Lasertec comes with dividend shock and nasty earnings

Strong long-term dividend record remains, but 2026 marks a pause in payout growth

Lasertec (TSE: 6920) fell sharply on 2 February, with shares down 14% to ¥31,310 after the company released new earnings guidance. The move contrasts sharply with the recent positive surprise from Disco (TSE: 6146), another Japanese semiconductor equipment name. While Lasertec remains one of Tokyo’s strongest long-term performers in both share price and dividends, the latest outlook points to slower growth and a break in its long-standing pattern of double-digit dividend increases.

Key Points

Shares fell 14% on 2 February to ¥31,310; 2026 YTD return now +6%

FY2026 revenue expected to decline 12.5% to ¥220bn

Dividend for FY2026 expected to remain unchanged at ¥329

Interim dividend raised 15% to ¥132, ex-date 29 December, payment 12 March

Company Overview

Lasertec is a Japan-based semiconductor equipment manufacturer best known for advanced inspection and metrology systems used in leading-edge chip production. Over the past decade, the company has been one of the most successful stocks in Tokyo, supported by strong demand from the global semiconductor industry and its dominant position in critical process equipment.

DIVIDEND SHOCKER………

Lasertec indicated that the full-year dividend for FY2026 is expected to remain unchanged at ¥329, marking a clear shift from the strong double-digit growth seen in previous years.

Over the last ten years, Lasertec’s share price has risen by more than 9,000%, making it one of Japan’s standout long-term performers. Lasertec was one of the Dividend Heroes in Japan for years, but will drop from the top selection next year without a dividend hike.

Dividend

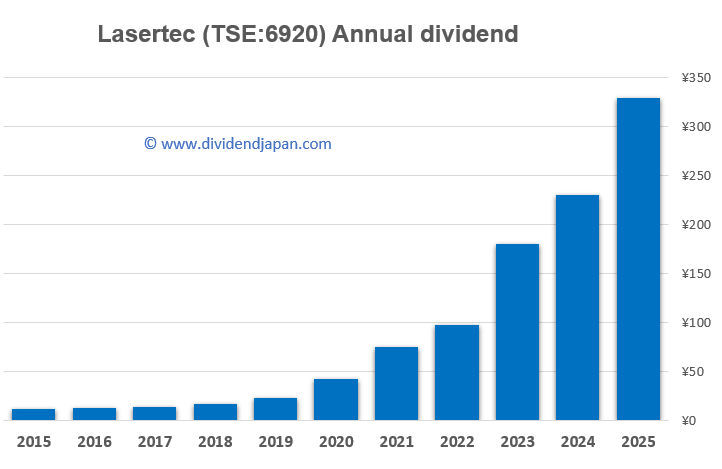

Lasertec has built an exceptional dividend track record. Over the past decade, total dividend growth amounts to nearly 2,800%, placing the company among the top dividend growers in Japan. The five-year dividend CAGR stands at around 50%, driven by rapid earnings expansion in recent years.

For FY2026, the company increased the interim dividend from ¥115 to ¥132, a 15% rise announced at the end of last week. The ex-dividend date for this interim payment was 29 December, with payment scheduled for 12 March.

However, Lasertec indicated that the full-year dividend for FY2026 is expected to remain unchanged at ¥329, marking a clear shift from the strong double-digit growth seen in previous years. At the current share price, the dividend yield is approximately 1%.

Financial Performance & Fundamentals

For the fiscal year ending 30 June 2026, Lasertec expects revenue to decline 12.5% to ¥220 billion. Earnings are also set to soften, with EPS projected to fall by nearly 15% to ¥72.

This guidance follows a period of exceptional growth: the stock gained 85% last year, and dividend growth remained strong through FY2025, when the dividend increased by 43%.

Based on current estimates, Lasertec trades at an estimated P/E of around 34 for FY2026, a relatively high valuation in light of declining revenue expectations and a flat dividend outlook.

Market Context

The sharp share-price reaction suggests that expectations had moved ahead of fundamentals. Similar to earlier periods in its history, Lasertec appears to be entering a phase of normalization after several years of outsized growth. While demand for advanced semiconductor equipment remains structurally important, the near-term outlook has clearly moderated.

Summary

Lasertec remains one of Japan’s most successful long-term semiconductor stocks, with extraordinary share-price appreciation and a decade of exceptional dividend growth. However, FY2026 marks a turning point: revenue is expected to decline, earnings are set to fall, and the company plans to hold the dividend flat at ¥329, ending a long stretch of double-digit increases.

Lasertec: Japan’s Dividend Champion on the Rise – Can It Reach Record Highs Again?

Lasertec Corporation (TSE:6920), a Tokyo-based pioneer in semiconductor and advanced optical inspection systems, has seen its shares surge on the Tokyo Stock Exchange in recent days. Known for delivering high-value, unique products through rapid development, Lasertec has carved out a leading …

At a valuation of roughly 34x earnings and a dividend yield of around 1%, the market reaction reflects a reset in growth expectations after several years of exceptional performance.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.