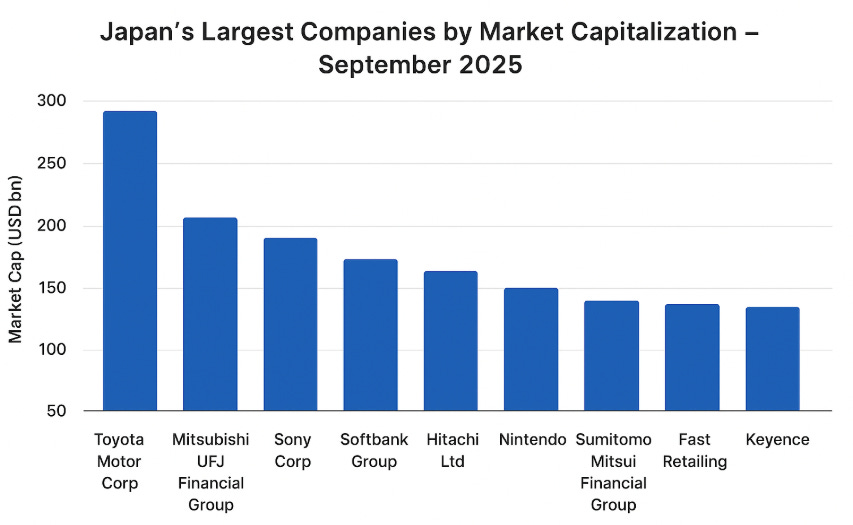

Japan’s Largest Companies by Market Capitalization – September 2025

Toyota is one of the few truly large companies listed on the Tokyo Stock Exchange

Japan is home to some of the world’s most influential companies, spanning industries from automobiles and technology to finance and telecommunications.

What stands out about Japan is the sheer number of small companies, most with a market capitalization in the tens to hundreds of millions of dollars. Fewer than ten companies have a market cap exceeding $100 billion.

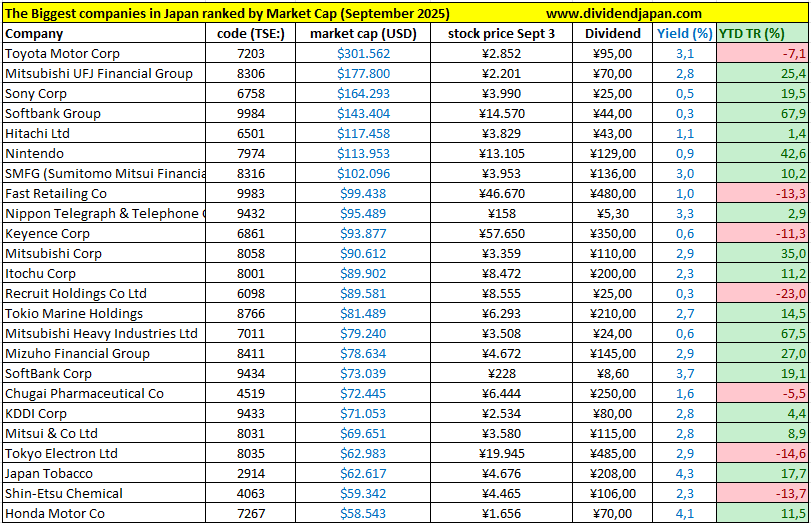

As of September 3, 2025, the following companies lead the Japanese market by capitalization. Each entry includes stock price, estimated dividend, dividend frequency, and yield.

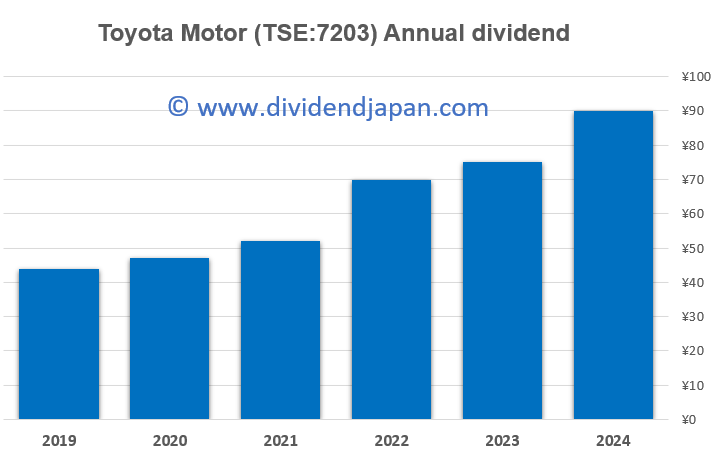

1. Toyota Motor Corp (TSE: 7203)

Market Cap: €259.97B / ¥45.04T / $301.56B

Stock Price: ¥2,852

Dividend per Share: ¥95 (semi-annual payment)

Dividend Yield: 3.1%

Toyota remains Japan’s automotive flagship, producing cars, trucks, and hybrids worldwide with a strong focus on sustainable mobility and electrification.

2. Mitsubishi UFJ Financial Group (TSE: 8306)

Market Cap: €153.28B / ¥26.56T / $177.80B

Stock Price: ¥2,201

Dividend per Share: ¥70 (semi-annual payment)

Dividend Yield: 2.8%

MUFG is one of Japan’s largest banks, offering a full range of services from retail banking to corporate finance and investment banking.

3. Sony Corp (TSE: 6758)

Market Cap: €141.63B / ¥24.54T / $164.29B

Stock Price: ¥3,990

Dividend per Share: ¥25 (semi-annual payment)

Dividend Yield: 0.5%

Sony combines consumer electronics, gaming, and entertainment, with a focus on digital content expansion and electronics innovation.

4. SoftBank Group (TSE: 9984)

Market Cap: €123.62B / ¥21.42T / $143.40B

Stock Price: ¥14,570

Dividend per Share: ¥44 (semi-annual payment)

Dividend Yield: 0.3%

SoftBank is a global technology conglomerate, managing a diversified portfolio of tech investments and telecommunications operations.

5. Hitachi Ltd (TSE: 6501)

Market Cap: €101.26B / ¥17.54T / $117.46B

Stock Price: ¥3,829

Dividend per Share: ¥43 (semi-annual payment)

Dividend Yield: 1.1%

Hitachi operates as a diversified industrial group, active in infrastructure, IT, and electronics, with a strong focus on social innovation solutions.

6. Nintendo (TSE: 7974)

Market Cap: €98.24B / ¥17.02T / $113.96B

Stock Price: ¥13,105

Dividend per Share: ¥129 (semi-annual payment)

Dividend Yield: 0.9%

Nintendo is a leading interactive entertainment company, renowned for its gaming consoles and iconic franchises such as Mario and Pokémon.

7. Sumitomo Mitsui Financial Group (TSE: 8316)

Market Cap: €88.01B / ¥15.25T / $102.09B

Stock Price: ¥3,953

Dividend per Share: ¥136 (semi-annual payment)

Dividend Yield: 3.0%

SMFG provides diversified banking services, including commercial banking, leasing, and securities, serving both domestic and international clients.

Is Lifedrink (TSE:2585) the new dividend star from Japan?

Japanese beverage maker Lifedrink Company Inc. has been on a remarkable growth trajectory over the past few years, delivering eye-popping returns for shareholders. Known for its range of soft drinks and tea products, the company combines strong revenue growth with rising dividends, making it one of Japan’s most intriguing mid-cap stocks. With impressive…

8. Fast Retailing Co (TSE: 9983)

Market Cap: €85.72B / ¥14.85T / $99.43B

Stock Price: ¥46,670

Dividend per Share: ¥480 (semi-annual payment)

Dividend Yield: 1.0%

Fast Retailing, the parent company of UNIQLO, is a global apparel retailer emphasizing high-quality casual clothing at affordable prices.

9. Nippon Telegraph & Telephone Corp (NTT) (TSE: 9432)

Market Cap: €82.32B / ¥14.26T / $95.49B

Stock Price: ¥158

Dividend per Share: ¥5.3 (semi-annual payment)

Dividend Yield: 3.3%

NTT is a leading integrated telecommunications provider in Japan, offering fixed-line, mobile, and data communication services.

10. Keyence Corp (TSE: 6861)

Market Cap: €80.93B / ¥14.02T / $93.88B

Stock Price: ¥57,650

Dividend per Share: ¥350 (semi-annual payment)

Dividend Yield: 0.6%

Keyence specializes in industrial automation sensors and measurement devices, serving manufacturing industries worldwide.

The table above shows the full list of companies with a market cap of $58 billion or more as of September 3, 2025. The average dividend yield is 2.1%.

Most of the stocks listed above have a very solid dividend history with annual increases. Moreover, all of these stocks pay a semi-annual dividend.

Key Takeaways:

Japan’s largest companies are diversified across automobiles, financials, technology, and telecommunications.

Most of these firms pay semi-annual dividends, with yields ranging from 0.3% (SoftBank Group) to 4.3% (Japan Tobacco).

Tech and industrial leaders like Keyence, Tokyo Electron, and Hitachi underscore Japan’s role in global manufacturing and electronics innovation.

Banks such as MUFG, SMFG, and Mizuho combine steady dividend returns with competitive YTD and total return performance.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.