WDB Holdings (TSE: 2475) shocks with dividend cut

Japanese Dividend Heroes: Even the Best Can Stumble

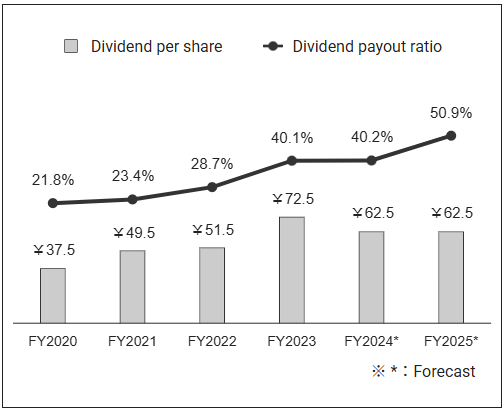

Investing in Japan remains unpredictable — even when you focus on so-called Dividend Heroes. A telling example is WDB Holdings (TSE: 2475), which after thirteen years of continuous dividend growth has now surprised investors with a full-year dividend cut of nearly 14%, from ¥72.50 to ¥62.50 per share.

Key Points

WDB Holdings (TSE:2475) cuts full-year dividend by nearly 14%, ending a 13-year growth streak.

Final dividend set at ¥38.5, slightly above guidance, but still down from ¥43.5 last year.

Dividend Hero title revoked after 18 years of uninterrupted payments.

Despite the cut, stock is up in 2025; current yield stands at ~3.4% gross.

No clear reason given for the lower payout beyond vague references to results and policy.

This includes a year-end dividend of ¥38.50 per share. Interestingly, this is ¥2.00 higher than WDB’s own forecast from February 2025, due to better-than-expected net profit. However, it is still ¥5.00 lower than the previous year’s final dividend of ¥43.50. So while the company formally calls it a dividend increase versus their prior guidance, investors are left grappling with a year-on-year decline.

For long-term followers, this shift is abrupt. WDB was our #1 Dividend Hero for 2025, and not without reason. Over the past decade, the company averaged a dividend growth rate of 27.5%, with nine out of ten years showing double-digit hikes. Until now, it hadn’t cut its dividend in eighteen years — a rare achievement, even by Japanese standards. We’ve therefore removed WDB from our Dividend Hero list, and will soon introduce its successor.

So what does WDB actually do? According to its official website, WDB Holdings is a Japanese holding company that provides science-focused human resources services. Its core business is placing researchers — particularly in life sciences — into R&D positions at pharmaceutical and biotech companies across Japan. The company also operates a contract research organization (CRO) that supports drug development with services such as clinical trials and data management. Its third segment focuses on infrastructure and software solutions to support scientific work. In their own words, WDB aims to “build the infrastructure for people who work in science.”

Despite the dividend drop, the stock has held up well. At ¥1,784 per share, the current gross yield remains solid at approximately 3.4%. That resilience — delivering positive price performance despite a dividend reset — reflects the strength of the underlying business.

WDB’s dividend move reminds us how fragile dividend consistency can be, even in companies with decade-long streaks. The company did not offer a detailed explanation for the full-year decline, other than referencing changes in earnings and payout policy. Going forward, they are targeting a 40% dividend payout ratio, which may result in more earnings-sensitive payouts.

We’ll be back soon with more on our new Japanese Dividend Hero. For now, WDB steps aside — a quiet reminder that history, even a strong one, doesn’t always repeat.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders! Investing in Japan isn’t for everyone, given its unique trading hours, large price swings, currency fluctuations, lot size requirements, and limited analyst coverage — yet the country also offers some of the world’s best dividend growth opportunities, with countless hidden gems waiting to be discovered.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.