Union Tool Co – Japan’s Precision Tool Leader Surges on Strong AI-Driven Demand

Advanced PCB drills fuel rapid earnings growth, record dividends and a major share-price breakout

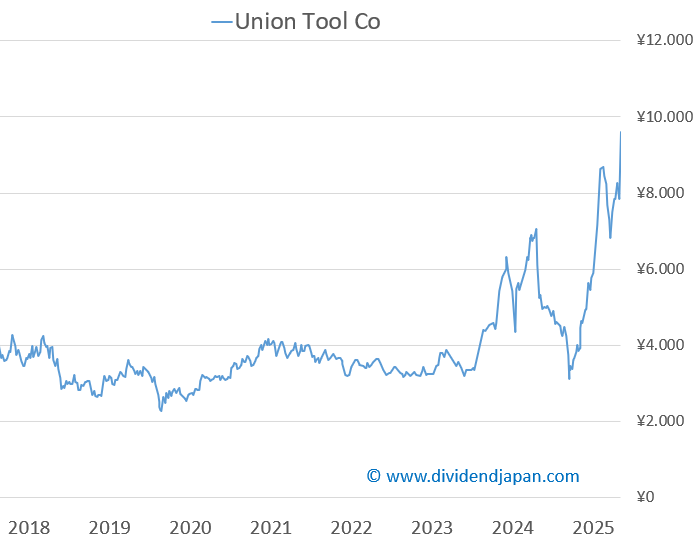

Union Tool Co. (TSE: 6278) was one of Tokyo’s strongest performers in week 48, rising 22% to a closing price of ¥9,590 on November 28. Demand for the company’s high-precision PCB drills and carbide tools continues to grow rapidly alongside global investment in AI hardware, data-center servers and advanced electronics. In parallel, Union Tool has raised its dividend again for fiscal year 2025, extending a multi-year trend of steady dividend expansion supported by strong earnings momentum.

Key Points

Week-48 share price jump: +22%, bringing 2025 YTD performance to +91%

Nine-month FY2025 revenue: ¥28.02bn, up 22.7% year-on-year

Dividend for FY2025 raised 25% to ¥105, payout ratio 34%

Market cap approx. ¥190bn (~USD 1.2bn), one analyst rates the stock “Buy”

Company Overview

Union Tool is a long-established Japanese manufacturer of ultra-precision cutting tools, specializing in micro-diameter PCB drills, carbide end mills and high-performance industrial tooling. These products are essential inputs for the production of high-layer printed circuit boards and advanced substrates used in servers, semiconductors, automotive electronics and industrial equipment.

The company maintains a vertically integrated production system, allowing it to control product quality and precision at each stage. Union Tool generates approximately 69% of its revenue in Japan, with meaningful contributions from Asia, the United States and Europe. Stronger demand from China and Taiwan has been a key driver in recent quarters, especially in advanced PCB manufacturing.

History

Union Tool’s origins date back to Japan’s early industrial electronics era. Over several decades, the company has evolved from a domestic maker of drilling tools into a global specialist in micro-precision manufacturing technology.

During the 1970s and 1980s, Union Tool began differentiating itself by developing highly durable PCB drills capable of meeting the rising complexity of printed circuit boards used in consumer electronics. As circuit boards became denser and multi-layered, the company’s technology became increasingly essential.

Through the 1990s and 2000s, Union Tool expanded internationally, establishing production and sales bases across Asia, North America and Europe. Product development shifted increasingly toward carbide tooling and high-performance industrial tools as the electronics and semiconductor industries matured.

Over the past decade, Union Tool has positioned itself at the intersection of AI, data-center infrastructure and high-precision PCB manufacturing, benefiting from strong demand for advanced substrates and high-layer PCBs required in next-generation computing.

Financial Performance

Union Tool delivered strong results in the first nine months of FY2025. Revenue increased 22.7% to ¥28.02 billion, while operating profit surged 55.3%. Net profit grew 30.7%, and EPS reached ¥269.45.

For the full fiscal year 2025, the company forecasts revenue of ¥37.5 billion, reflecting continued robust demand. The prior fiscal year saw revenue rise 28.7% to ¥32.6 billion, and projections for FY2025 imply growth of 20.5% to approximately ¥39.3 billion.

Key Figures (Fundamentals) Union Tool Co

Share price: ¥9,590 (Nov 28 close)

Market cap: ~¥190 billion (~USD 1.2 billion)

Dividend FY2025: ¥105 (+25% YoY)

Dividend yield: ~1.3%

Dividend outlook: ¥125 expected for FY2025; potential toward ¥150 in coming years

Payout ratio: 34% (FY2024)

FCF outlook: ~¥6.665bn estimated for FY2027

Revenue FY2024: ¥32.6bn (+28.7%)

Revenue FY2025 forecast: ~¥39.3bn (+20.5%)

EPS FY2024: ¥305.86 (+71.7%)

EPS FY2025 estimate: ¥364.7 (+19.2%)

Operating margin: ~21%

ROIC: ~7.5% (FY2024)

P/E (2025 est.): approx. 26x

Earnings momentum has been strong: EPS increased 71.7% in FY2024 to ¥305.86, with analysts expecting a further 19.2% increase in FY2025 to ¥364.7. The company maintains a solid operating margin of around 21%, while ROIC has historically remained between 7% and 10% (FY2024: 7.5%). The estimated P/E ratio for 2025 stands at 26.

Dividend

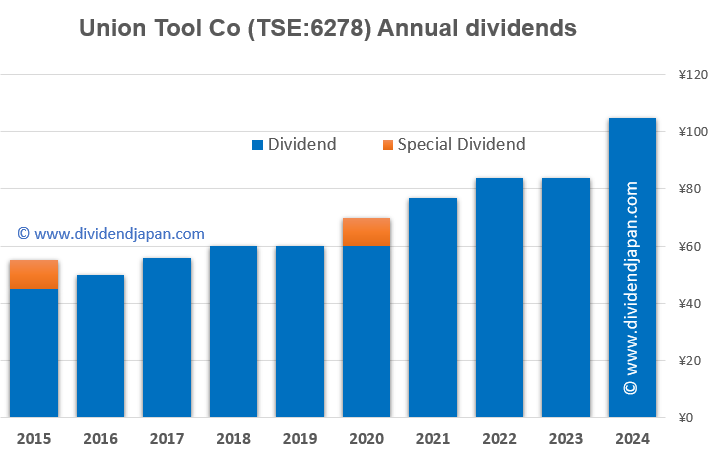

Union Tool raised its dividend by 25% for FY2025 to ¥105 per share, marking the highest annual dividend in its history. This is the second time in five years that the company has increased its payout by more than 25%.

For FY2025, expectations point toward an annual dividend of ¥125, with further increases anticipated in the coming years. Market forecasts suggest a dividend approaching ¥150 within three years, supported by strong cash generation. Union Tool Co also paid ¥10 per share special dividends in both 2015 and 2021.

The interim dividend for FY2025 was raised from ¥45 to ¥60, and a higher year-end dividend is expected. Union Tool typically pays its final dividend in late March.

The payout ratio of 34% (FY2024) reflects a typical level for Japanese industrials and leaves ample headroom for future increases. Free cash flow is projected to rise significantly, with FY2027 estimates at ¥6.665 billion versus current dividend outlays of roughly ¥1.5 billion, indicating substantial capacity for continued distribution growth.

Ownership

The largest shareholder of Union Tool is Koei Company, holding 31% of outstanding shares. Koei Company operates in non-life insurance, real-estate management and rental activities. Union Tool also maintains a broad institutional and global shareholder base.

Sector & Competitors

Union Tool operates in the precision-tooling sector, serving industries such as electronics manufacturing, semiconductor packaging, industrial machinery and PCB fabrication. The company competes with both Japanese and global producers of micro-precision drilling tools, carbide tooling and high-performance industrial cutting equipment.

While a range of companies operate in standard tooling, Union Tool holds a strong position in high-end PCB drills and advanced substrate tooling, segments that are directly tied to next-generation electronics and AI-related demand. Its main competition comes from other precision tooling producers in Japan, Taiwan, China, Europe and the United States.

Oriental Consulting: 4% yield with 42.5% annual growth

Oriental Consultants Holdings (TSE: 2498) saw strong growth again this year, supported by another year of double-digit revenue expansion and one of Japan’s most impressive long-term dividend growth records. With the latest annual dividend at ¥120, a yield of

Summary

Union Tool continues to deliver rapid growth, supported by global demand for AI-related electronics and high-layer PCB manufacturing. With two consecutive years of double-digit revenue expansion, strong earnings momentum and consistently high operating margins, the company has built a solid platform for future growth.

The dividend has been raised repeatedly, most recently by 25%, and with a payout ratio of 34% and rising free cash flow, the company maintains capacity for further increases. While the estimated P/E ratio of 26 places the stock above historical levels, projected EPS growth of nearly 20% and expansion in data-center and AI-driven applications continue to support the company’s outlook within the precision-tooling sector.

Would you buy Union Tool? Let us know in the comments below this article!

At DividendJapan.com, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.