Advantest Shares Surge 22% on Strong Earnings and Buyback Plan

Advantest hits record highs as AI spending fuels profits and investor optimism

Japan’s Advantest Corp. (TSE: 6857) surged 22% on Wednesday October 29, 2025, after reporting strong quarterly results and unveiling a new share buyback plan. The maker of semiconductor testing equipment raised its operating profit forecast for the fiscal year ending March 2026 by 25% to ¥374 billion, citing sustained demand from AI-related investments.

Key Points

Advantest (TSE: 6857) shares jumped 22% to ¥22,120, reaching a record high.

FY2026 operating profit forecast raised 25% to ¥374 billion.

July–September operating profit surged 71% year-on-year to ¥108.4 billion.

Company announced a new share buyback program and higher mid-term targets.

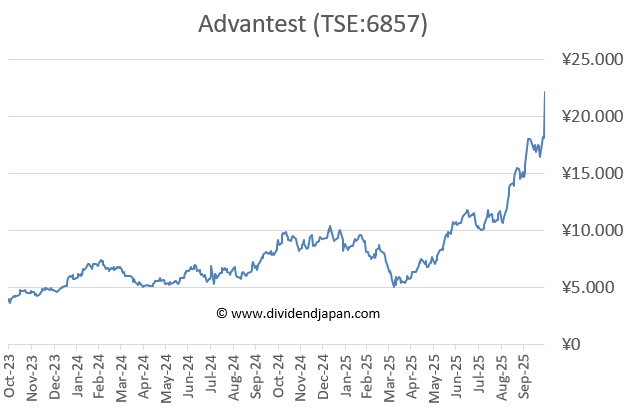

Stock up 140% year-to-date, among the best semiconductor performers in Japan.

Operating profit in the July–September quarter climbed 71% year-on-year to ¥108.4 billion, supported by strong orders from data center and chip manufacturing customers. “We have grown confident that the favourable business environment, supported by the ongoing build-out of global AI data centre infrastructure, will continue,” said CEO Douglas Lefever during the company’s earnings briefing.

Company Overview: Teradyne peer

Advantest Corporation is a leading Japanese supplier of semiconductor testing systems, widely used to verify and measure chip performance during production. The company plays a key role in the AI and high-performance computing (HPC) supply chain. Its main global competitors include Teradyne (NASDAQ: TER 0.00%↑ ) and Cohu (NASDAQ: COHU 0.00%↑ ). Teradyne also reported strong earnings after the market close Tuesday, resulting in a soaring stock price together with its biggest competitor Advantest.

Teradyne also reported strong earnings after the market close Tuesday, resulting in a soaring stock price together with its biggest competitor Advantest.

With its stock up 140% in 2025, Advantest is one of Japan’s best-performing semiconductor names this year. Just this June we first wrote about Advantest when the company was below ¥10,000. The company has more than doubled since that publication and now holds a market capitalization of around ¥17 trillion (≈ $111 billion) and maintains a strong balance sheet with more cash than debt.

Earlier this week we already wrote about Kioxia Holdings (TSE:285A), another semiconductor company from Japan soaring in 2025 because of explosive AI driven demand. Kioxia is up more than 400% YTD.

Valuation and Dividend

We have followed Advantest for many years, and while growth has accelerated impressively, the valuation is demanding — the stock now trades at an estimated price-earnings ratio of about 65. The main weakness remains its modest dividend yield of 0.3%, which has become even lower following the sharp rise in share price.

Dividend growth has lagged behind peers. In 2024, the dividend rose just 1.5%, and while 2025 brings a 14% increase to ¥39 per share, the pace still trails many other Japanese technology companies. The payout had even declined once before, from ¥23 in 2019 to ¥20.5.

Analyst Sentiment

Analysts remain broadly positive, with 5 strong buy, 10 buy, 6 hold, and 1 sell ratings. That single bearish call likely had a rough day, as today’s 22% surge pushed Advantest to a new all-time high.

Another stock soaring today is Lasertec (TSE:6920), the semiconductor peer that we highlighted earlier on dividendjapan.com. Lasertec closed up 7.5%. Many semiconductor companies from Japan will report earnings in the next couple of days.

At DividendJapan.com, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.

The valuation concern is real, but Advantest's positioning in AI chip testing is hard to replicate. A P/E of 65 looks steep until you considr the structural shift happening in the semiconductor industry. The weak dividend yield is disapointing for income investors, but the buyback program shows management's confidence in the business trajectory.