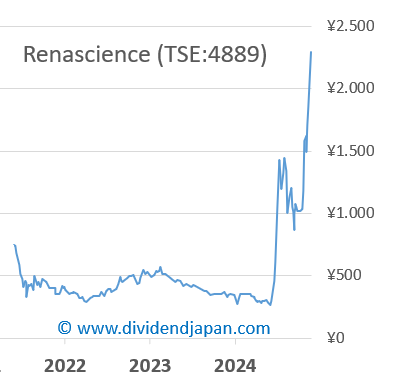

Pharmaceutical stock Renascience from Japan is up 670% in 2025

Despite Falling Revenues and No News, Renascience Soars — A Case of Momentum-Driven Mania in Tokyo

Japan’s Renascience Inc (TSE:4889) surged another 17% today, closing at a record high of 2,291 yen. This brings its 2025 year-to-date gain to an extraordinary 671%, making it the top-performing pharmaceutical stock in Tokyo.

Key Points

Renascience Inc (TSE:4889) is up 671% in 2025, hitting a record high of 2,291 yen.

Revenue fell 32% in FY2025, with another 14.1% drop forecasted.

No news behind the surge; momentum buying likely driving the rally.

Renascience Inc develops and sells pharmaceuticals and medical devices, focusing on innovative solutions—including AI—for medical challenges. It targets aging-related diseases like cancer, diabetes, respiratory, and cardiovascular conditions, as well as issues affecting women, children, and COVID-19.

The market value of Renascience, which only went public in 2021, now stands at nearly 25 billion yen — roughly €171 million. So far, the company has reported mixed results, with revenue for fiscal year 2025 (ending March) falling to 132.7 million yen from 194.2 million yen in 2024 — a drop of nearly 32%. Moreover, on May 14, when publishing its annual results, Renascience forecasted an additional revenue decline of 14.1% for the current fiscal year 2025.

There has also been no recent news to explain the stock’s surge. We believe this is mostly a case of the “Japanese” way of investing — everyone piling into whatever’s rising fast — something we’ve seen before with names like Liberta (TSE:4935).

The largest shareholder is Toshio Miyata, holding 21.5% of outstanding shares. Interestingly, he recently sold part of his stake, which is now worth over $5 million.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders! Investing in Japan isn’t for everyone, given its unique trading hours, large price swings, currency fluctuations, lot size requirements, and limited analyst coverage — yet the country also offers some of the world’s best dividend growth opportunities, with countless hidden gems waiting to be discovered.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.

Renascience stock closed up 20.6% today at 2933 yen.