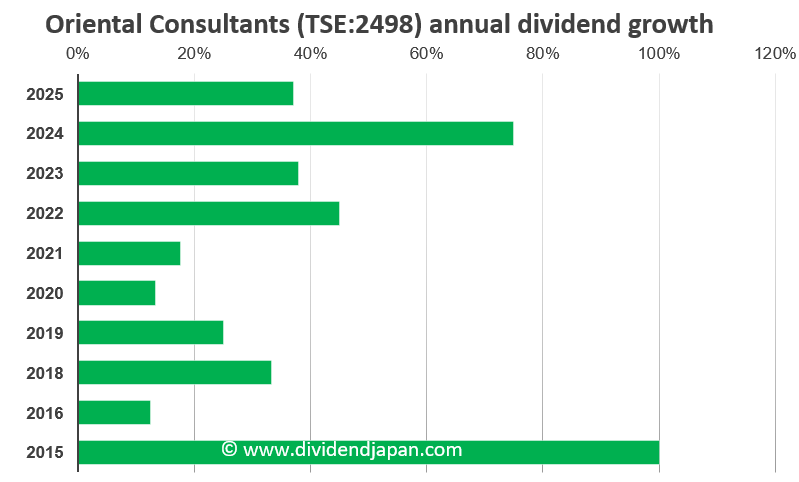

Oriental Consultants Holdings (TSE: 2498) saw strong growth again this year, supported by another year of double-digit revenue expansion and one of Japan’s most impressive long-term dividend growth records. With the latest annual dividend at ¥120, a yield of 3.9% at today’s share price of ¥3,065, and a five-year average dividend growth rate of 42.5%, the company combines high dividend momentum with steady financial performance. Oriental Consultants also completed a 1:2 stock split, while maintaining its dividend policy.

Key Points

Founded in 1957; major Japanese infrastructure & engineering consultancy with global footprint

Dividend has grown 10 years in a row, averaging 42.5% per year over the past five years

Latest dividend: ¥120; yield 3.9%; payout ratio 27.6%

Revenue for FY2025 grew 10% to ¥95.365bn; ROIC over 21%; EPS up ~49% YoY

Company Overview

Oriental Consultants is a Japan-based engineering consultancy providing transportation planning, infrastructure design, urban development, water management, environmental services, disaster-resilience planning, and smart-city development.

Through its global subsidiary Oriental Consultants Global (OCG), the group operates across Asia, Africa, the Middle East, and Latin America, handling large-scale rail, road, bridge, airport, water-management, and urban-planning projects.

History

1957 – Company established as an engineering consultancy in Japan

1960s–80s – Expansion into transportation and public-sector infrastructure engineering

1990s – Start of overseas consulting activities

2014 – Establishment of Oriental Consultants Global

2010s–2020s – Growth in digital engineering, smart mobility (ITS), and disaster-management sectors

Financial Performance

The most recent annual results, published on 14 November, show another year of solid operational momentum. Group revenue rose 10.5% year-on-year to ¥95.365 billion, marking the second consecutive year of double-digit top-line growth. Profitability also strengthened materially, with operating profit increasing 20.5%, ordinary profit rising 43.6%, and net profit advancing 47.0% compared with the prior year.

Earnings per share reached ¥318, reflecting an almost 49% year-on-year increase, supported by strong project execution both domestically and overseas. Total orders climbed to ¥97.654 billion, up 9.7%, driven by steady demand for disaster-prevention and infrastructure-maintenance projects in Japan, as well as healthy activity on large-scale transportation and engineering programs overseas.

Oriental is one of the Dividend Heroes in 2025

With ROIC above 21% in FY2024 and valuation multiples that historically remain below 10x earnings, Oriental Consultants stands out as a highly efficient operator with a long track record of consistent profitability and balance-sheet discipline. The company currently has no analyst coverage, which is unusual for a business of its size and international footprint.

Dividend

Oriental Consultants has developed one of Japan’s most impressive long-term dividend profiles. The company has now raised its dividend for 10 consecutive years, and over the past five years the payout has increased at an average rate of 42.5% per year.

The latest annual dividend was ¥120, up from ¥87.5 the year before, and at the current share price of ¥3,065 this corresponds to a 3.9% yield. Despite this strong growth, the payout ratio for FY2025 stands at a moderate 27.6%, suggesting the company still has room to continue increasing shareholder distributions in line with profit expansion.

A 1:2 stock split was recently implemented, though management has maintained the underlying dividend policy unchanged. The combination of strong earnings growth and controlled payout levels has been a key driver of the company’s long-running dividend momentum. Actually, Oriental Consultants is one of the Japanese Dividend Heroes in 2025.

Ownership

An unusual and defining feature of Oriental Consultants is the role of its employees in the shareholder base. Staff members collectively hold 19.5% of all outstanding shares, making them the single largest shareholder group.

This structure creates a high degree of alignment between employees and long-term corporate performance, and it has contributed to the company’s disciplined capital allocation, sustained profitability, and stable organizational culture.

Sector & Peers

Oriental Consultants is a key player in Japan’s infrastructure-consulting sector. Domestic peers include:

Nippon Koei Co., Ltd.

CTI Engineering Co., Ltd.

Pacific Consultants Co., Ltd.

Internationally, the group compares to AECOM ACM 0.00%↑ , Arup, SMEC, and other global engineering consultants, especially in development-agency-funded infrastructure projects. Aecom recently announced another big dividend hike.

Would you buy this stock? Let us know in the comments below this article!

Market Context

Japan’s infrastructure, disaster-prevention, and urban-development spending continues to provide a supportive environment. Overseas demand remains strong, especially in emerging markets. The company’s medium-term plan targets further expansion in smart-city, digital engineering (DX), O&M, and overseas design centers.

At DividendJapan.com, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.