Japan’s High Share Prices Challenge Small Investors — But Stock Splits Bring Hope

Japan’s soaring share prices keep small investors on the sidelines — unless stock splits open the door.

Japan’s stock market has delivered strong gains in recent years with stock hitting fesh all time highs this week, but the structure of the market still makes it difficult for smaller investors to participate. One major reason is that Japanese shares must usually be purchased in minimum lots of 100 shares, rather than by the single share as in the U.S. or Europe.

Key Points

Japan’s 100-share minimum makes many stocks too costly for small investors.

Giants like Uniqlo owner Fast Retailing and Keyence trade above ¥50,000 per share.

Japan leads the world in stock splits, with 70+ last month.

High prices once deterred sokaiya (yakuza-linked extortionists).

When a company’s share price is ¥10,000, that means you need at least ¥1 million (around $6,500 or €6,000) for a single investment. For investors hoping to build a diversified portfolio, that’s simply unrealistic — unless they already have a large amount of capital to begin with.

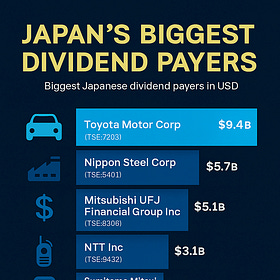

Japan’s Billion-Dollar Dividend Giants

While Japan is often associated with technological innovation, precision manufacturing, and a culture of corporate conservatism, its dividend landscape tells a story of quiet strength and growing shareholder returns. Thanks for reading DividendJapan.com! Subscribe for free to receive new posts and support my work.

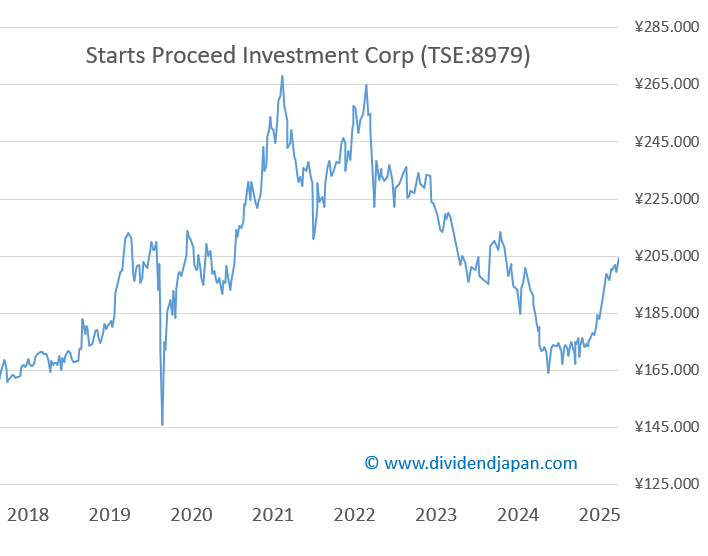

Many of Japan’s most famous listed companies trade at prices well above that level. Fast Retailing (TSE:9983), Keyence (TSE:6861), and Disco (TSE:6146) all have share prices of around ¥50,000 or more, while roughly ten listed firms still trade above ¥100,000 per share. Some of the highest-priced names are real estate investment trusts (J-REITs), but even ordinary industrial and technology companies can have prices that make them inaccessible to retail investors.

One of the highest-priced stocks on the Tokyo market is Starts Proceed Investment Corp. (TSE:8979), which currently trades around ¥200,000 per share. Anyone wishing to invest must commit at least one million yen — more than $125,000 — just to buy the minimum lot.

A Surge in Stock Splits

The good news is that Japan is changing — fast. More and more companies are splitting their shares, lowering the unit price and opening the market to smaller investors.

Japan has quietly become the global leader in stock splits, with hundreds of companies announcing them every year. Just last month, we counted more than 70 stock splits — a pace far beyond the U.S. or Europe, where there are only a handful each month and perhaps a few dozen per year among major names.

“Just last month, we counted more than 70 stock splits in Japan”

These splits improve market liquidity and allow broader participation. For the first time in decades, the Japanese stock market is becoming more accessible to ordinary investors.

📘 Sidebar: Why Didn’t Japanese Companies Split Their Shares Before?

For many years, Japanese companies deliberately avoided stock splits. There was a cultural and strategic reason for that — and, according to some observers, a darker historical one as well.

“In the past, companies from Japan are said to keep their share prices high to make it difficult for outsiders — including organized crime groups — to buy even a single share (or 100) and attend shareholder meetings to pressure management.”

By maintaining very high share prices, companies effectively protected themselves against hostile or disruptive shareholders, including so-called sokaiya — corporate extortionists often linked to yakuza organizations. Buying a single share to gain shareholder rights could cost tens of thousands of yen, creating a natural barrier.

Today, as governance improves and oversight tightens, that old rationale no longer applies. Modern boards are under pressure from the Tokyo Stock Exchange and global investors to make shares more accessible, encourage retail participation, and raise valuation levels.

The result: a surge of stock splits that not only make Japan’s market more liquid, but also more democratic.

At DividendJapan, we aim to highlight these opportunities and uncover hidden gems that may not yet be on your radar. Stay tuned as we explore Japan’s dividend growth stories and the next generation of market leaders!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.

The barier to entry for Keyence has been massive for retail investors, especially when you need ¥5 million just to start building any meaningful position. The stock split trend is a game changer becuase it's not just about accessibility but also liquidity improvements that could narrow those wide bid-ask spreads. It's interesting how the sokaiya concern kept prices artificially high for so long when modern governance could have addressed that differently. Japan's democratization of its equity markets through splits might finally unlock the retail participation that's been missing for decades.